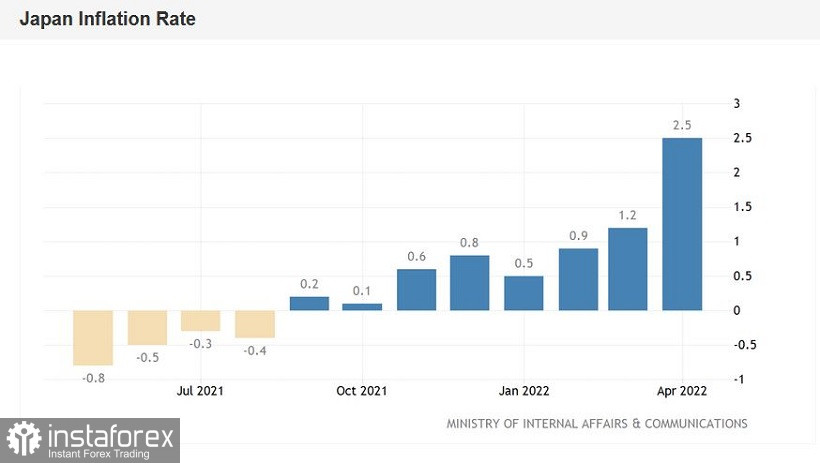

The yen ignored the release of key data on inflation in Japan. Although the report surprised with its "green color," all components exceeded the predicted values. Japan has not remained aloof from the global increase in inflationary pressure—the main indicators have been growing for the third month in a row, but the April results are of a breakthrough nature.

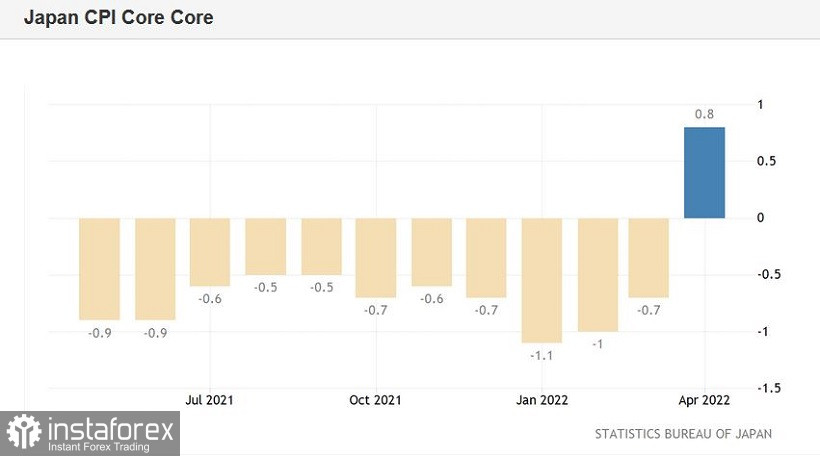

The general consumer price index continued its upward movement, rising this time to the mark of 2.5% (against the forecast of growth up to 1.5%). This is the strongest growth rate of the indicator since November 2014. The consumer price index, excluding fresh food prices, also showed positive dynamics, rising to 2.1% in April. The growth rate of this indicator became the highest since March 2015. Another component—the consumer price index excluding food and energy prices—left the negative area for the first time in many months: this indicator came out at around 0.8%.

The structure of today's release suggests that food prices in Japan jumped by 4% in April at once (this is the strongest price increase in the last 7 years). The price of fuel and utilities has risen significantly (by 15.7% at once). Clothes and footwear increased in price by 0.8%, furniture went up by 2.3%.

As we can see, inflation growth rates have increased significantly, as evidenced by long-term records. Therefore, the reaction of the yen looks, at first glance, illogical—during the Asian session on Friday, the USD/JPY pair even grew by several tens of points, although then it sharply reversed and returned to its previous positions. Over the past two days, the pair has been trading in the area of 127–128 figures, essentially repeating the trajectory of the US dollar index. The yen follows the greenback, while the national macroeconomic statistics of Japan do not affect the USD/JPY dynamics.

This is due to the position of the Japanese regulator. Bank of Japan Governor Haruhiko Kuroda, who is an ardent supporter of loose monetary policy, recently reiterated his dovish stance. Note that the March data on the growth of the consumer price index in Japan also came out in the green zone, reflecting rising inflation in the country. But the head of the Bank of Japan remained adamant: the central bank must continue to ease policy to achieve its price target. According to him, Japan has not yet reached a situation where inflation is steadily at the target of two percent.

At the end of the last meeting, the Japanese regulator also voiced a similar, already familiar rhetoric of a "dovish" nature: the central bank ruled out the possibility that in the foreseeable future it will change its current accommodative mood and (especially) raise the interest rate. According to most members of the Bank of Japan, inflation growth is temporary, and is due to rising energy and commodity prices. As an argument, members of the BoJ point to the weak growth of the consumer price index excluding food and energy prices, which has indeed been in the negative area for many months (since March 2021). In April, it exceeded zero, but its growth looks much more modest compared to the growth of the general CPI.

Just on Monday, the head of the Bank of Japan said that it was "important for the regulator to support economic activity with powerful monetary easing." According to him, it will take additional time for Japan to establish steady and stable inflation. How long it will take is unknown.

As for the devaluation of the yen, Kuroda prefers not to dramatize the situation. He was rather worried about the growth rate of USD/JPY ("sharp exchange rate movements are undesirable"), but the fact of the depreciation of the national currency does not bother Kuroda. A similar position is taken by some other representatives of the BoJ. For example, in early April, board member Asahi Noguchi said that the advantages of a weak yen for the Japanese economy "outweigh the disadvantages." In his opinion, the expensive national currency has "more painful consequences", in particular, in the form of deflation. It is noteworthy that similar rhetoric was voiced this week at the IMF. According to IMF Deputy Managing Director Kenji Okamura, "the depreciation of the yen helps Japan." In other words, the cheap yen has not become a "headache" for the Bank of Japan, so the central bank will not correct the situation, including verbally.

In my opinion, the yen will continue to move in the wake of the US currency, which, in turn, will react to the increased hawkish mood on the part of the Fed and the deterioration of the external fundamental background. The intensity of anti-risk risk sentiment is still not decreasing: geopolitical risks remain on the agenda, providing support to the safe dollar. At the moment, the USD/JPY pair is trading in a wide price range, between the lower and middle lines of the Bollinger Bands indicator on the daily chart (127.20 – 129.20). When approaching the lower border of the price corridor, longs will become a priority with targets of 128.50 (Kijun-sen line) and 129.00 (Tenkan-sen line).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română