On Monday, the US Treasury released another report on foreign capital flows for March. The report was to assess the extent to which investors reacted to the development of the military operation in Ukraine and, consequently, what the rate of withdrawal of capital to the US was. According to the report, there were no capital movements. This came as a big surprise. On the contrary, the dynamic is negative. Foreign investors are reducing their investments in US securities.

In March net sales of equities by foreign investors amounted to $94.3 billion, an all-time record. For corporate bonds and government agency securities the movement is minimal, as for treasuries the monthly decline is around 97 billion and the trend is clearly not in favour of the dollar.

The EU and Japan, the main providers of capital to the US, are having clear revenue problems. In the EU, the trade deficit is growing at a record high of €28.5bn in March. Japan has had a 9-month trade deficit and an 8-year record in January. The disappearance of trade surpluses is preventing key US allies from buying US debt.

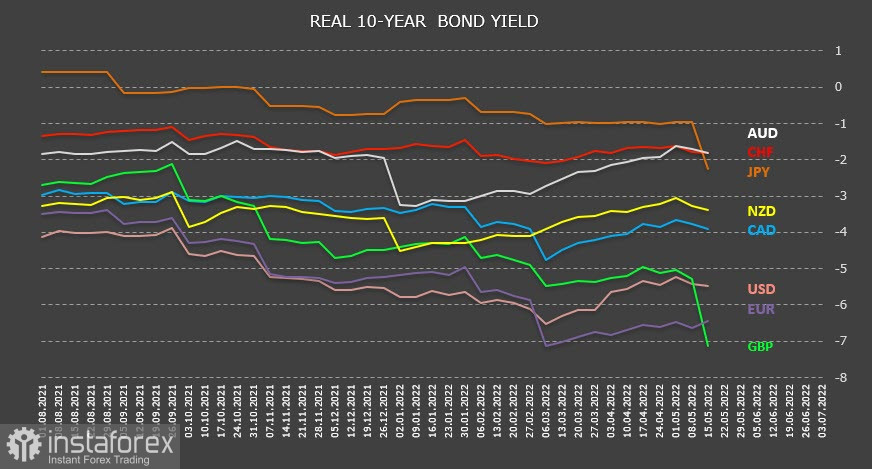

There is a contradiction. The dollar index has been rising rapidly in recent months, but foreign investors are not buying the dollar to invest in US securities. However, this is not surprising. Real yields are falling, despite hawkish statements from Fed officials. Central banks have started to raise rates to curb inflation, but real yields (calculated as the difference between 10-year government bond yields and inflation) are below zero for all countries.

The Japanese yen was the highest on this chart until Friday morning, as inflation was only 1.2% in March. However, the yen did not stay at the top for long, as inflation rose sharply to 2.5% in April and real yields in Japan went down. The euro and especially the pound are the worst performers, with the dollar having real returns below -5% as of Friday. These financial conditions really do not attract an investor.

The chart showing real yields is disappointing. The efforts of central banks have not yet yielded any results. The most likely scenario for the global economy in the face of rising inflation and slowing economic growth is stagflation. According to a May survey by Bank of America Global Research, some 77% of investment fund managers say they see "below-trend growth and above-trend inflation," also known as stagflation, as the most likely outcome for the global economy next year. This is the highest percentage since August 2008.

About 72% of fund managers expect the global economy to weaken over the next 12 months. This is the most pessimistic view of fund managers on the global economic outlook since 1995.

The real yield chart and the lack of a pronounced flow of foreign capital into the US shows that demand for the dollar has speculative and technical grounds rather than fundamental ones. Investors are guided by the Fed's rate hike schedule, which is expected to be more aggressive than that of other central banks. This provides some increase in demand for the dollar as a higher yielding currency in the future. It must also be assumed that the world's major debt is denominated in dollars and as the crisis unfolds, the demand for the funding currency increases because debt obligations need to be fulfilled in a deteriorating financial environment. This factor also indicates nothing about the strength of the dollar.

The development of the energy and food crisis will give an advantage to exporting countries. We assume that demand for the dollar will decline in the coming weeks. There is a high chance of strengthening for the Canadian dollar as well as the NZD and AUD, which are largely China-focused. The euro and pound will remain under strong pressure as they have no fundamental basis for growth.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română