Although inflation in the United States has declined, it has not helped European currencies in any way. It was expected that the growth rate of consumer prices would slow down from 8.5% to 8.2%, which would be a reason for the Federal Reserve to revise the pace of interest rate hikes in the direction of slower growth. But it is precisely the expectation of a strong increase in interest rates in the United States that is the main driving force behind the growth of the dollar. And a slowdown in inflation could have caused a revision of these expectations, which should have led to a noticeable weakening of the US currency. However, inflation slowed only to 8.3%. And it is too early to say that the Federal Reserve will reconsider the current pace of monetary policy tightening.

As a result, the pound and the single European currency began to lose their positions noticeably. Especially the pound, which literally collapsed. And such a strong fall in the pound is largely due to purely internal problems. The fact is that the state of the British economy is causing more and more concerns. At the moment, there is active talk in the United Kingdom about the extremely high risk of mass bankruptcy of ordinary citizens due to a sharp increase in utility bills. According to the latest estimates, published just yesterday, by the end of this year, about one and a half million Britons may be beyond the poverty line. And such forecasts do not contribute to the growth of optimism about the prospects of the British economy and the pound.

Inflation (United States):

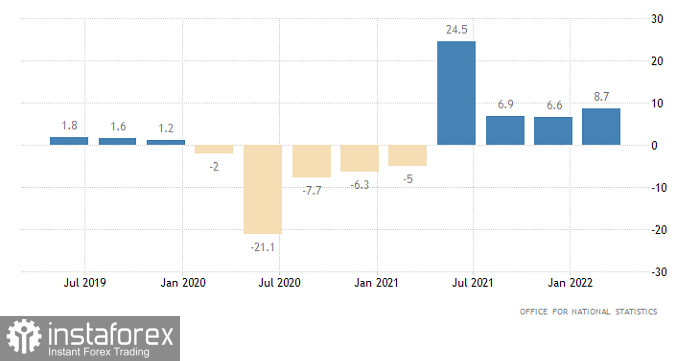

The situation for the pound is further aggravated by the GDP data for the first quarter, the growth rate of which, although it increased from 6.6% to 8.7%, still disappointed investors. Economic growth was expected to accelerate as much as 9.0%. At the same time, there is no doubt that economic growth will slow down sharply in the second quarter. And since it is now growing slower than forecasts, the results of the second quarter may turn out to be completely terrifying.

Change in GDP (UK):

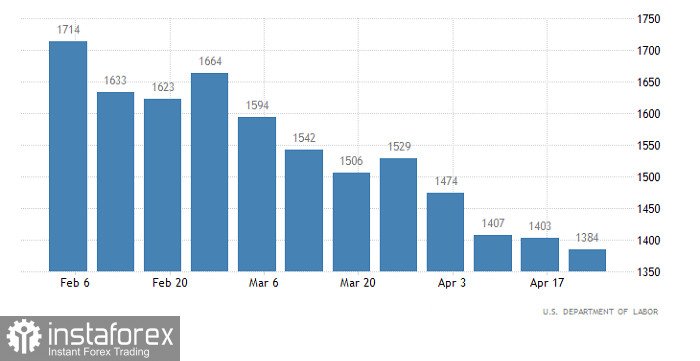

Nevertheless, one should not write off such a simple fact as the apparent oversold value of the pound. So a local correction is clearly overdue. And the single European currency has remained in the corridor, from which it has not been able to escape for almost two weeks. It just moved to the lower limit of the range from 1.05 to 1.06, and it is logical to expect a gradual movement to the upper limit. The reason may be data on applications for unemployment benefits in the United States, which should show an increase, albeit not significant. So, the number of initial claims should increase by 5,000, and the continuing claims by 6,000.

Number of continuing claims for unemployment benefits (United States):

Data on producer prices, whose growth rates may slow down from 11.2% to 11.0%, will not affect the situation in any way. As a matter of fact, they will repeat yesterday's data on inflation, which the market has already taken into account.

Producer Price Index (United States):

The EURUSD currency pair has been moving in the 1.0500/1.0600 side channel for the second week in a row, consistently working out the set boundaries. In this situation, there is a process of accumulation of trading forces, which will lead to a natural acceleration at the time of the breakdown of one or another border of the flat.

The GBPUSD currency pair resumed its downward course after a short stop. This led to the breakdown of the variable pivot point 1.2250, which resulted in the prolongation of the main trend. The prospect of price development considers a deeper decline in the pound sterling towards the psychological level of 1.2000. At the same time, local overheating of short positions in the short term allows for a small pullback in the market.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română