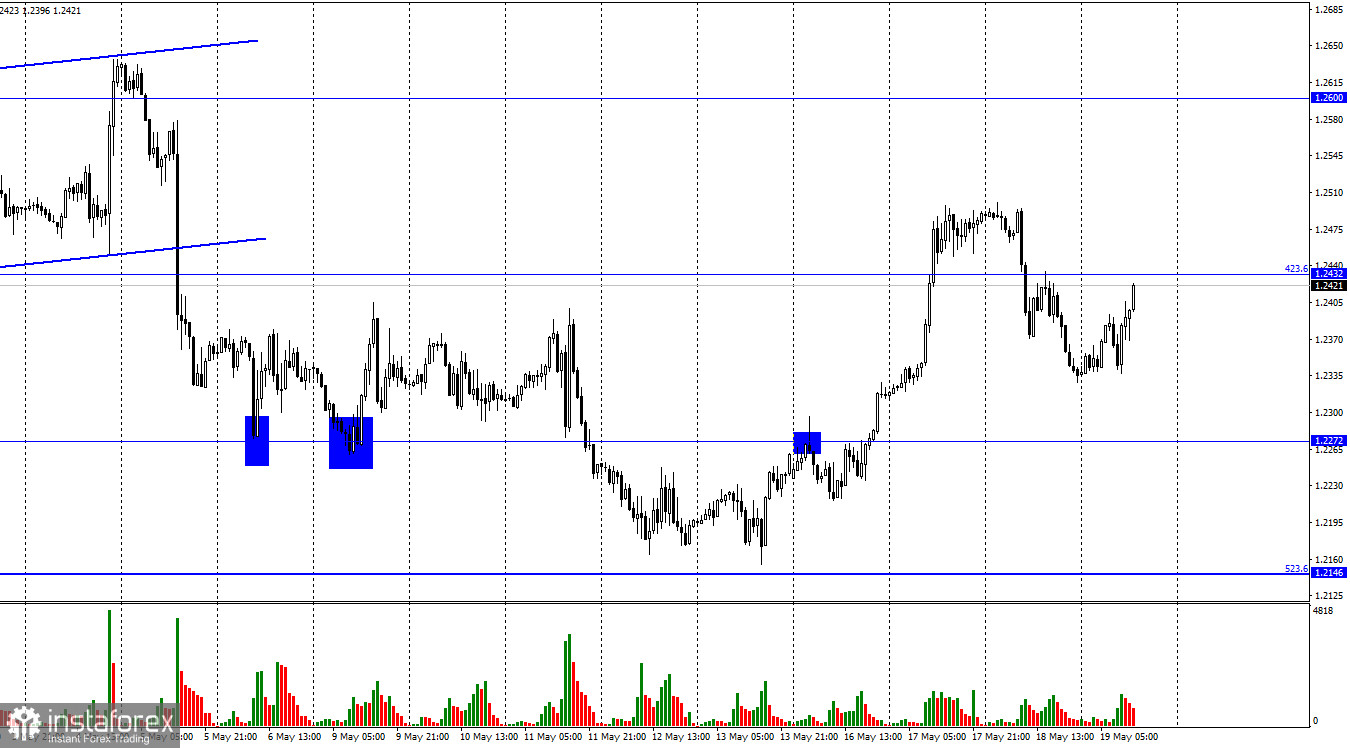

According to the hourly chart, the GBP/USD pair performed a reversal in favor of the British on Thursday after a strong fall on Wednesday, when a report on British inflation was released, which jumped to 40-year highs. Today in the UK, the calendar of economic events is also empty, so I see a good sign for the pound that today it shows growth for no reason. This week, another report on retail trade in the UK will be released only tomorrow morning, but the most interesting (unemployment, inflation, wages) is already over. The rebound of quotes from the Fibo level of 423.6% (1.2432), however, will work again in favor of the US currency and the resumption of the fall towards the level of 1.2272. Fixing the pair's rate above the level of 1.2432 will increase the likelihood of further growth towards the level of 1.2600. This growth had already begun but was shot down by the notorious inflation report. For the British pound, the outlook has improved dramatically over the past few days. Things are not as bad in Britain right now as they may seem. Unemployment rates and wages are very good, although GDP turned out to be weaker than expected, but also at a very good level in the first quarter (0.8% q/q), and the Bank of England still raised the interest rate four times. In the last few months, traders seem to have ignored all the positive news on the pound. But someday the fall of the Briton due to the geopolitical situation in Ukraine had to end. I think now is a good time for that. And if I'm right, then the pound can grow by another 300-400 points completely freely if traders remember that the monetary policy of the Fed and the Bank of England is now almost identical. The UK, which is no longer a member of the European Union, can solve all its problems on its own, and it does not have problems with oil and gas. New wells will be developed in the North Sea, there will be supplies from the USA, and production volumes in Norway or Denmark will be increased. In general, the British will not remain without oil and gas. And the prices are now rising everywhere and for everything.

