Bitcoin collapsed to the lowest mark since December 2020. This sharp price action assured investors that the flagship cryptocurrency is not as lucrative as it seemed. Those who used to consider the crypto to be a goldmine are now thinking about how to cut losses. What seemed to be a great opportunity to hit the jackpot is tuning into heavy losses.

The bitcoin magic was about its stunning rally. So, crypto fans jumped on the bandwagon, reckoning lofty profits that they could have gained if they had bought tokens at the dawn of the crypto market. For its history of more than 10 years, the crypto market has never closed below the lowest level of the previous year. 2015 looks to be a failure because for the most part of the yearBTCUSD traded below the bottom of 2014. Eventually, the token closed the year above this level. 2022 is sure to be an exception from the rule.

Amid the COVID pandemic and mind-blowing stimulus programs conducted by the US Fed, bitcoin managed to set an all-time high of more than $69,000. However, as soon as it became clear that cheap liquidity would leave the market, the number one cryptocurrency was hurt by massive sell-offs. BTCUSD quotes have lost about 56% of their value from the levels of November peaks, and the capitalization of the 500 largest digital assets, led by Bitcoin, has shrunk from almost $4 trillion to $1.2 trillion.

Market capitalization of digital assets

At thesame time, the shares of American companies, whose activities were related to the crypto market, also faced heavy losses. The market value of the 25 largest issuers, including Block, Coinbase Global, and Robinhood Markets, contracted by $200 billion.

In essence, the normalization of the Fed's monetary policy has led to the fact that bitcoin has turned from a magical asset into a normal asset, the value of which fluctuates depending on monetary policy, the state of the economy, and capital market conditions. A similar story happened with gold, which, after the end of the gold standard era, first developed a stunning rally and then entered into its trading range and continues to trade sideways. The precious metal used to be a magical asset for the baby boomer generation, just as it was with the flagship cryptocurrency sector and the millennial generation.

