This week, trading activity on the EUR/USD market is rather slow. It seems that the market has taken another break, and since Monday, the pair has been trading in a relatively narrow range. In fact, the most popular forex pair is currently holding in a flat channel, and it is hard to say when it will leave it. The recent Fed meeting where the regulator raised the rate by 50 instead of 25 basis points caused an unexpected market reaction which suggests that the US dollar has been largely overbought. As for the euro, traders are hesitating to buy it due to the weakness of the European economy and the less hawkish stance of the ECB compared to its American counterpart. Meanwhile, members of the US Federal Reserve continue to maintain a tough stance on monetary policy. Thus, Federal Reserve Bank of Atlanta President Raphael Bostic noted the instant reaction of financial markets to the Fed's actions.

In other words, Bostic could be referring to the fact that further aggressive monetary tightening has been quickly priced in by the USD market. Well, it is hard to disagree with that. Bostic also noted the strong state of the world's leading economy and strong demand, while stressing that the policy of the US central bank must be adaptive and reliable. According to the Atlanta Fed President, the regulator needs to be heading towards the neutral range somewhere between 2-2.5%. Another Fed policymaker, Cleveland Fed President Loretta Mester, spoke yesterday in favor of a rapid rate hike, the main purpose of which is to reduce inflation. According to Mester, it would be very reasonable to raise the federal funds rate several more times by 50 basis points at the upcoming FOMC meetings. At the same time, Mester does not rule out a rate hike by 75 basis points but only at one of the meetings. As you can see, Fed's policymakers keep demonstrating a tough approach to future policy. Yet, the reaction to such statements is getting weaker. It may be that the market has already adjusted to these changes. Before moving on to technical analysis, let me remind you that the main event of the day will be inflation reports in the US which include the US consumer price index and the base value of the index.

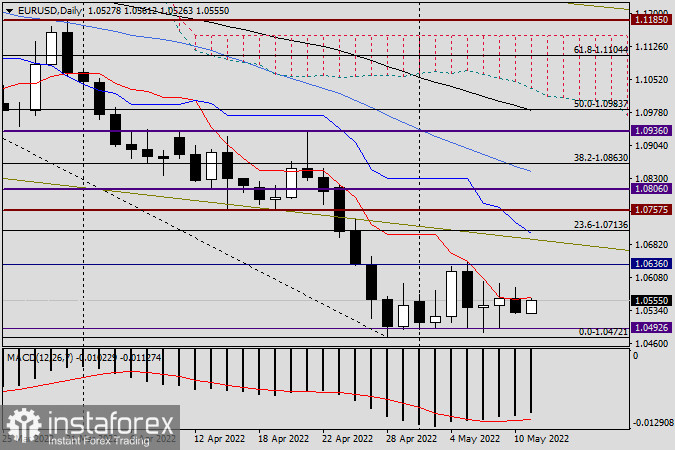

Daily chart

On the daily chart, we can clearly see that the market is trading flat. At the same time, long lower shadows of several previous candlesticks indicate that the further decline is unlikely. The upside potential of EUR/USD is limited by the red Tenkan line of the Ichimoku indicator located at 1.0562. A close above the Tenkan line will create technical conditions for further growth. There is one more thing. As long as the euro/dollar pair is trading above the most important psychological and technical level of 1.0500, the uptrend remains relevant. If bears manage to break through the support at 1.0472, the price may resume its decline with even greater force. It is always hard to predict further direction when the pair is trading flat as the situation can unfold in different ways. But as far as I see it, buying the pair from the area of 1.0510-1.0480 looks like a good option. However, selling is also possible, especially if the euro bulls fail to push the quote above the red Tenkan line.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română