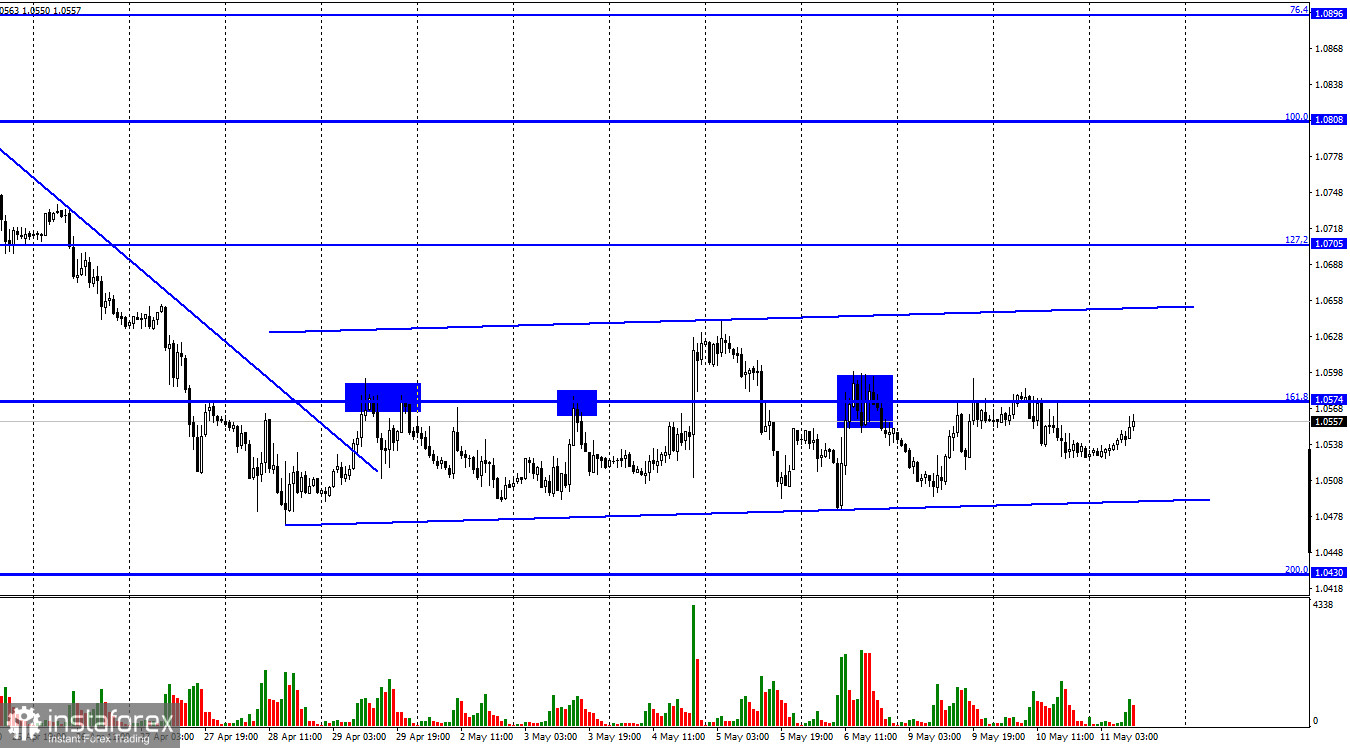

Good afternoon, dear traders! Yesterday, the euro/dollar pair dropped slightly after a rebound from the correction level of 161.8% - 1.0574. However, today, it recovered to this level again. Another reversal from 1.0574 will strengthen the US dollar. Yet, it may also lead to a slight decline in its quotes. The pair has been stuck in the sideways corridor for the last two weeks. So, I do not expect the euro to fall further or rise sharply. As I have already mentioned, despite the sideways channel, trading sentiment is now more bearish. Besides, there have been no events this week that could somehow trigger a trend reversal. The US inflation report for April is on tap today. Perhaps it may change market sentiment. We will find out whether it is true only in the second half of the day. At the time of writing the article, the pair was located in the middle of the sideways corridor. The odds that the price may break out of the channel are extremely slim.

