The euro continues to delight its buyers today, having strengthened again at the beginning of today's European session. The pound, on the contrary, fell sharply after the publication of the Purchasing Managers' Index (PMI) at 08:30 GMT. The S&P Global/CIPS manufacturing PMI fell to 54.6 in May from 55.8 in April. The PMI index for the services sector fell to 51.8 in May from 58.9 in April. The forecasts were 55.1 and 57.0 respectively.

Values above 50 indicate an increase in activity. However, the relative decline in indicators turned out to be a negative factor for the pound. The published data "suggest that the economy is slowing down as inflationary pressures have risen to unprecedented levels," S&P economists said.

Such a significant relative decline in business activity again made market participants doubt the prospects for an interest rate increase by the Bank of England.

The BoE is pursuing a policy of tightening monetary policy to fight inflation at a time when the UK economy could enter a recession this year, although the government will try to avoid it, by all means, economists say.

The pound is also under pressure due to the difficult situation with Brexit (in terms of the protocol on Northern Ireland) that has again appeared in the background. According to media reports, the UK is planning to pass legislation over the next three weeks that will repeal some of the provisions of the Brexit agreement. The EU may respond by threatening to cancel the trade agreement altogether or suspend the agreement.

The pound fell sharply today both against the dollar and in cross pairs, including EUR/GBP. It rose sharply at the start of today's European session after ECB President Christine Lagarde told Bloomberg TV live at the World Economic Forum in Davos that the central bank's rates are likely to turn positive at the end of the third quarter.

Yesterday, Lagarde signaled that the ECB may raise its key interest rate in July (for the first time in 11 years) to reduce the risks of record-high inflation and ease growing concerns about the euro's weakness. "It is likely that we [at the ECB] are likely to be in a position to exit negative interest rates by the end of the third quarter," Lagarde said. She also confirmed that the Asset Purchase Program (APP) will end at the very beginning of the third quarter.

"If we [the ECB] see inflation stabilising at 2% over the medium term, a progressive further normalisation of interest rates towards the neutral rate will be appropriate. The ECB will take all necessary steps for this," Lagarde said.

The euro rose sharply after Lagarde's new announcement today, despite the release of weaker-than-expected PMIs. Thus, the preliminary Purchasing Managers' Index (PMI) for the manufacturing sector in May fell to 54.4 from 55.5 in April, and the index for the services sector fell to 56.3 from 57.7. Despite the relative decline, the PMI index still points to strong growth.

In Germany, whose economy is the locomotive of the entire European economy, business activity, on the contrary, is gaining momentum. The Purchasing Managers Index (PMI) for the manufacturing sector in Germany rose to 54.7 in May (against the forecast of 54.0 and 54.6 in April). The composite PMI also turned out to be better than the forecast and the previous value: 54.6 against 54.0 and 54.3, respectively.

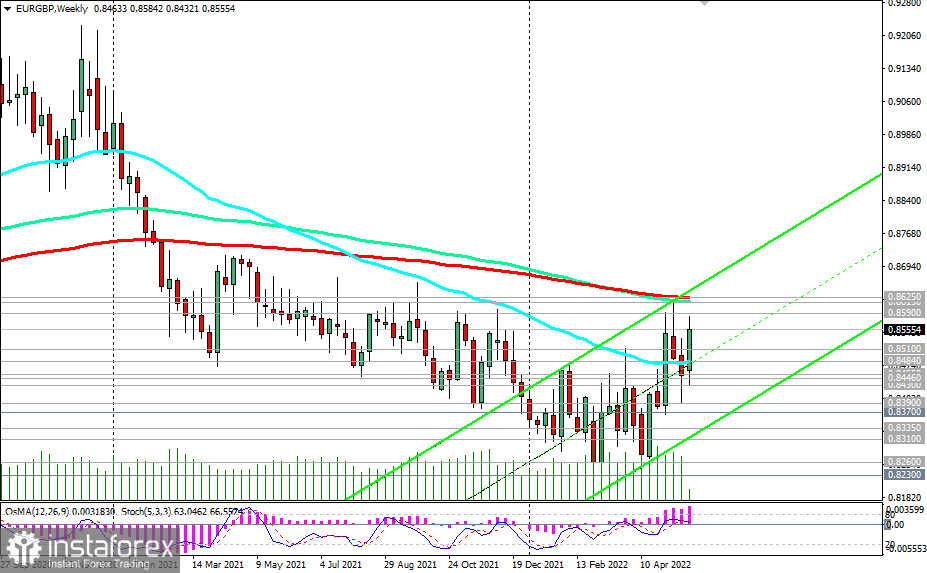

As a result of the coincidence of overlapping factors, EUR/GBP rose sharply today at the beginning of the European session, reaching 0.8584, which is 91 points higher than the opening price of today's trading day, heading again towards the key resistance level at 0.8625, separating the long-term bull market from the bear market.

Lagarde will deliver her speech again today at 18:00 (GMT) as part of events related to the International Economic Forum in Davos. During the speech of the head of the ECB, the volatility of trading increases not only in the euro and European stock indices, but also in the entire financial market, especially if Lagarde touches on the subject of the monetary policy of the central bank. New statements on the topic of curtailing the QE program and raising rates in the Eurozone may cause a new growth of the euro. If Lagarde does not touch on the subject of the ECB's monetary policy, then the reaction to her speech will be weak.

A little earlier (at 16:20 GMT), Fed Chairman Jerome Powell will speak at the same event. So, during this period of time, a new surge of volatility is expected in the financial market, including in the EUR/GBP pair.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română