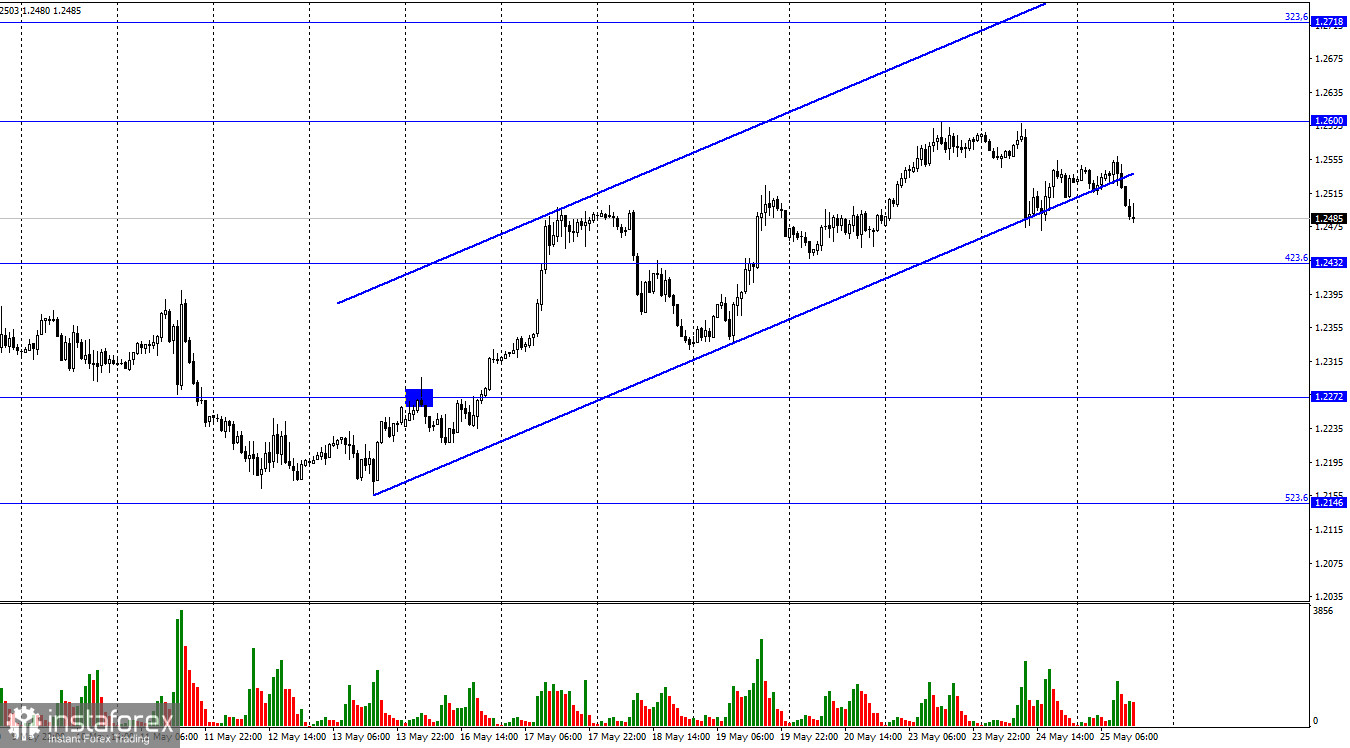

Hello, dear traders! On the hourly chart, the GBP/USD pair rebounded from the level of 1.2600 on Tuesday. A day earlier, it also rebounded from this level. Therefore, bull traders failed to favor further British pound's rise. Today, the pair's quotes performed a new reversal in favor of the US currency and started a new decline towards the correction level of 423.6% at 1.2432. Moreover, today the pair closed with gains. Consequently, the sentiment of traders is now considered bearish. Notably, there were no statistics in the UK today. The PMI report in the service sector might be disappointing for traders as the index dropped from 58.9 to 51.8. Notably, the limit for this indicator is the level of 50.0. Thus, any value below it is considered negative for the economy. Besides, the service sector in May was very close to the point to expand below this limit as early as June or July.

Apart from it, there was no shocking news for the pound this week. However, the euro and the pound may fall in the coming days until the end of this week as they have been rising for 7-8 days. It is not as if the downtrend is unlikely in both pairs as they declined significantly for a long time. Therefore, a rise to 400-500 points is not interpreted as the beginning of a new trend. Nevertheless, both pairs took the first step towards a new trend. The news background is significant at the moment. June is coming. It means that a new Fed meeting will take place soon at which the interest rate may be increased by 0.50%. Traders have almost no doubts about it. Thus, this increase is probably included in the prices. Otherwise, the dollar will have a legitimate reason to start rising again.

