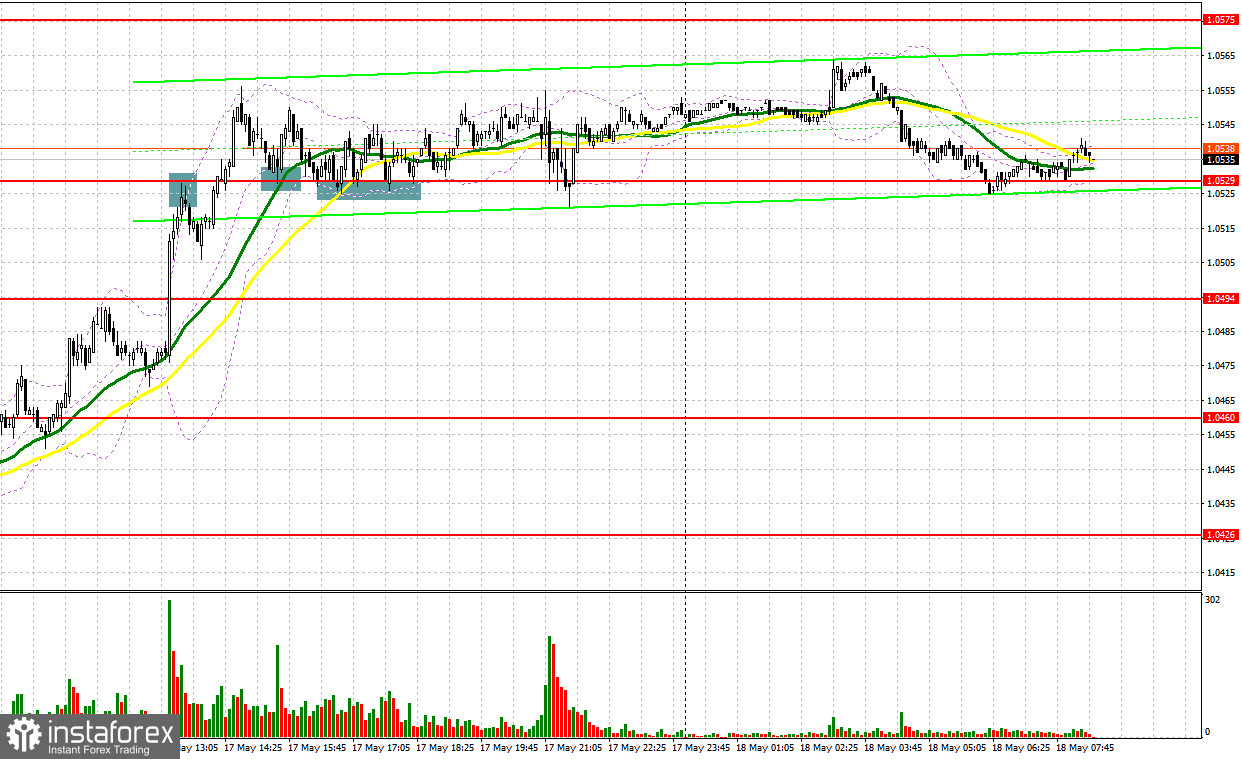

Yesterday, quite a lot of market entry signals were formed, but not all of them turned out to be as profitable as we would like. I suggest you take a look at the 5-minute chart and figure out what happened. I paid attention to the 1.0462 level in my morning forecast and advised you to make decisions on entering the market from it. Eurozone GDP for the first quarter of this year turned out to be better than economists' forecasts, which provided confidence to the euro bulls. A false breakout at the 1.0462 level at the very beginning of the European session generated a signal for short positions, but, as I think you already understood, losses were recorded on it. We missed resistance at 1.0497 quite a bit, so we didn't manage to enter short positions from this level, as well as longs from 1.0462 due to the lack of a clear test from top to bottom of this range. It continued to rise in the afternoon, and a false breakout at 1.0529 generated a signal for shorts against the trend. The downward movement amounted to about 15 points, which brought back demand for the euro. A breakthrough and reverse test from the top to the bottom of this range gave a signal for longs. However, the new jump to the peak was about 20 points and that was it. Other entry points to buy from this level gave even less positive results.

