The main event scheduled for today is the release of the US inflation report for April. Analysts are optimistic about the figures. Inflation is expected to rise by only 0.2% versus a 1.2% increase in March. The annual inflation rate is likely to drop to 8.1% from 8.5%. If this scenario comes true, it will indicate the Fed is likely to take control of inflation. It will have a positive impact on financial stability and the sentiment in the global market. The US dollar is sure to extend gains as real bond yields will start moving out of the negative zone.

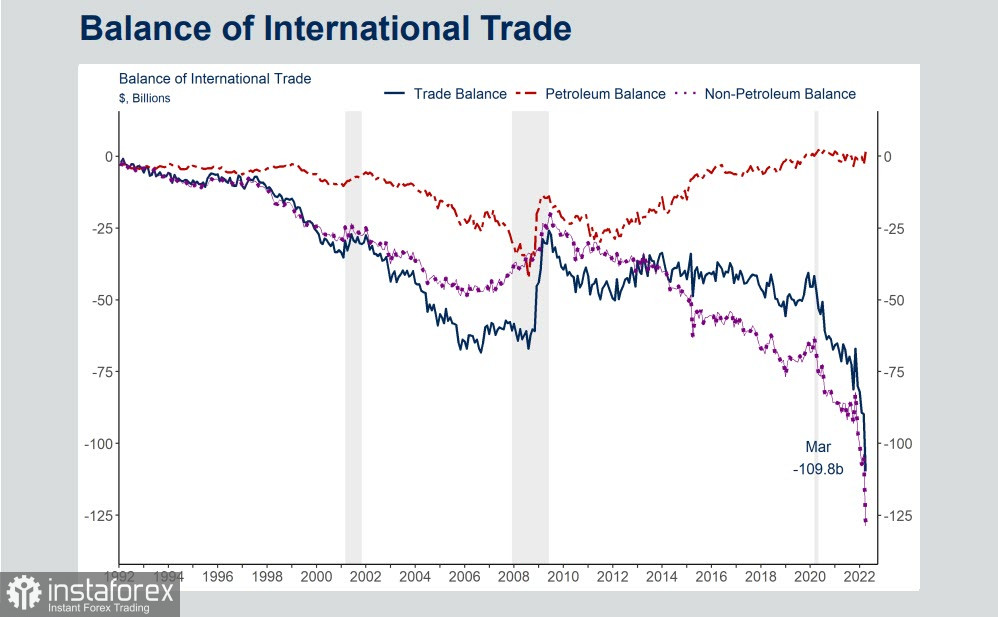

On Thursday, the producer price index is due. Analysts are also anticipating a positive reading. On Friday, the US import and export price indexes will be released. The indicators are projected to jump. Taking into account a steep drop in the US trade balance, an increase in import prices may fuel inflation.

Thus, signs of financial stability may appear if market experts see that the Fed is gradually taking inflation under control. If today's data comes out worse than forecasts, market could be gripped by panic. Commodity currencies will incur the biggest losses. The US dollar will retain its upwardmovement in any scenario.

USD/CAD

The yield of Canada's 109-government bonds rose above 3% for the first time since 2011. As the Bank of Canada continues to raise the key rate, mortgage interest rates rise exponentially. As expected, it led to a downshift in housing demand. Housing market prices are likely to remain high as long as the Bank of Canada hikes the key rate.

The housing market report published last week turned out to be neutral. Additionally, the economy added 15,000 new jobs, but the number of working hours decreased by 1.9% in monthly terms. A slowdown in the pace of the labor market recovery casts doubt on the Bank of Canada's GDP outlook. The regulator expects the reading to increase by 6% in the 2nd quarter on the yearly basis.