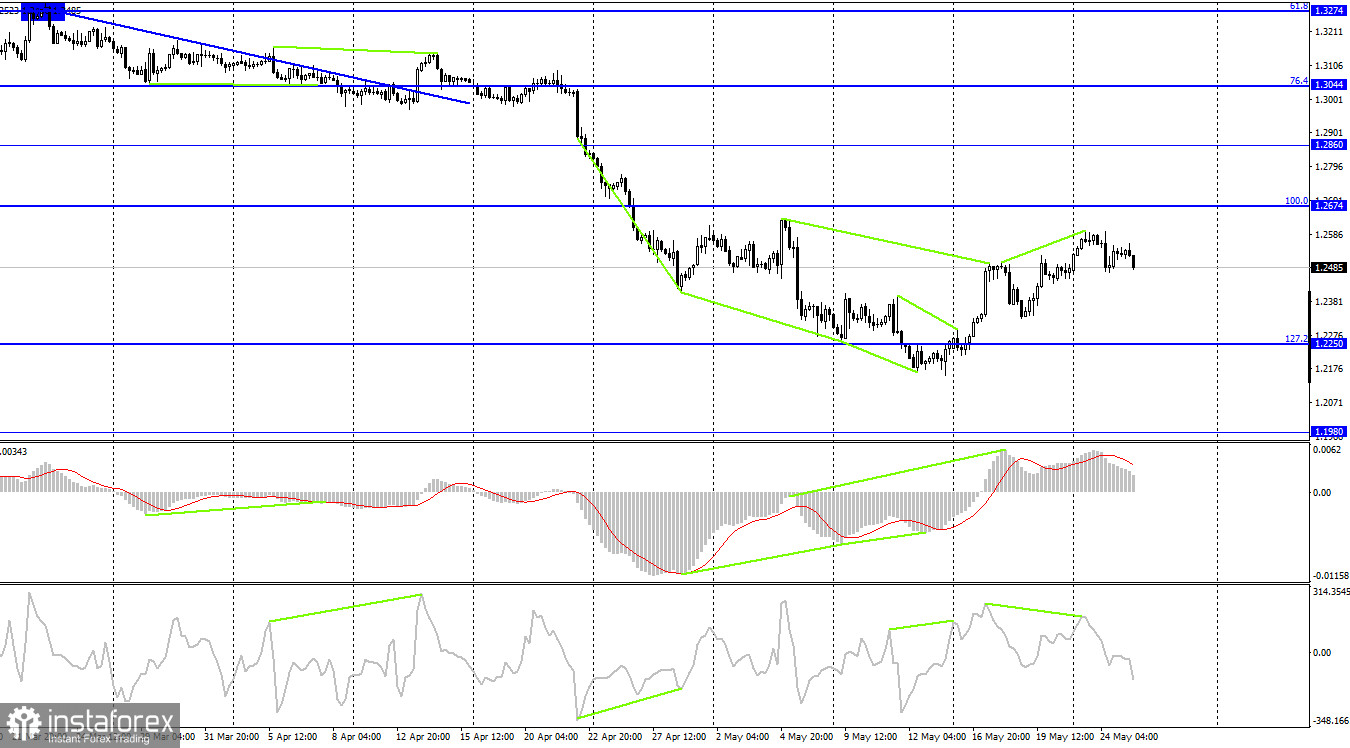

On the 4-hour chart, the pair made a reversal in favor of the US currency after forming a bearish divergence in the CCI indicator. Therefore, the fall towards the correction level of 127.2% at 1.2250 started. There are no reversal signals in favor of the British pound at the moment. On the hourly chart, the pound closed below the uptrend corridor indicating a possible decline in the coming days.

