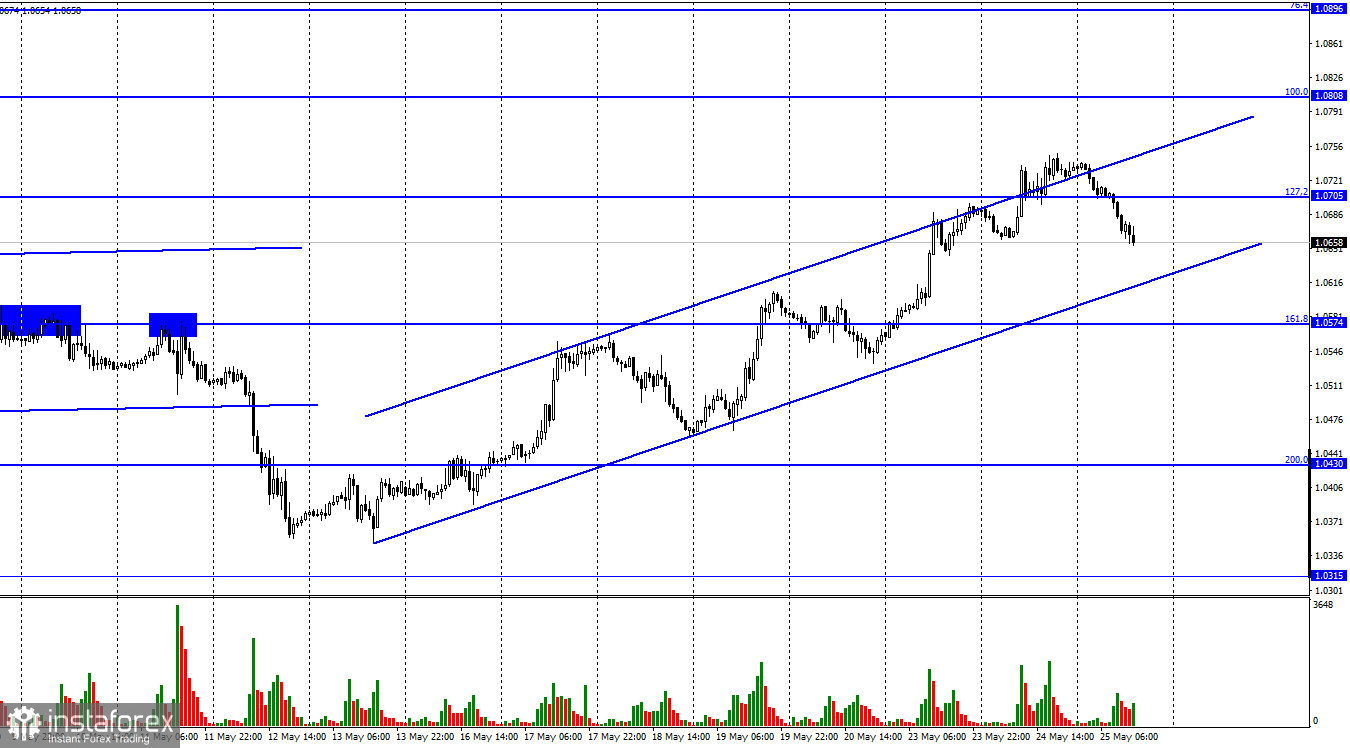

The EUR/USD pair continued to grow on Tuesday, consolidating above the correctional level of 127.2% at 1.0705. However, the pair failed to continue its rally on Wednesday. The US dollar strengthened and the pair started falling towards the Fibo level of 161.8% at 1.0574. At the moment, the pair is trading within the ascending channel, which hints at the bullish sentiment of traders. If the pair fixes below the channel, it may increase the probability of further downward movement. If we have a closer look at the chart, it becomes clear that the euro has not performed anything special yet. It has been rising for almost two weeks and it is still rising at the moment. However, closing below the channel, as the pound did today, may derail any further prospects for the EU currency. If you look at the long-term time frames, the growth of the euro looks like a small correction. Notably, the fall of the euro started over a year ago from the level of 1.2350. Thus, the fall of the quotes may start again quite easily, if the news background supports the USD. Yesterday, the EU business activity report was slightly worse than traders had expected. The same is true for the US business activity report. As expectations were not much different from reality, traders showed almost no reaction to these events. Jerome Powell spoke in the evening and Christine Lagarde spoke in the afternoon. In his speech, the Fed Chairman barely touched upon the topic of monetary policy, while the ECB Head said that the interest rate may be raised twice in 2022. Against this backdrop, the European currency might have continued its rally, but it's Wednesday, there is no news and traders are clearly aware that ECB rate hike promises are not the same as the Fed rate hike. The US dollar has depreciated, but it may strengthen at any moment.