When to go long on EUR/USD:

A major rise in the euro could end as quickly as it began. For this reason, be careful with long positions. To do this, you need to make sure that there are large players in the market at the nearest support levels. Eurozone inflation data can help with that. In the event that the indicators go beyond economists' forecasts and the CPI index continues its active growth in April this year, I recommend continuing to buy the euro, as this will force the European Central Bank to be more active regarding changes in monetary policy.

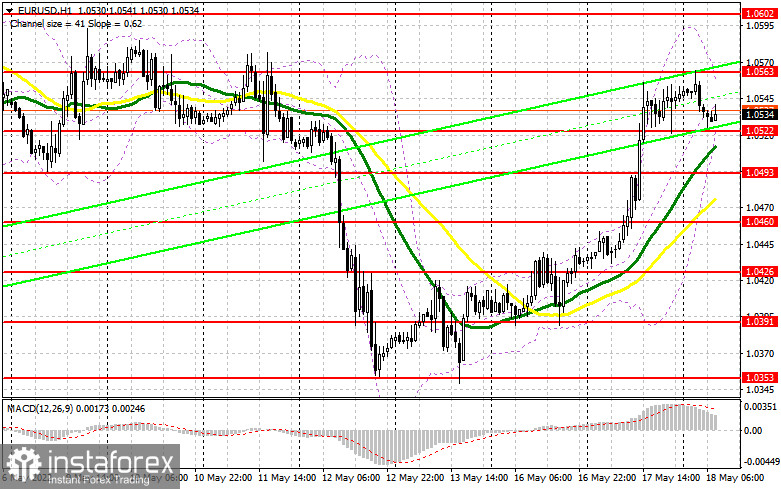

In this regard, the first task for today is to protect the intermediate support at 1.0522, just below which are moving averages, playing on the bulls' side. If the pair declines after the inflation data is released, forming a false breakout at this level will generate an excellent signal to buy the euro in continuation of developing the bull market and with the prospect of a return to 1.0563. A break and test of this range from top to bottom creates a new signal for entering long positions, opening up the possibility of a correction to the area of 1.0602, where I recommend taking profits.

The 1.0640 high will be a more distant target, but we can reach this level in the afternoon, when a number of US reports will be released and representatives of the Federal Reserve will give speeches. In case EUR/USD falls and bulls are not active at 1.0522, this will be the first call that yesterday's growth was nothing more than "fake". This has been repeatedly seen on the market recently, so do not fall for this bait. The best option to buy would be a false breakout near the low of 1.0493. I advise you to open long positions immediately on a rebound only from 1.0460, or even lower - in the area of 1.0426, counting on an upward correction of 30-35 points within the day.

When to go short on EUR/USD:

The lack of aggression on the bears' part and dismantling a number of stop orders along with a technical upward correction of the pair is not surprising - especially when the euro was so heavily oversold against the US dollar. Today, bears can only count on the lack of progress in the growth of the consumer price index in the eurozone, which will protect 1.0563.

Divergence on the MACD indicator, which has now formed and forming a false breakout at this level after the release of the data - all this will be the first signal to open short positions with the prospect of a return to 1.0522. For this level, a very active confrontation will unfold, or should unfold. If it does not exist, all this will only increase the presence of bears in the market. A breakthrough and consolidation below 1.0522, as well as a reverse test from below upwards of this level, will give a new signal for shorts, which will result in dismantling a number of bullish stop orders and to the strengthening of the bearish trend with the prospect of a return to 1.0493 and 1.0460, where I recommend taking profits.

