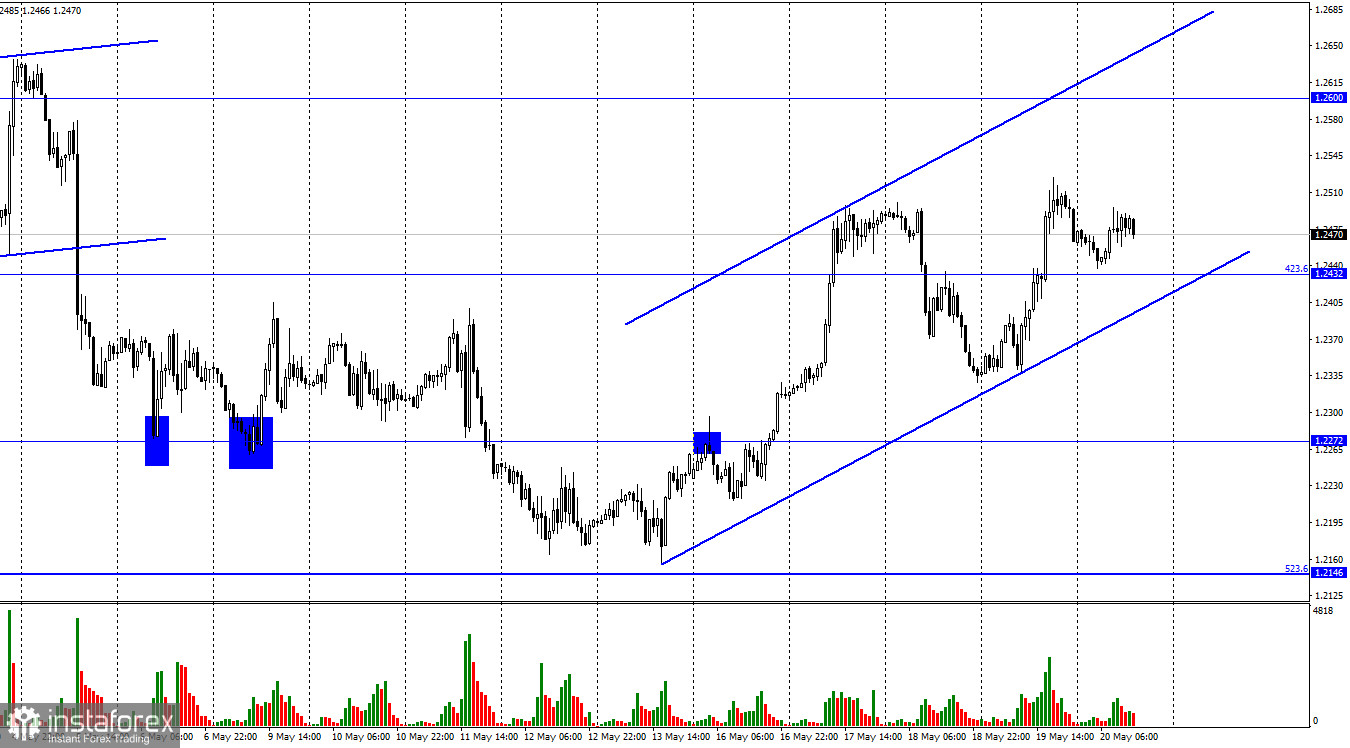

Hi, dear traders! According to the H1 chart, GBP/USD settled above the retracement level of 423.6% (1.2432) on Thursday. While the pair failed to extend its upside movement on Friday, it still remains above the 423.6% level. The ascending trend channel indicates traders are currently bullish. If GBP/USD settles below the trend channel, it could resume its fall towards 1.2272. There were a lot of key UK data releases this week, such as unemployment, average earnings, and inflation, as well as today's retail sales data. However, traders did not react to today's data release. Retail sales decreased by 4.9% YoY and increased by 1.4% MoM in April, exceeding expectations.

While this data release was mostly positive, bullish traders still lost steam. GBP/USD is finishing this week in positive territory, but the pound sterling's position is still precarious. Traders are wary about inflation in the UK, which exceeds inflation in both the US and the eurozone. Furthermore, the Bank of England could even pause its monetary tightening course for several months. This week, GBP advanced thanks to strong macroeconomic data, which could fail to provide support for the pair next week. If GBP/USD manages to stay within the ascending channel, the uptrend would continue. Negative economic events could end the pound's upsurge.

According to the H4 chart, the pair settled above the retracement level of 127.2% (1.2250). This allows GBP/USD to rise further towards the next Fibo level of 100.0% (1.2674). Earlier, the pair descended somewhat due to a bearish MACD divergence - it has since reversed upwards. There have been no emerging divergences today.