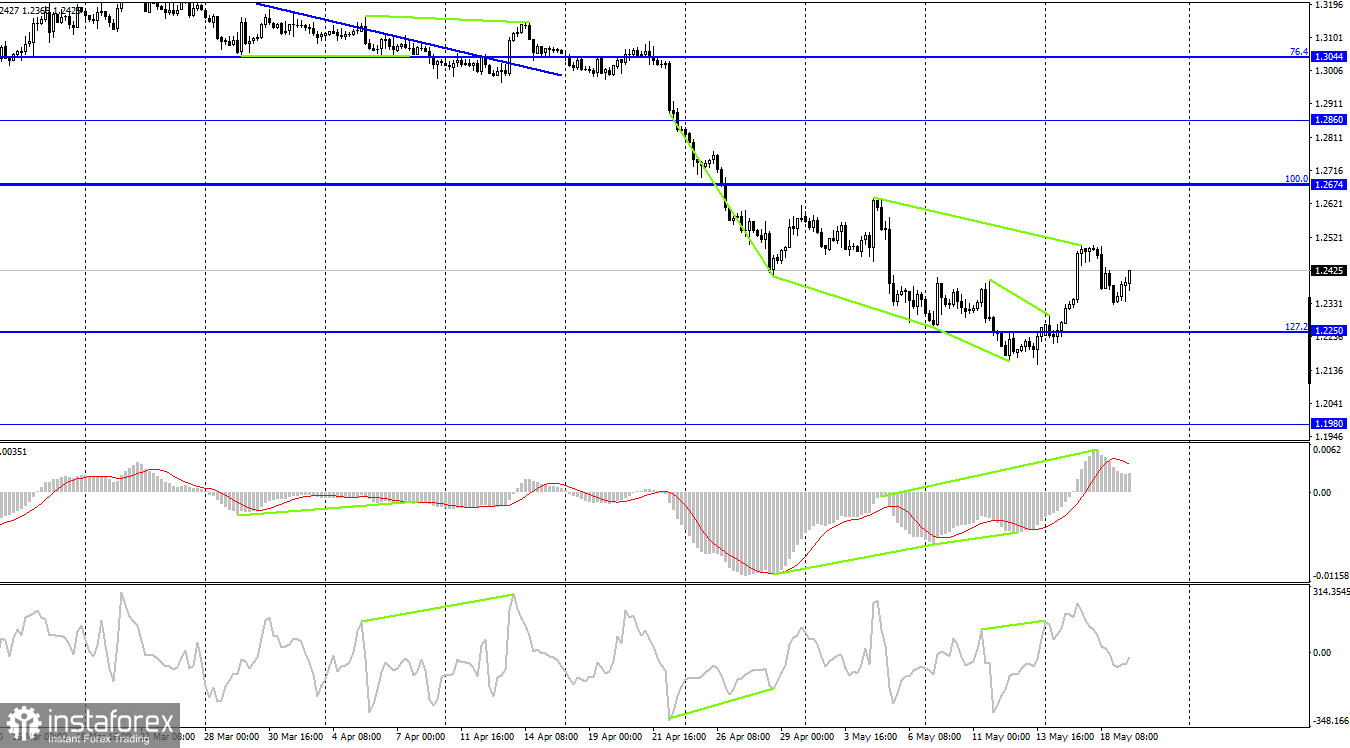

On the 4-hour chart, the pair secured above the corrective level of 127.2% (1.2250), which allows it to continue the growth process towards the next Fibo level of 100.0% (1.2674). The "bearish" divergence of the MACD indicator allowed the pair to perform a slight drop, but now the growth process has resumed. No new emerging divergences are observed in any indicator today.