The 1.0426 level is a more distant target. The upward trend will continue if the EUR/USD moves up in the first half of the day if we receive strong data on the eurozone, and also if the bears are not active at 1.0563, and then it will really be possible to talk about building a new bullish trend. The optimal scenario in this case would be short positions during a false breakout forming in the area of 1.0602. You can sell EUR/USD immediately on a rebound from 1.0640, or even higher - in the area of 1.0691, counting on a downward correction of 30-35 points.

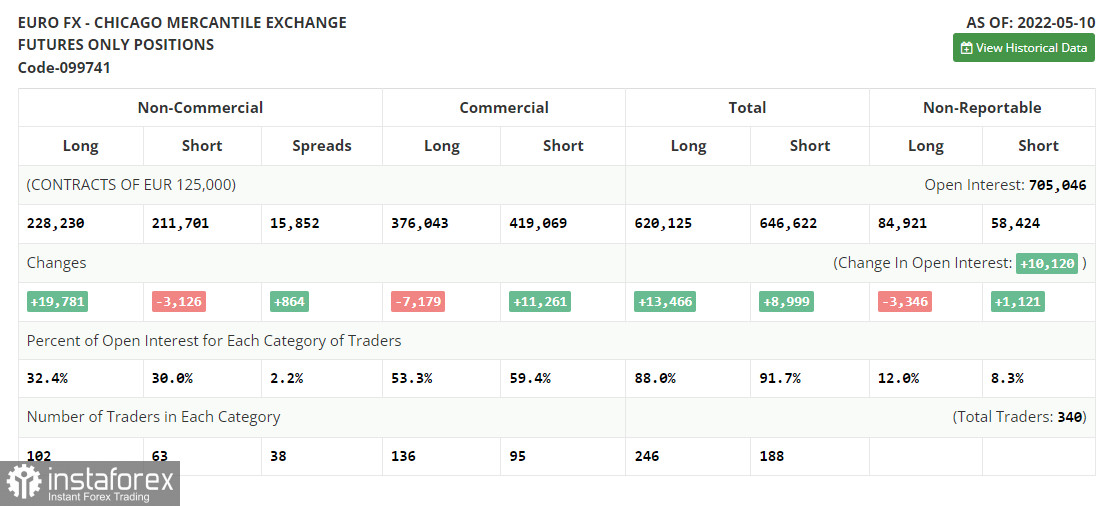

COT report:

The Commitment of Traders (COT) report for May 10 shows a sharp increase in long positions and contraction in short ones. The euro's overbought status indicates interest from traders and investors. Recent statements from ECB policymakers arouse optimism in hope that the euro will be able to develop an upward cycle. The ECB governing board will increase the deposit rate by 0.25% as early as July 2022. The next rate hikes will follow in September and in December. The deposit rate will stand at 0.25% at the year-end.

Besides, the key interest rate will be raised in September and in December from the current zero level to 0.5%. Such a hawkish policy will allow the euro buyers to touch the bottom in the near future. Nevertheless, the US Fed alongside escalating geopolitical jitters might derail such plans. Let me remind you that the US Fed intends to pursue aggressive monetary tightening. There are rumors that the FOMC could lift interest rates by 0.75% at a time at the next policy meeting. This scenario gives a clear signal to buy the US dollar in the medium term.

The COT report reads that long non-commercial positions jumped rapidly by 19,781 from 208,449 to 228,230. At the same time, short mom-commercial positions dropped by 3,126 from 214,827 to 211,701. I noted that the low rate of the euro makes it more attractive for traders. Currently, we see that more buyers are entering the market. The overall non-commercial net positions rose to 16,529 at the end of the last week against the negative -6,378 a week ago. EUR/USD closed last week almost flat at 1.0546 against 1.0545 in the previous week.

Indicator signals:

Moving averages

Trading is above the 30 and 50-day moving averages, which indicates an attempt by the bulls to continue the upward correction.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakthrough of the lower border of the indicator in the area of 1.0522 will lead to a new fall in the euro.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română