It was meant to happen

Hi, dear traders!

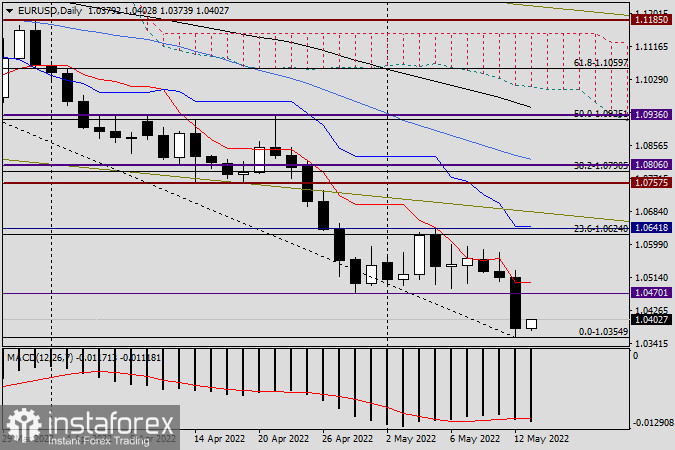

Yesterday, after a prolonged sideways consolidation, EUR/USD broke out of the 1.0641-1.0470 price range and fell to 1.0355, as market players continued to follow the aggressive monetary tightening course of the Federal Reserve.

Unlike other central banks, the Fed can follow this course thanks to the robust state of the US economy. Regulators in other countries will likely be forced to tighten their own monetary policy at a much slower pace. In the meantime, Ukraine plans to shut down Russian gas transit due to the conflict, putting Europe on the brink of an energy crisis and increasing demand for USD as a safe haven asset.

Yesterday's US PPI data release was mixed, however it was unlikely to cause the EUR/USD breakout. Today's data releases are EU industrial production report, US import prices data, and US consumer sentiment report by the University of Michigan.

Daily

As it was stated earlier, EUR/USD slumped yesterday, falling below the support level of 1.0470 and the key technical level of 1.0400. This indicates that the downtrend could continue. The technical area of 1.0320-1.0300 is now in focus of bearish traders. However, the pair could still retrace back to the broken support levels of 1.0400-1.0470. If EUR/USD does retrace to these levels, it will allow opening short positions. However, it is unlikely to happen today, the final trading session of the week. Nevertheless, traders could still open short positions with small targets if EUR/USD retraces towards 1.0400, 1.0420, and 1.0445, and if bearish reversal patterns appear at smaller timeframes. Positions should probably not be kept open over the weekend.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română