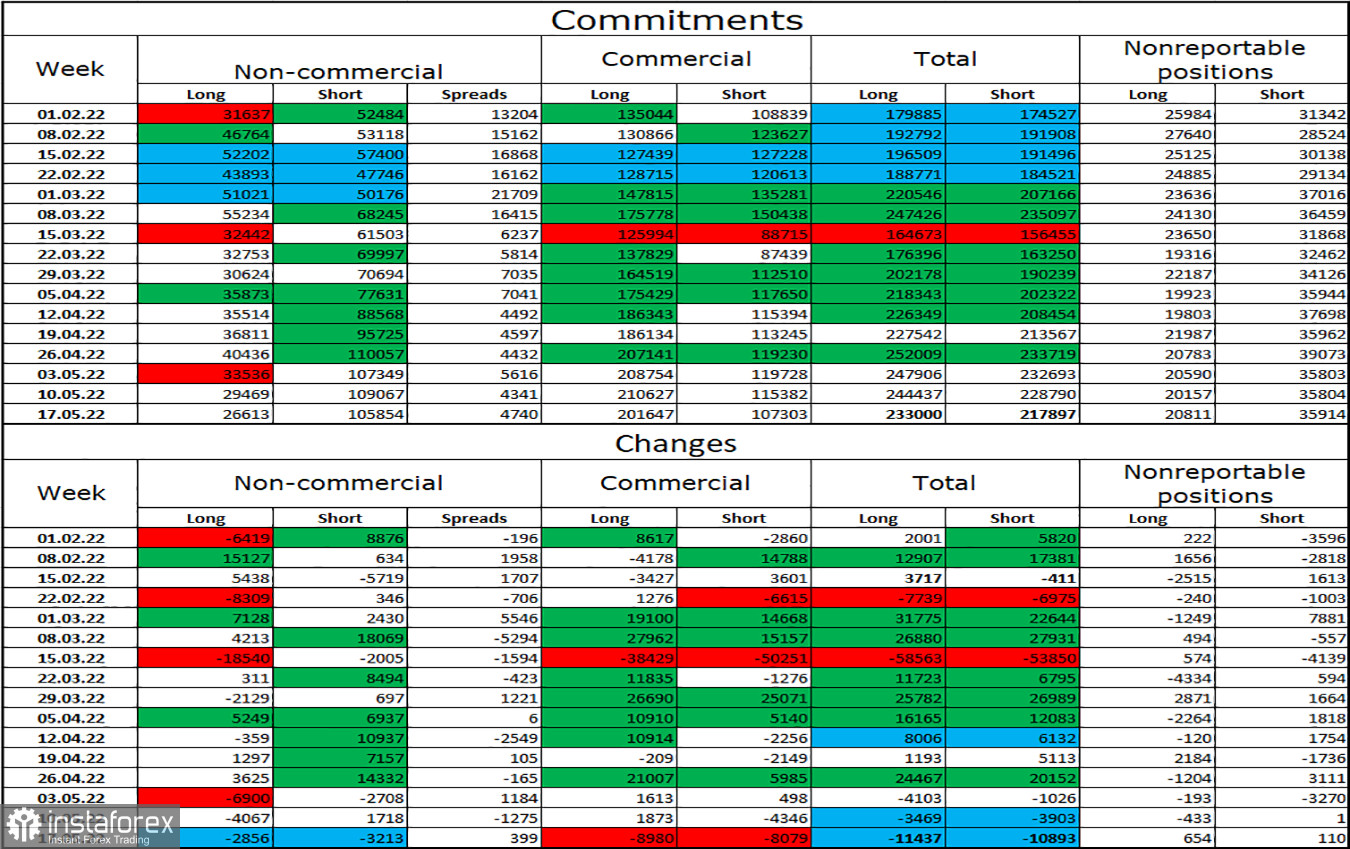

COT report:

The sentiment of non-commercial traders has not changed dramatically over the past week. The number of long contracts held by speculators decreased by 2856, and the number of short contracts dropped by 3213. Therefore, the general sentiment of major players remained bearish. The ratio between the number of long and short contracts held by speculators still corresponds to the current market situation. There are 4 times more contracts for longs than shorts (105,854 versus 26,613). Besides, major players continue to sell off the pound. Thus, I expect that the British pound might resume its decline during the next weeks. Moreover, such a large gap between the number of longs and short contracts may indicate the change in the market trend. Therefore, the pound is likely to have completed its long decline.

US and UK economic news calendar:

US - Change in volume of long-term goods orders (12-30 UTC).

US - Publication of Fed meeting minutes (18-00 UTC).

On Wednesday, the economic calendar for the UK is completely empty. On the contrary, the durable goods orders report was released in the US. Moreover, the Fed minutes were published on Wednesday. I believe that the news background will have little effect on the sentiment of traders.

GBP/USD outlook and recommendations for traders:

I recommend selling the pound if there is a rebound from the level of 1.2600 on the hourly chart with the targets of the lower boundary of the corridor and 1.2432. Currently, these trades can be held open. I do not recommend buying the pound at the moment as the fall may continue in the next few days.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română