Yesterday, US President Joe Biden made a speech. He touched upon one of the most important topics for the country - inflation. Biden said that high inflation was fueled by supply chain disruptions due to the coronavirus pandemic, as well as lockdowns introduced in many countries worldwide over the past two years. Countries are still unable to tackle supply chain problems. Notably, supply chains are unlikely to stabilize for some crucial categories of goods in the long term because of the Russia-Ukraine conflict. Ukraine may be unable to harvest crops, plant new ones, or sustain livestock production as the conflict evolves. It may also hinder exports of wheat and other agricultural crops from Ukraine. Kyiv has already imposed restrictions on grain exports. In addition, there are many logistic problems as Ukrainian seaports are currently blocked. Biden noted that his administration and the Fed are doing everything possible to curb inflation as quickly as possible. However, the regulator has already stated that it may take a long time before the Fed is able to push inflation to the target level despite constant rate hikes.

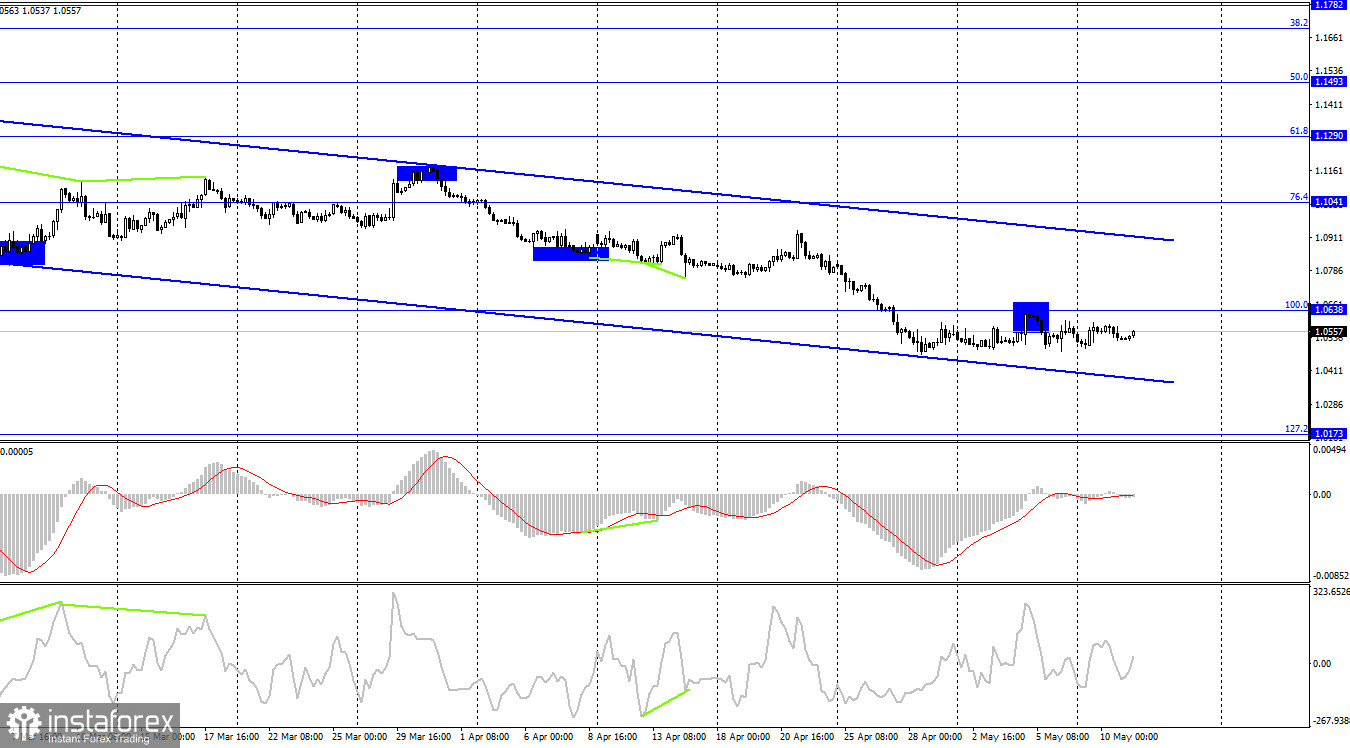

On the 4-hour chart, the euro/dollar pair retreated from the Fib correction level of 100.0% - 1.0638. The US dollar took advantage of it. Thus, the pair may drift lower to the next Fibo correction level of 127.2% - 1.0173. A persistent drop in the quotes indicates that the trend is now more bearish. If the pair consolidates above the level of 1.0638, it may rise to the upper limit of the downward corridor.