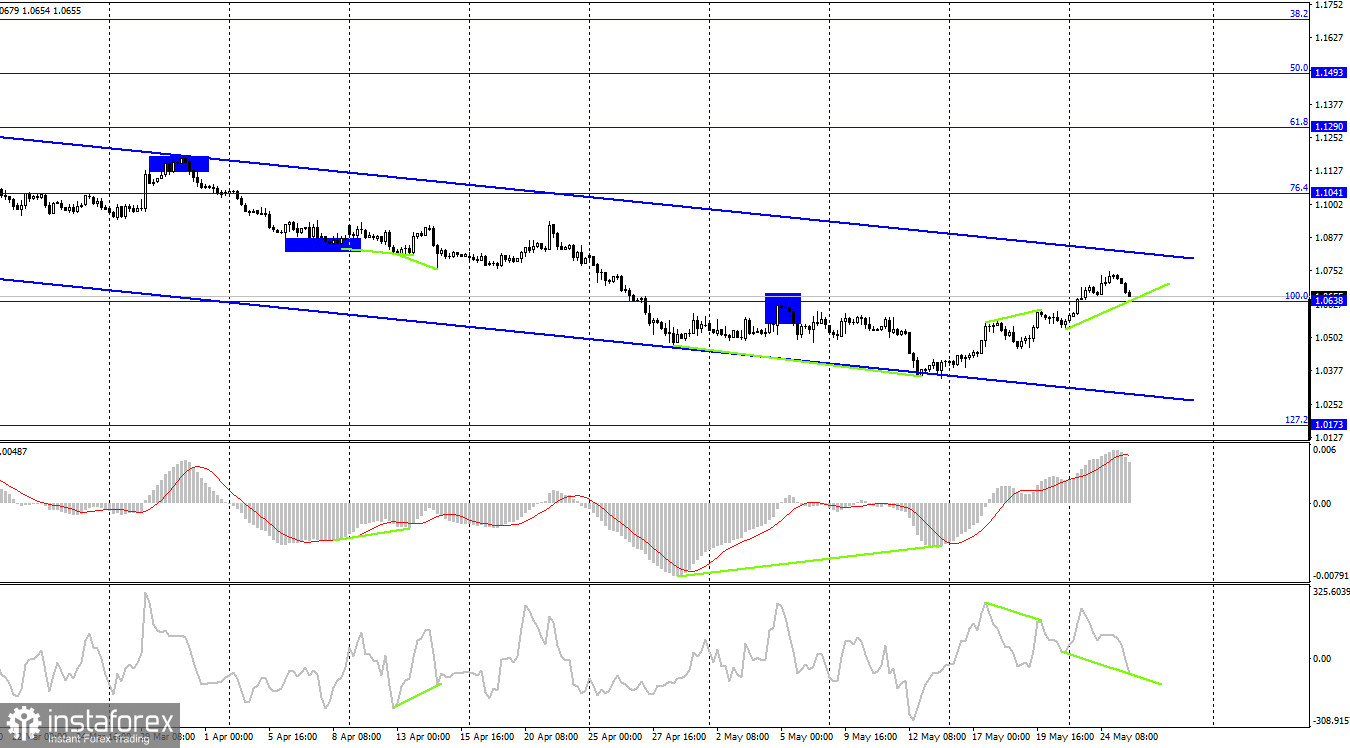

On the 4-hour chart, the pair has fixed above the correctional level of 100.0% - 1.0638. Thus, the growth can be continued in the direction of the upper line of the downward channel. Consolidation above the upper boundary may trigger the further growth of the euro towards the Fibo level of 76.4%, 1.1041. The CCI indicator has a bullish divergence, which may coincide with the rebound from the level of 100.0%.

