The Australian dollar paired with the US currency today made another attempt at corrective growth, reacting to the Australian labor market data. The report turned out to be quite positive, although with some flaws—but traders focused their attention primarily on its positive aspects. Aussie cheered up again and tried to gain a foothold above the 0.7000 level.

Note that this is not the first attempt of such an assault. Since then, when the AUD/USD bears crossed this key price barrier, buyers are persistently trying to come back. This week, traders were even able to rise "from the depth" of the 68th figure, as part of another corrective growth. However, they could not stay above the 0.7000 mark. Even today, AUD/USD bulls are trying to overcome a key milestone, relying on Australian labor market data. Given the failures of previous attempts, it can be assumed that the current attempts will end sadly. Therefore, it is advisable to use the current corrective growth to open short positions.

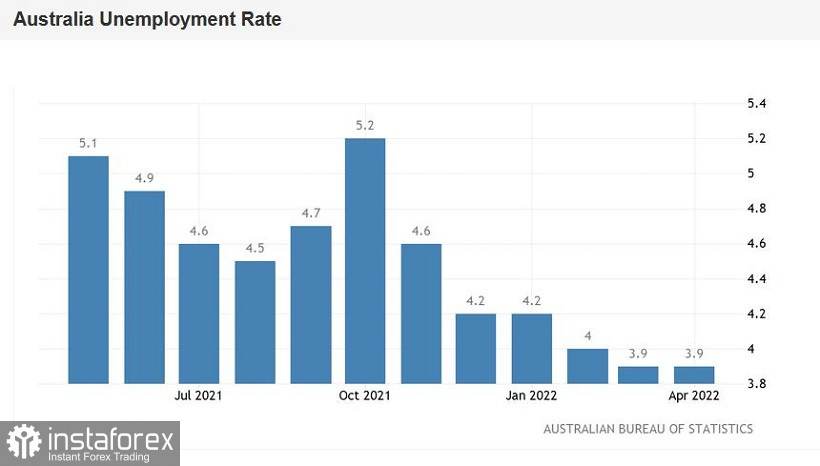

Unemployment in April remained at the March level, that is, at around 3.9%. This is the lowest level since 1974. By the way, in pre-crisis times, that is, before the coronavirus pandemic, this figure fluctuated in the range of 5.0%–5.3% for many months. Therefore, now we can say that the labor market has not only returned to the area of pre-crisis values, but also consolidated below the minimum levels. As for hidden unemployment, this indicator, according to experts, is at the level of 6.1%, which is the minimum value since September 2008.

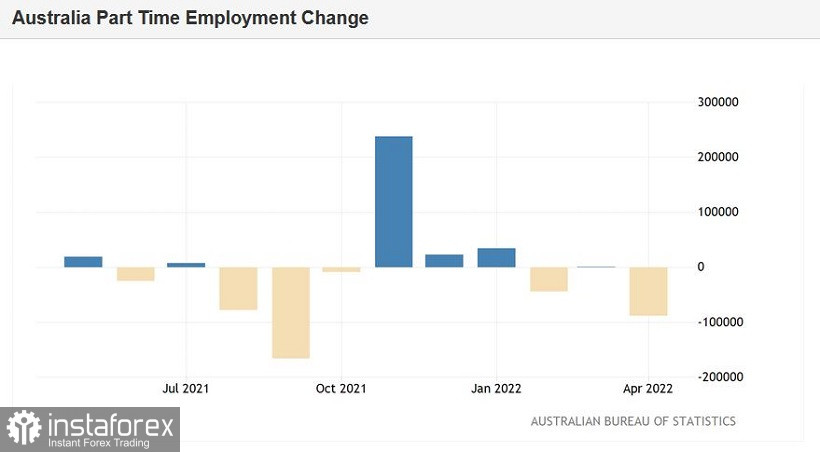

It is also worth paying attention to the growth rate of employment in April. The overall component came out in the red zone, being worse than the forecast values. The indicator reflected an increase of only 4,000 (with a growth forecast of 30,000). However, the highlight here is something else—a fairly optimistic balance of strong growth in full employment against the background of a sharp decline in part-time vacancies.

The structure of the overall indicator suggests that the growth was due to full employment. While part-time employment showed a negative result (the ratio of +92,000/-88,000). At the same time, it is known that full-time positions, as a rule, offer a higher level of wages and a higher level of social security compared to temporary part-time jobs. Therefore, the current dynamics in this regard is extremely positive, even despite the modest overall result. Moreover, a similar pattern was observed in the previous month: the component of full-time employment exceeded the component of partial employment.

All this suggests that the Australian labor market has once again demonstrated its "positive qualities," allowing AUD/USD buyers to count on a more hawkish attitude from the RBA members.

And yet, in my opinion, today's release will not be able to reverse the situation for the pair. The Aussie is still trading in the wake of the US currency, while the success of the Australian economy or the hawkish signals from the RBA only allow the Aussie to go into a correction, but no more. For example, this week the minutes of the May meeting of the Reserve Bank were published, the main theses of which inspired AUD/USD buyers to storm the 70th figure again. But after they broke the key price barrier of 0.7000, the upward momentum began to fade away—the sellers of the pair joined the work and were able to open sell orders at a better price.

The latest comments from Fed officials suggest that the Fed will raise rates at a more aggressive pace (compared to the RBA), and probably for a longer time. Therefore, despite the well-founded ambitions of AUD/USD buyers, they are unlikely to be able to gain a foothold above 0.7000. Moreover, for the development of an upward trend, it is not enough for the bulls of the pair to stand above this target. They must at least cement their positions above 0.7050 (the middle line of the Bollinger Bands indicator on the D1 timeframe). Only in this case will it be possible to talk about the prospects for reaching the 71st figure. To date, we are seeing only a correction, flavored with good labor market data.

Pay attention to the daily chart: over the past three days (including today) the upward momentum of AUD/USD has faded as it approaches the above resistance level of 0.7050. It is obvious that this is the most optimal price area for opening short positions with downward targets of 0.7000 and 0.6950 (the Tenkan-sen line on the D1 timeframe).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română