Economists still expect the dollar to strengthen again, and one of the main reasons for this is the Fed's monetary policy, the most stringent among the world's largest central banks.

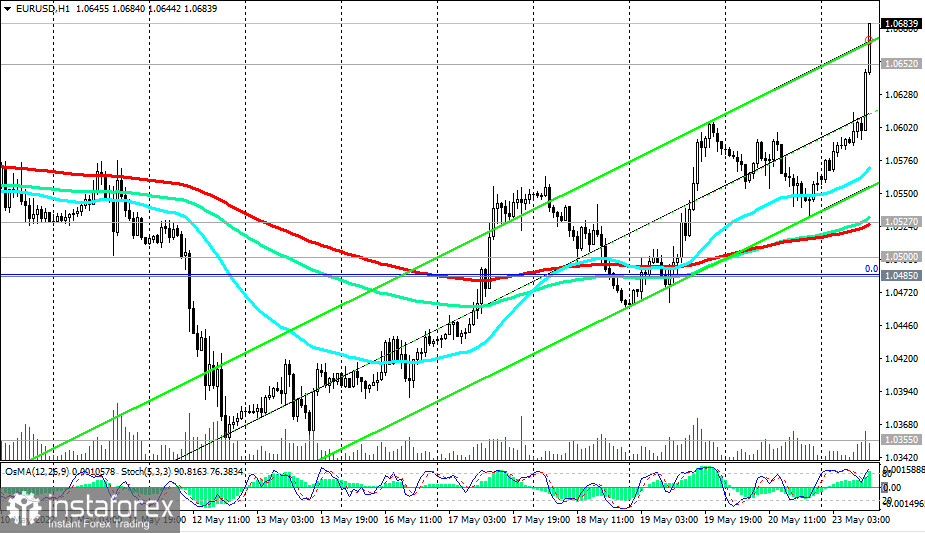

At the time of writing this article, EUR/USD is close to 1.0685, 122 points above the opening price of today's trading day. Given that the average intraday volatility of the EUR/USD pair ranges from 50 to 120 points, it has risen to the maximum value of this range today.

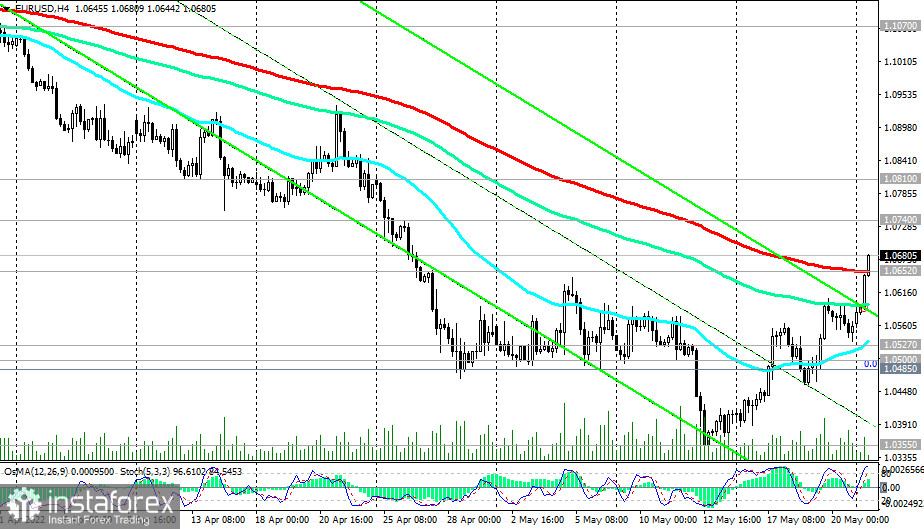

The price also broke through the important short-term resistance level 1.0652 (200 EMA on the 4-hour chart). We also assumed that if the weakening of the dollar continues, then the target of EUR/USD growth (in the range of 1-2 days) may be the resistance level of 1.0740 (50 EMA on the daily chart). But even if it is broken, the growth of EUR/USD will still be limited by the resistance level of 1.0810 (local lows and the upper limit of the descending channel on the daily chart).

As we noted above, one of the main reasons for the resumption of the growth of the dollar is the Fed's monetary policy, the most stringent among the world's largest central banks.

If our point of view and forecast turns out to be correct, then short positions can be entered from the current level with pending limit orders for sale near the resistance levels of 1.0700, 1.0740, and 1.0800. A signal to enter short positions will also be a breakdown of the support level of 1.0652 with targets at the support levels of 1.0527 (200 EMA on the 1-hour chart), 1.0500.

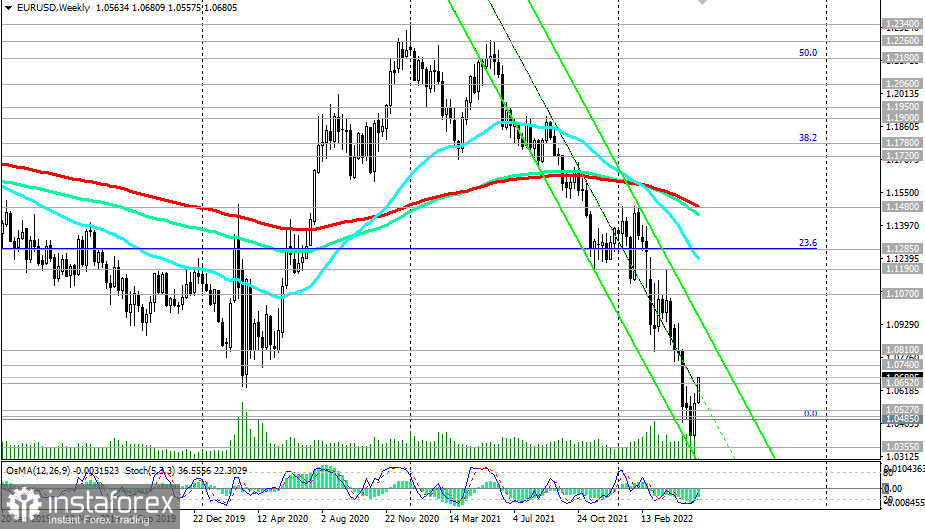

A break of the support level at 1.0485 (the low in the pair's decline from 1.3870 that began in May 2014) will be a confirming signal for the resumption of the EUR/USD downward trend.

In the current situation, short positions remain preferable.

Support levels: 1.0652, 1.0600, 1.0527, 1.0500, 1.0485, 1.0400, 1.0355, 1.0300

Resistance levels: 1.0700, 1.0740, 1.0800, 1.0810, 1.1000, 1.1070, 1.1100, 1.1190, 1.1285

Trading Tips

Sell Stop 1.0635. Stop-Loss 1.0695. Take-Profit 1.0600, 1.0527, 1.0500, 1.0485, 1.0400, 1.0355, 1.0300

Sell Limit 1.0700, 1.0740, 1.0800. Stop-Loss 1.0830. Take-Profit 1.0652, 1.0600, 1.0527, 1.0500, 1.0485, 1.0400, 1.0355, 1.0300

Buy Stop 1.0695. Stop-Loss 1.0635. Take-Profit 1.0740, 1.0800, 1.0810, 1.1000, 1.1070, 1.1100, 1.1190, 1.1285

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română