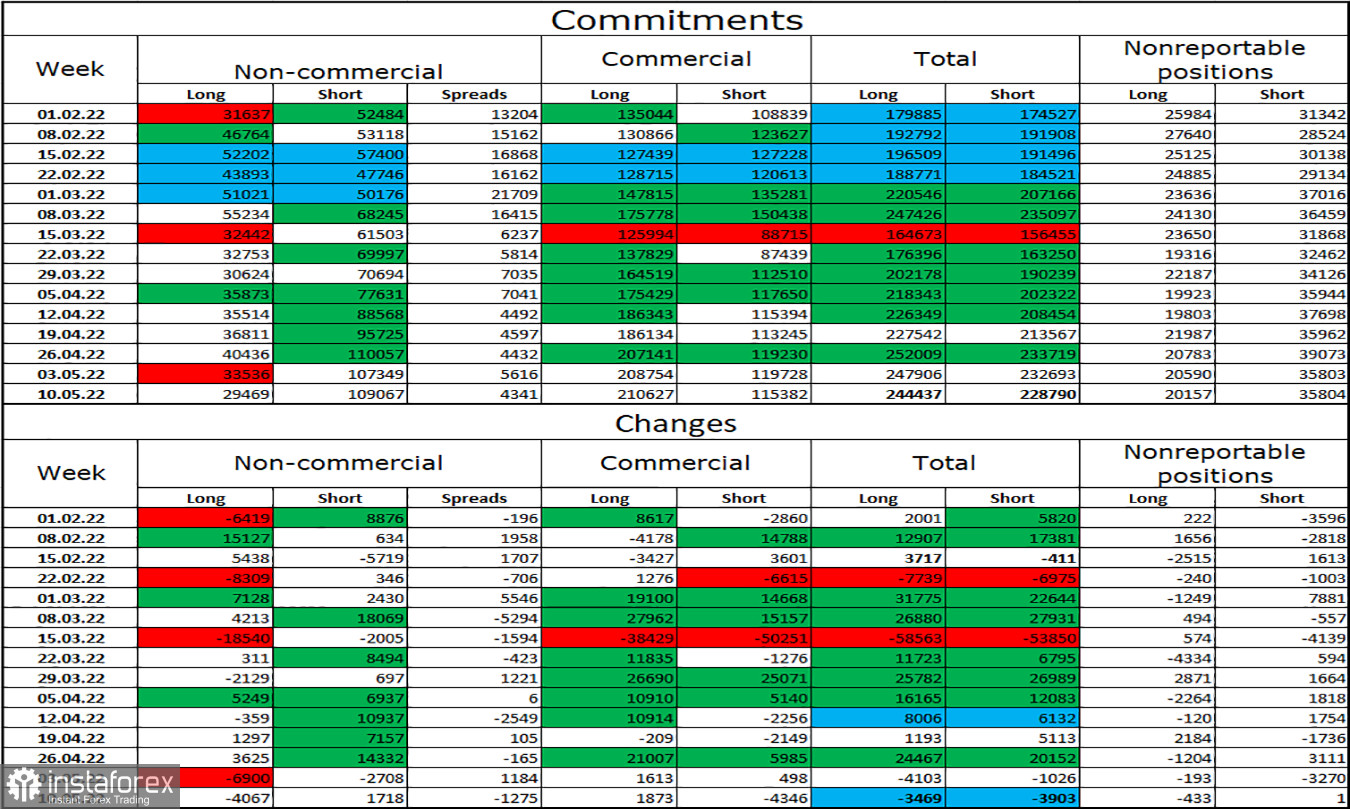

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has not changed too much over the past week. The number of long contracts in the hands of speculators decreased by 4,067 units, and the number of short contracts increased by 1,718. Thus, the general mood of the major players has become even more "bearish". The ratio between the number of long and short contracts for speculators still corresponds to the real picture on the market - longs are 4 times more than shorts (109,067-29,469). The big players continue to get rid of the pound. Thus, I expect that the pound may continue its decline over the coming weeks. But also such a strong gap between the number of longs and shorts may indicate an imminent change of trend in the market. I do not rule out that the British will end its long fall in the near future.

News calendar for the USA and the UK:

US - number of initial and repeated applications for unemployment benefits (12:30 UTC).

There is not a single important entry in the calendar of events in the UK on Thursday, and in the USA there is only one entry, but not too important. For the rest of the day, the influence of the information background on the mood of traders will be minimal or absent.

GBP/USD forecast and recommendations to traders:

I now recommend selling the British if a clear rebound from the level of 423.6% (1.2432) with a target of 1.2272 is performed. I recommend buying the British when closing quotes above the level of 423.6% on the hourly chart with a target of 1.2600.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română