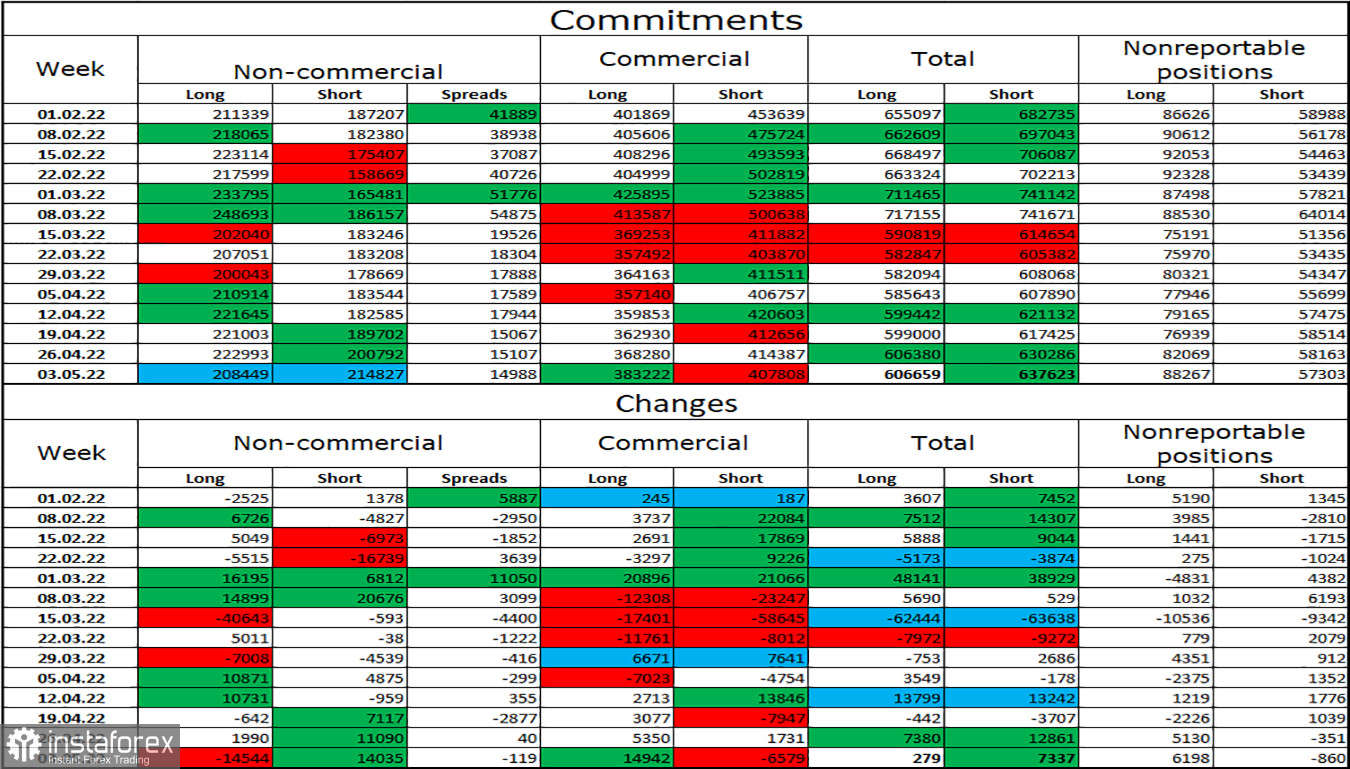

Commitments of Traders (COT):

Last week, speculators closed 14,544 Long contracts and opened 14,035 Short contracts. Apparently, the bullish mood of the major market players has been weakening for the third week in a row. Now, the total number of Long contracts amounts to 208,000, while the number of Short contracts totals 214,000. The mood of the "Non-commercial" category of traders has become more bearish for the first time in quite a long time. The euro/pair keeps falling. The COT reports have indicated a possible growth of the pair for several months in a row. To this end, I am not sure that the pair seems to have resumed the long-awaited trend. The prolonged military conflict in Ukraine, the deterioration of relations between Europe and Russia, new sanctions, and the ECB's soft stance have a very strong impact on the mood of traders.

The economic calendar for the US and the EU:

EU - ECB President Christine Lagarde will deliver a speech (08:00 UTC).

US – CPI index (12:30 UTC).

On May 11, the economic calendar for the EU and the US contains one crucial event for each country. European traders will surely take notice of Christine Lagarde's speech. The US is scheduled to unveil its inflation data. These two events may strip volatility in the market.

Outlook for EUR/USD and trading recommendations:

It is better to open short positions if the pair rolls back from the 1.0574 level on the 1H chart with the prospect of a drop to the lower border of the sideways corridor. I would advise you to refrain from opening long positions as long as the pair is stuck within the sideways channel on the 1H chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română