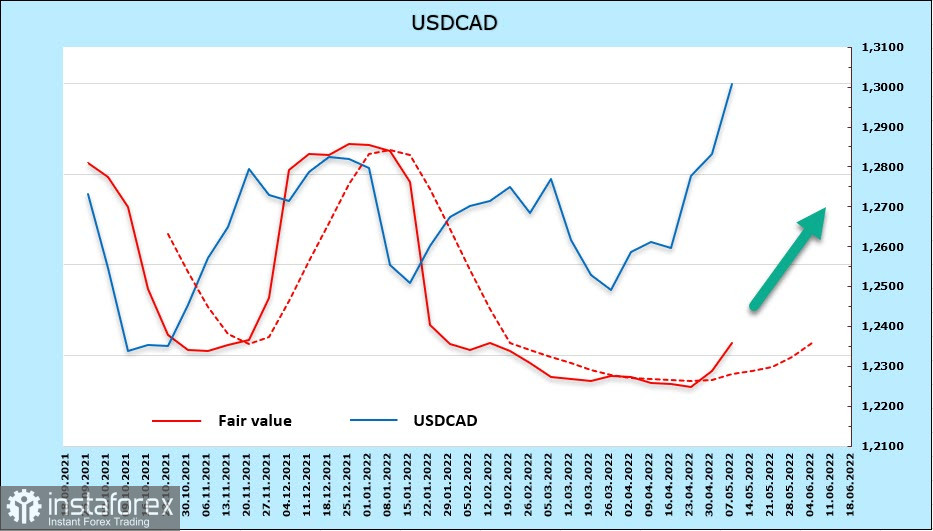

The net long position on CAD for the reporting week changed significantly, falling by 925 million to 703 million. Bulls are holding the upper hand. However, the trend is getting more bearish. The estimated price climbed higher, indicating a trend reversal.

A week earlier, I assumed that the pair could break out of the range, moving upwards. USD/CAD advanced to the resistance level of 1.3010, a 38.2% increase from more than a year-long fall caused by the pandemic. It approached a new high. Technical indicators also signal further growth. The target level is 1.3335. A possible pullback is unlikely to be significant. The pair may reach the support level of 1.2890/29 or 1.2812 but it looks less likely. After that, it could resume its upward movement.

USD/JPY

The Bank of Japan's stance on monetary policy remains unchanged. The trajectory of the yen is also very clear. The watchdog did not cut the benchmark rate during the pandemic. Hence, there is no need to hike it now. Inflationary pressure in Japan is weak. Apart from that, inflation is unlikely to reach the 2% target. The Japanese government is on the same page with the BoJ. For this reason, the main goal of the central bank is to keep Japan's benchmark 10-year yield at the 0.25% upper limit. By buying up bonds, the regulator pours additional liquidity into the market. As a result, the yen becomes cheaper. If it refrains from buying bonds, the yen is trading in the current range or it may begin a correction.

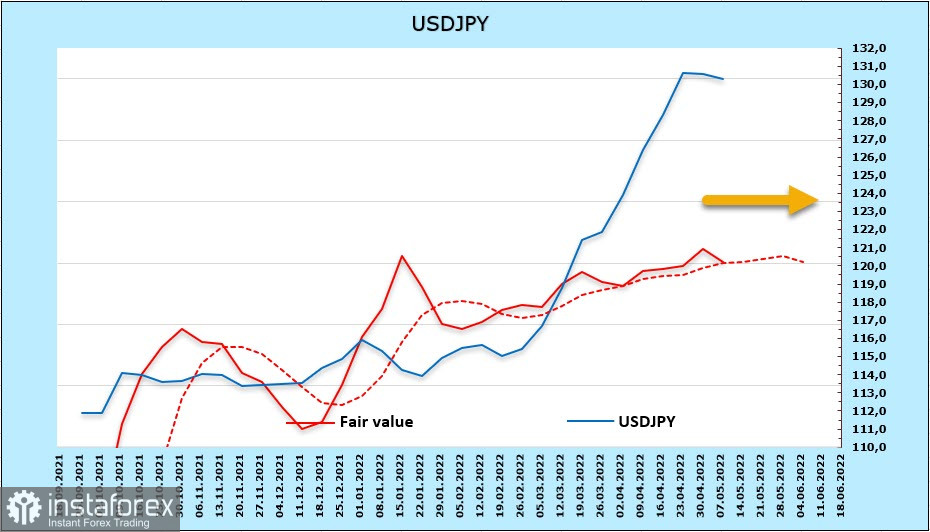

The net-short position on the yen rose by 295 million to 9.68 billion over the week. The change is small, signaling a likelihood of a downward correction. The market price is noticeably lower than the spot price, which jumped considerably amid the BoJ's decision to buy an unlimited quantity of government bonds.

If the BoJ stops buying bonds at a fixed price, this will inevitably lead to a downward correction. Demand for the yen as a safe-haven asset is strong for many reasons. The nearest support zone is 127.10/50. A reversal to 124.20, which is the Fibo correction level of 23.6%, is unlikely. The consolidation with a slight pullback looks more likely. however, the long-term target level is still 135.19.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română