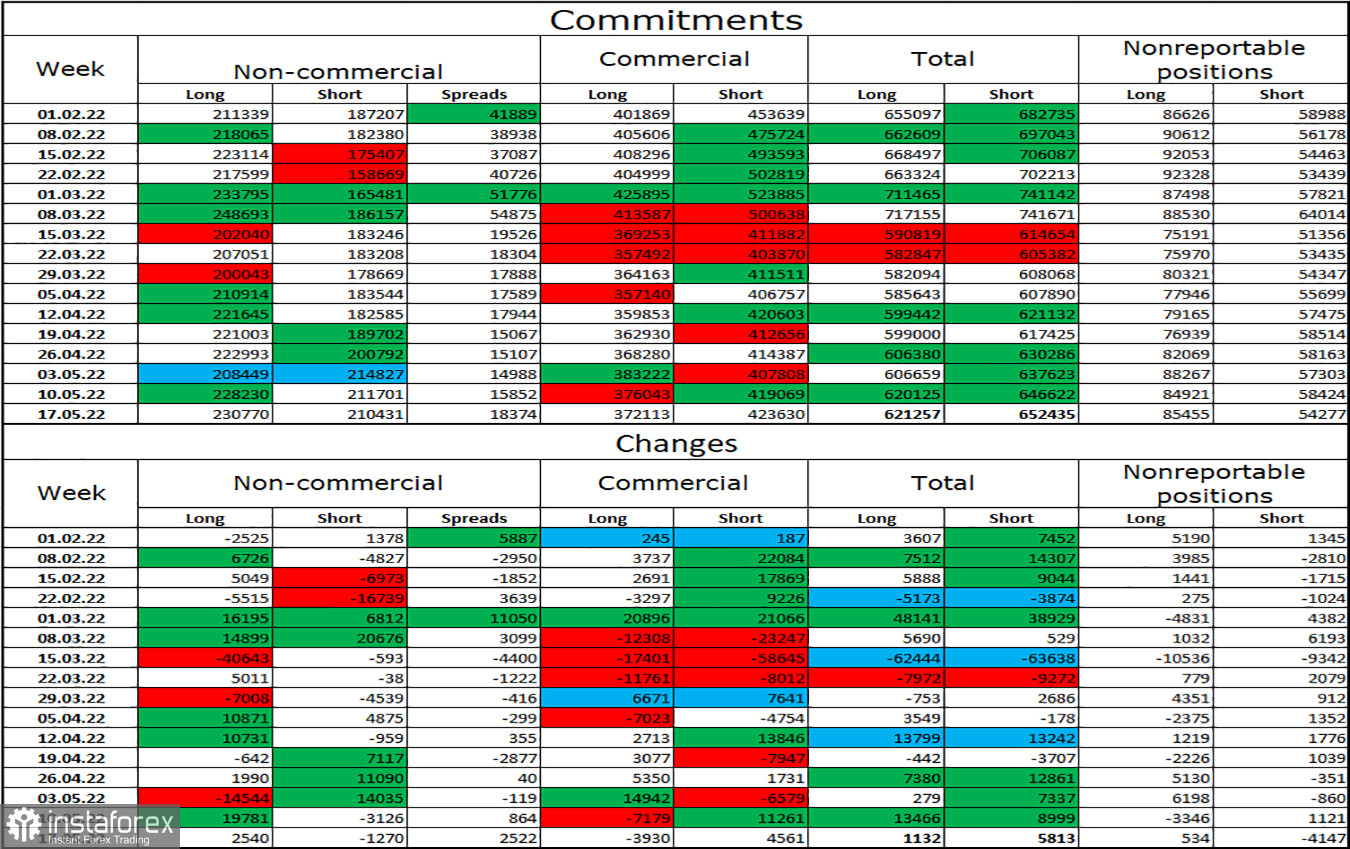

Commitments of Traders (COT) report:

Last reporting week, traders opened 2,540 long positions and closed 1,270 short ones. It means that the bullish sentiment of the big players has strengthened again. The total number of long contracts on their hands is now 230,000, and short contracts is estimated at 210,000. As you can see, the difference between these figures is not considerable, and one would not even say that the euro has been falling all the last months. During the last months, the euro maintained a bullish sentiment, but it did not help the EU currency. The situation is about the same now. The COT report continues to suggest that the big players are buying the euro, while in the meantime the currency is falling. Therefore, expectations on the COT report and reality just do not coincide right now.

Economic calendar for US and EU:

EU. ECB President Christine Lagarde speaks (08-00 UTC)

U.S. Durable Goods Orders (12-30 UTC)

U.S. FOMC meeting minutes (18-00 UTC)

On May 25, the EU and US economic calendars are much scarcer than the day before. Christine Lagarde's speech in the morning gave no reason for traders to react. In the evening, the publication of the Fed minutes is scheduled. The information background for the rest of the day may have an indirect effect on the mood of traders.

EUR/USD forecast and recommendations for traders:

It is recommended to sell the pair if it closes below the channel with targets 1.0574 and 1.0430 on the hourly chart. I recommend buying the euro if there is a pullback from the level of 1.0638 on the 4-hour chart with the target of 1.0705 or buying the euro on a rebound from the bottom line of the upward channel with the target at 1.0705.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română