The main cryptocurrency has significantly spoiled its reputation due to the massive collapse and the situation with the algorithmic stablecoin UST. At the same time, Bitcoin defended the vital milestone of $30k, but the rebound turned out to be extremely uncertain. The price is hovering around $30.8k, and the activity of sellers is not growing, unlike the volatility. On May 11, the next stage of the Fed's general policy and the publication of the consumer price index are planned. And here the market should prepare for the fact that the main cryptocurrency will once again test the strength of the $30k milestone.

There is no longer any doubt that Bitcoin is perceived solely as a high-risk asset. The reserve and risk hedging instrument is not relevant in a strong downward trend. However, the coin still has a straw that can mitigate the current fall. The publication of reports on the growth of the price level promises to weaken the position of the USD. This is due to the fact that, according to all forecasts, due to the ongoing war in Ukraine, as well as global sanctions, the inflation rate will remain above 8%. For the majority of investors, this may run counter to the official position of the Fed, according to which the situation with inflation growth is under control.

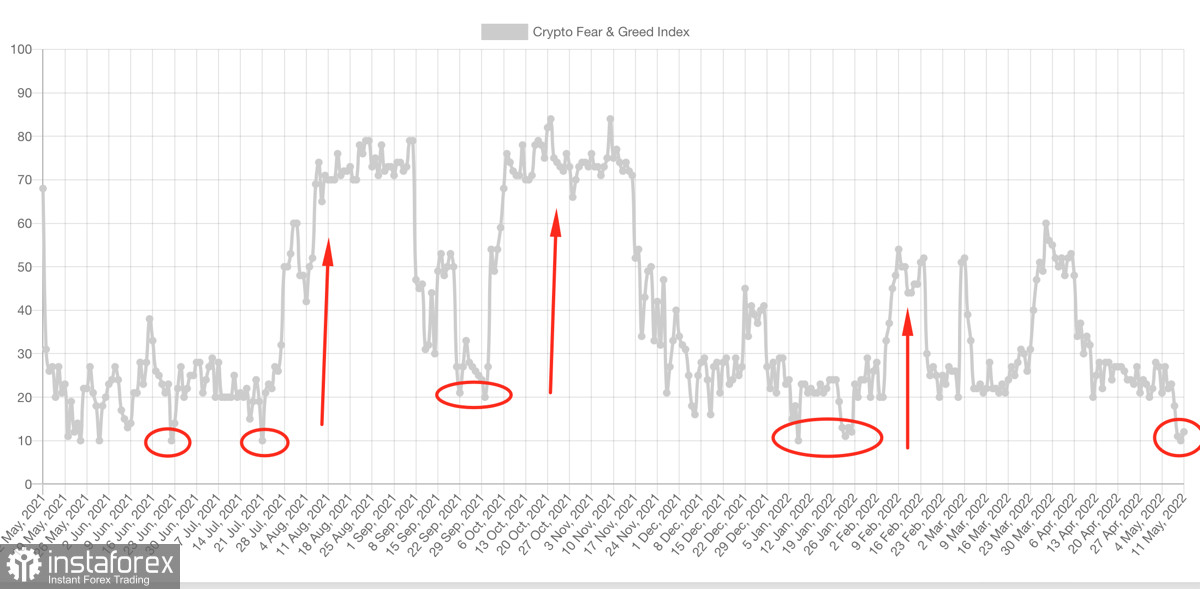

However, it is important to understand that high inflation, despite the increase in the key rate to the range of 0.75%–1%, will have far-reaching consequences. We'll talk about them a little later. Now let's analyze the short-term effect for Bitcoin quotes. Keeping the inflation index at a high level indicates the weakness of the US dollar and may serve as a local burst of activity in the markets of high-risk assets. Another important factor is the achievement of a local bottom by the fear and greed index. If you look at the historical perspective, you can see that when the level 11 is reached, the price starts to rise, and the sentiment improves.

The second important factor indicating a possible stage of growth of the cryptocurrency market is the correction of the DXY index. The indicator reached the milestone of 103 and began to decline towards the local support area. Historically, DXY correction has led to the growth of high-risk instruments, including Bitcoin. The last time the US dollar index reached 103 was in March 2020. In the same period, BTC/USD began an upward movement.

Now let's move on to the negative consequences of persistently high inflation. This means that the Fed will continue to tighten monetary policy, rate hikes will be more aggressive, and the pace of market liquidity shrinkage will increase in volume. We can definitely say that, despite the local benefit, for Bitcoin, a high level of inflation in the current environment will be much more painful than for the US dollar.

As of May 11, the asset is trading around $30.6k. The coin is trying to find a support zone and is in consolidation. Despite the gradual return of the RSI and the Stochastic Oscillator to the bullish zone above 40, the MACD clearly indicates a possible divergence in the event of an increase in the price of BTC. This indicates the absence of real prerequisites for a price reversal. With this in mind, we assume that the asset will make a local impulsive upward movement to the $33k–$34k zone, after which it will return to $30k. It is also quite possible that Bitcoin will drop to a key support zone below $30k in the $27k–$28k area.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română