Trend analysis

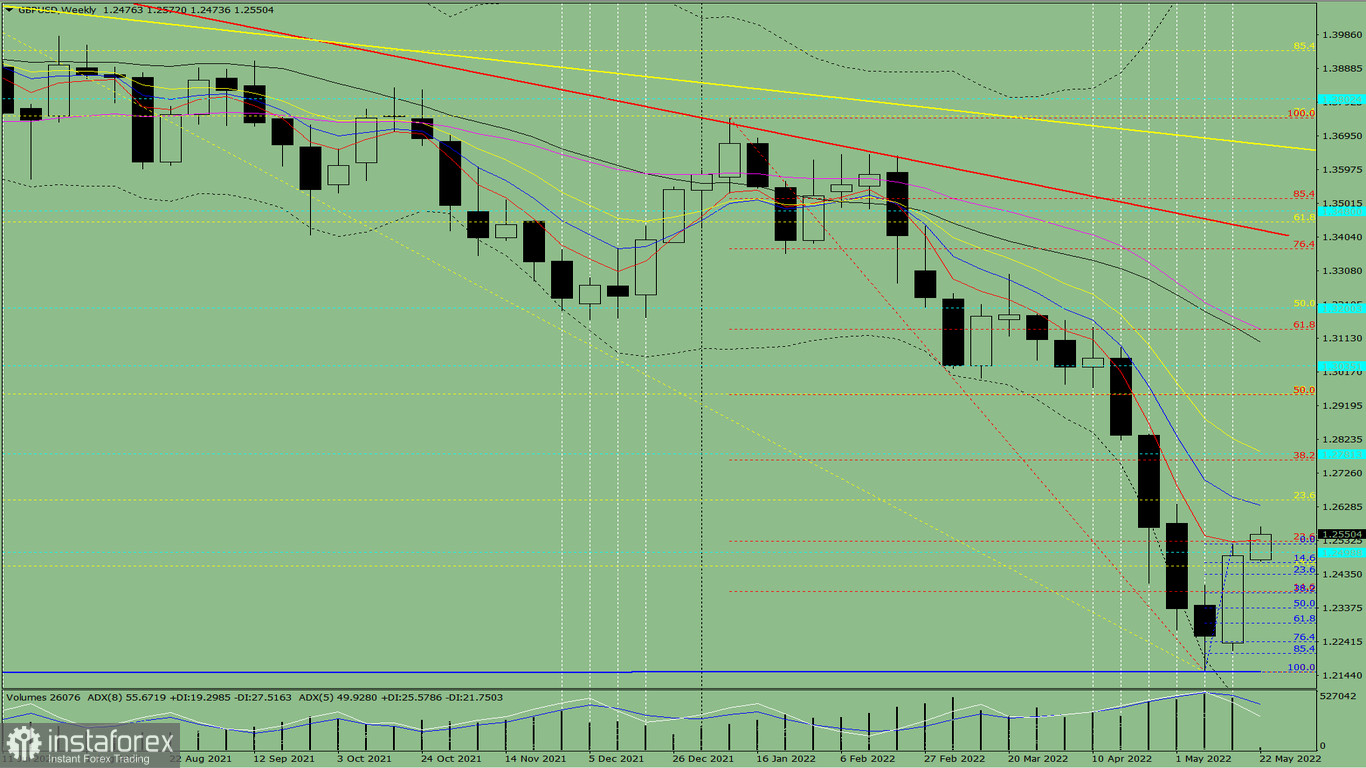

This week, the price is likely to move up from 1.2529 – the closing level of the weekly candlestick – to the 23.6% retracement level of 1.2648 (yellow dotted line). After the quote has reached this level, the target will stand at the 38.2% retracement level of 1.2763 (red dotted line). Should the pair touch this mark, a pullback will occur.

Fig. 1 (weekly chart)

Comprehensive analysis:

- indicator analysis - up

- Fibonacci levels - up

- volumes - up

- candlestick analysis - up

- trend analysis - up

- Bollinger bands – up

- monthly chart - up

Based on comprehensive analysis, an uptrend is likely.

Analysis of the candlestick on the weekly chart: there is a high possibility of an upward move this week, with the white weekly candlestick without lower and upper shadows.

The price is likely to move up from 1.2529 – the closing level of the weekly candlestick – to the 23.6% retracement level of 1.2648 (yellow dotted line). After the quote has reached this level, the target will stand at the 38.2% retracement level of 1.2763 (red dotted line). Should the pair touch this mark, a pullback will occur.

Alternatively, the quote could rise from 1.2529 – the closing level of the weekly candlestick – to the 23.6% retracement level of 1.2648 (yellow dotted line). As soon as the mark is reached, there could be a fall to the 38.2% retracement level of 1.2382 (blue dotted line). Should the price touch this barrier, the upward move will resume to the 23.6% retracement level of 1.2529 (red dotted line).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română