The EUR/USD currency pair continued its upward movement on Tuesday. Not as strong as the day before, but now the stability of the growth of the euro currency is important. After falling almost non-stop and recoilless over the past months, it is now important for it to recover as much as possible. We have already noted that there were no important macroeconomic events on Monday. Therefore, it was very important to observe the growth of the euro and the pound on such an "empty" day. If the market is set up to buy the euro currency even on days when there is no reason for this, then the euro can start a new upward trend now. Recall that, in fact, now the euro currency is supported only by a technical factor. From time to time, there is some news that theoretically can support the demand for the euro, but we do not believe that the increase in EU GDP in the first quarter from 0.2% in the first estimate to 0.3% in the second estimate was able to change the mood of traders from "bearish" to "bullish". The same goes for the illogical rhetoric of Christine Lagarde. If everything is absolutely clear with the Fed, its policy, and attitude now, then the ECB raises so many questions. We will talk about this a little more below.

As for the technical picture, so far it looks promising for the euro/dollar pair. The junior channel of linear regression turns upward, the CCI indicator does not enter the overbought area, and the price managed to overcome its previous local maximum. We believe that these grounds are enough for the euro to continue strengthening for some time. Unfortunately, it is impossible to say exactly how long the euro will grow. Everything may end with a banal correction for him, after which fundamental and geopolitical factors will again begin to put pressure on buyers, and those, in turn, will begin to refuse new purchases of euros.

Christine Lagarde gives illusory hopes to the European currency.

Well, one of Christine Lagarde's speeches took place this week. It is noteworthy that it took place on Monday, although it was absent from the calendar of important events. But that's okay since Lagarde's statements did not affect anything radically. The euro currency grew on Monday even without the speech of the ECB head. A similar pattern was observed on Tuesday. What did Lagarde tell the market this time? Probably, the key thesis of her speech was the assumption of raising the key rate to 0%. It already sounds pretty funny, but it should be remembered that the loan rate cannot be lowered below zero (otherwise banks will pay extra for loans issued), but the deposit rate has been negative for many years already (that is, when you bring money to the bank, you pay the bank, not it to you). Thus, according to Lagarde, rates may equalize in the third quarter at around 0%. There is no talk of a greater tightening of monetary policy yet.

And what do we have as a result? The maximum that the ECB can achieve in 2022 is a zero interest rate. At the same time, the Fed may raise its rate to 2.5% or even 3%. Given the fact that while inflation in the US has slowed by "as much as" 0.2%, the rate will have to be raised for a long time and persistently. Consequently, we absolutely cannot say that Lagarde's rhetoric has become "hawkish". Even if the ECB raises the rate a couple of times a year (so that the economy does not slip into recession), this does not compare with the actions of the Fed (at least planned). Hence the conclusion: the ECB still takes an extremely weak position, and fears the consequences for its economy due to the geopolitical conflict in Ukraine and unprecedented sanctions against Russia, which it introduces. If the ECB starts raising the rate quickly, then economic growth will also quickly become negative, which, of course, the European Union would like to avoid. Therefore, we do not doubt that the Fed will raise the rate, but there are plenty of doubts that the ECB will raise the rate.

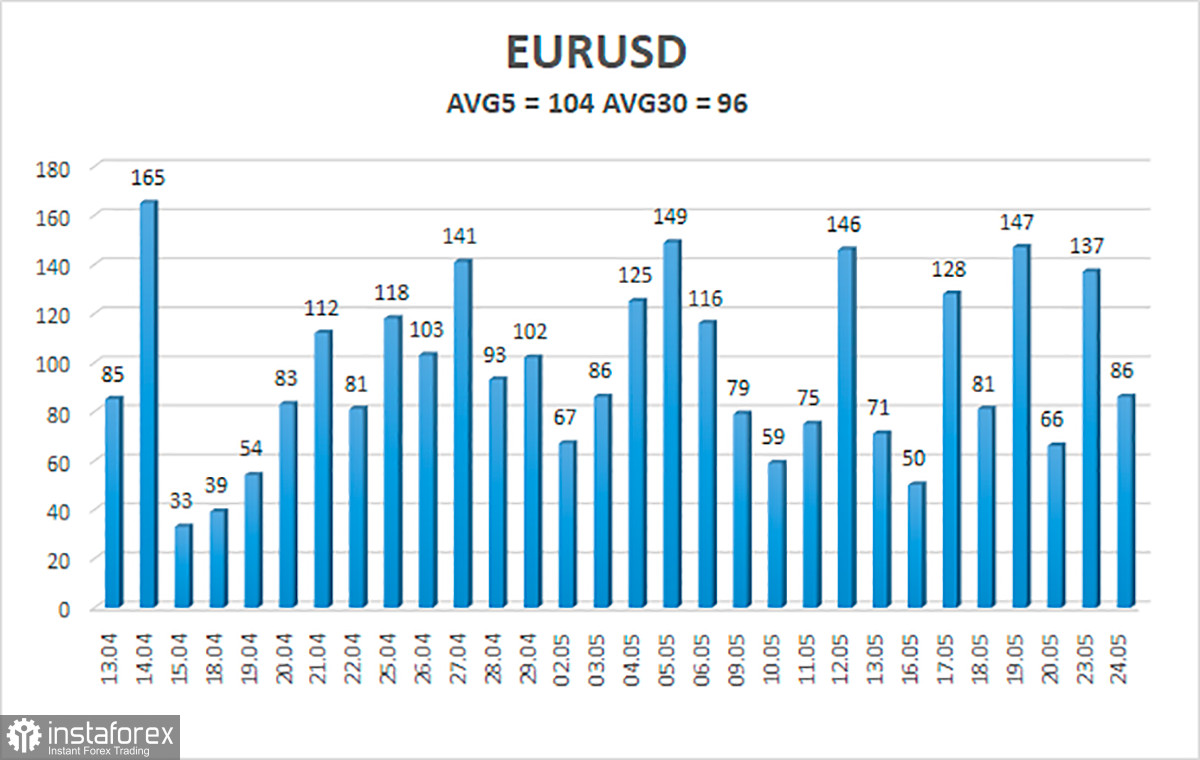

The average volatility of the euro/dollar currency pair over the last 5 trading days as of May 25 is 104 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0633 and 1.0840. The reversal of the Heiken Ashi indicator downwards signals a round of corrective movement.

Nearest support levels:

S1 – 1.0620

S2 – 1.0498

S3 – 1.0376

Nearest resistance levels:

R1 – 1.0742

R2 – 1.0864

R3 – 1.0986

Trading recommendations:

The EUR/USD pair continues to be located above the moving average and continues to form an upward trend. Thus, now it is necessary to stay in long positions with targets of 1.0840 and 1.0864 until the Heiken Ashi indicator turns down. Short positions should be opened with a target of 1.0498 if the price is fixed below the moving average line.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which you should trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română