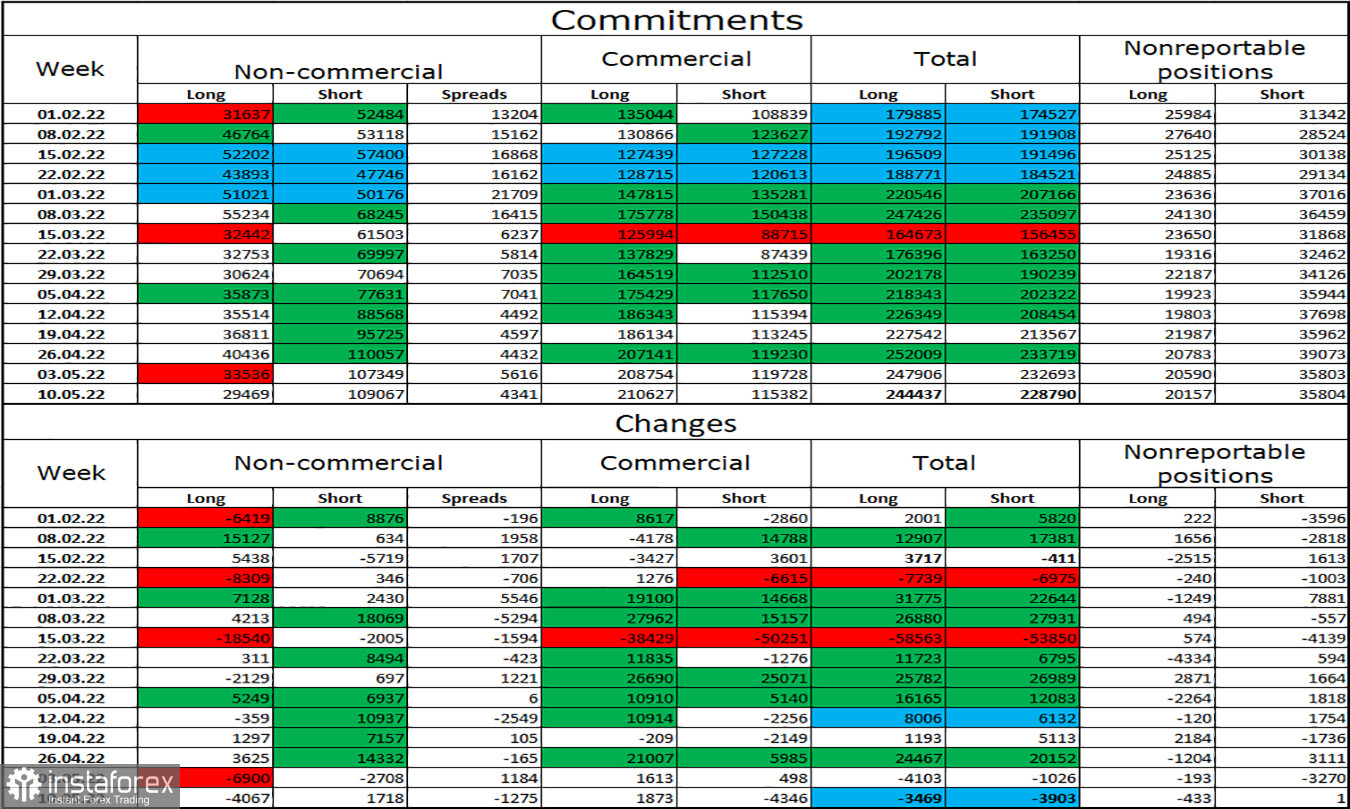

Commitments of Traders (COT) report:

The mood of Non-commercial traders did not change significantly last week. Traders closed 4,067 Long positions and opened 1,718 Short positions, indicating that major market players are now increasingly bearish. The total number of open Long positions exceeded short ones fourfold (109,067 - 29,469), as market players lower their exposure to GBP. The pound sterling is likely to continue to descend over the next couple of weeks. However, the massive gap between net longs and net shorts suggests GBP could rally in the near future.

US and UK economic calendar:

UK: Retail sales with auto fuel (06-00 UTC).

Traders have largely ignored the UK retail sales data. There are no important events in the US today.

Outlook for GBP/USD:

New short positions can be opened if the pair closes above the ascending trend channel, with 1.2272 being the target. Yesterday, traders were recommended to open long positions if GBP/USD closed above the retracement level of 423.6% on the H1 chart, with 1.2600 being the target. These positions can be kept open.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română