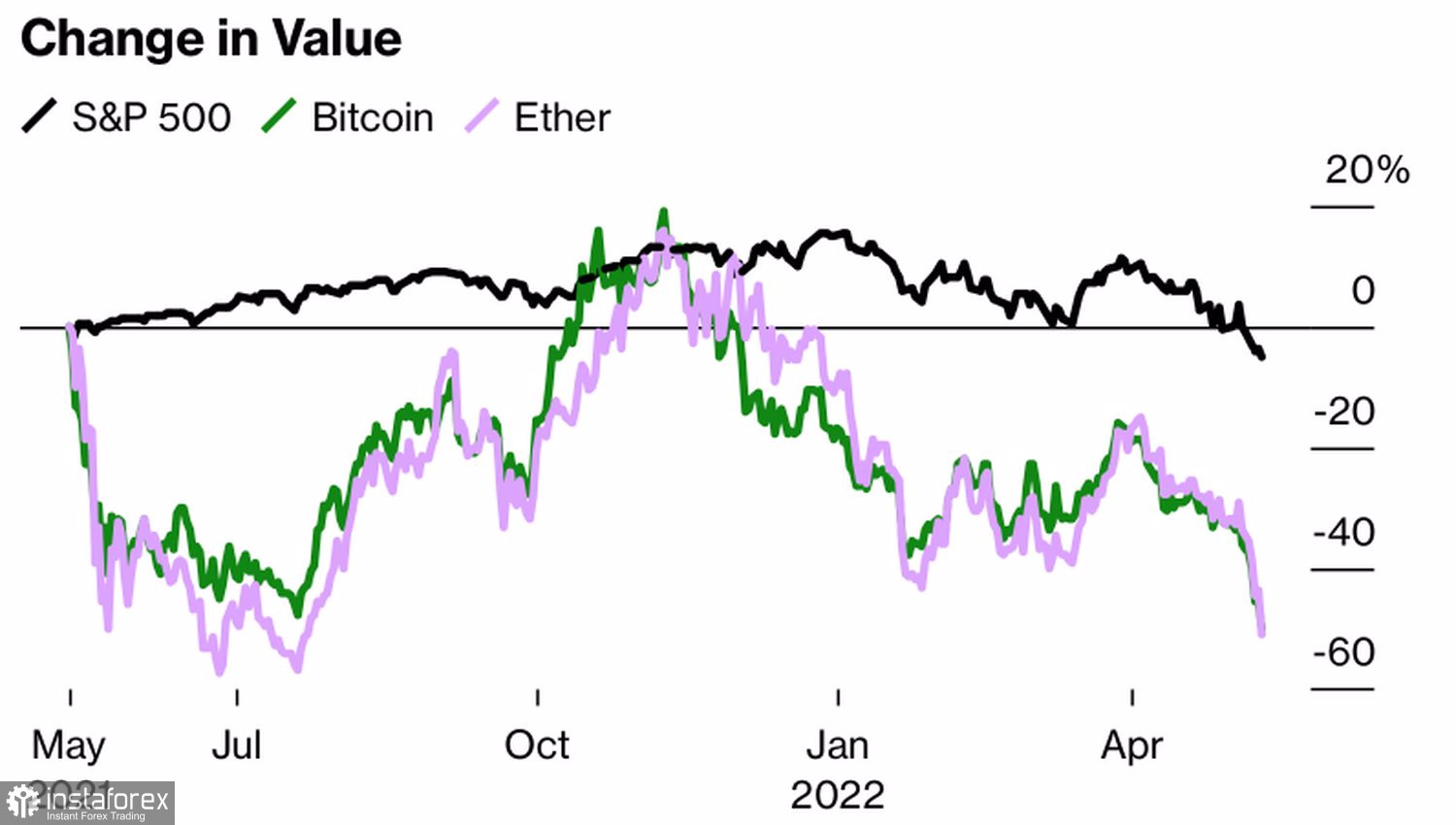

Dynamic of S&P 500, bitcoin and Ethereum

In May,bitcoin was hit with a double whammy by the Fed's focus on aggressive monetary tightening and the fact that collateralized stablecoins, which should be pegged to the US dollar at a ratio of 1 to 1, unexpectedly unlinked from the US currency and sank below its value. TerraUSD set a bad example, and it turned out to be contagious even for the largest representative of the sector - Techer.

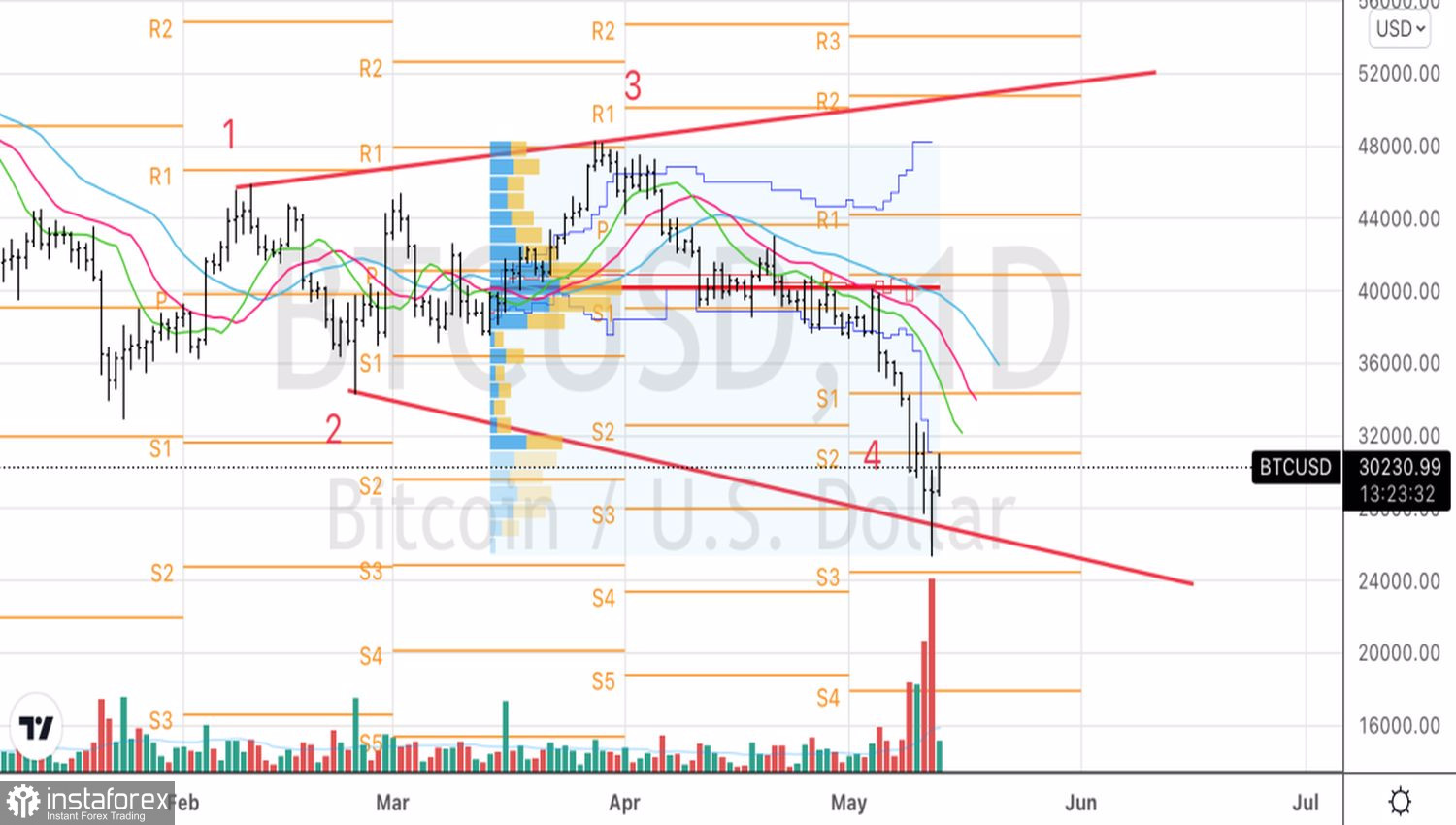

Technically, on the daily BTCUSD chart, there is a pin bar formation on increased volumes. This is a signal that the bulls are ready to assert strength. A break of resistance at 31050, where both the lower line of the fair value and the pivot level are located, may become a signal for short-term purchases.

Daily chart of bitcoin

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română