Yesterday, the Fed published the minutes of its May meeting. Officials agreed that they needed to raise interest rates by half a point at the next two meetings this year, continuing an aggressive set of measures to allow for more flexibility in responding to ongoing changes in the economy and inflation. The report notes the strong commitment and determination of all Fed policymakers to bring price stability back to the target level of around 2%.

Many investors are now concerned not only about high inflation but also about the rather high possibility of a recession in the economy, although they were encouraged by the less hawkish tone of Fed Chairman Jerome Powell. According to the minutes, there is quite serious uncertainty about the potential fault lines in the financial markets as well as level of rates, which will really constrain demand and influence the fall in inflation. The main issue is to keep the pace, as any wrong action could have a real impact on the labor market. This will result in a sharp decline in retail sales and a slowdown of the US economy.

Today, the second US GDP growth estimate for the first quarter of this year will be released. It is expected to be revised up to -1.3% versus -1.4% according to the first estimate. Mentions in the minutes of a possible move to restrictive policy also signal that officials will not stop until inflation returns to their 2% target. This is a strategy that indicates that policy will become more data-dependent after the Fed meetings in June and July.

Earlier this week, Raphael Bostic, president of the Federal Reserve Bank of Atlanta, said that policymakers could potentially suspend interest rate hikes in September after raising by half a percentage point at each of their next two meetings. "I have got a baseline view where for me I think a pause in September might make sense. After we get through the summer and we think about where we are in terms of policy, I think a lot of it will depend on the on-the-ground dynamics that we are starting to see. My motto is observe and adapt," he told reporters.

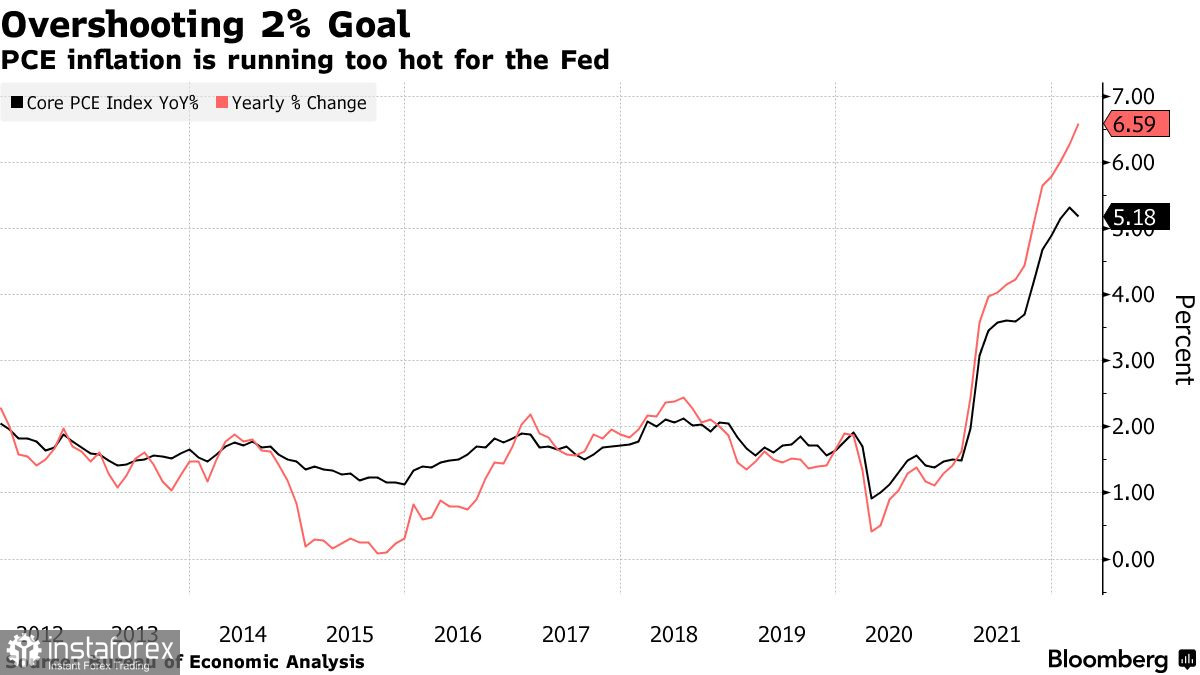

Inflation in the USA is currently at its highest level in 40 years. It is more than three times above the central bank's target of 2%. If inflation continues to rise, the Fed will start to act more aggressively. However, the minutes show that there is no serious need for this yet.

Most participants in the meeting agreed that an increase in the target range of 50 basis points would probably be appropriate at the next few meetings. Some members concluded that a fuller assessment of the situation would be available later in the year. Only then it will be possible to fully assess the effects of policy tightening and the extent to which economic changes require policy adjustments.

Fed officials said that future policy would be shaped by the changing economic outlook and its risks. Notably, at the meeting in May, officials also agreed on plans to reduce their balance sheet by $8.9 trillion. This puts additional upward pressure on borrowing costs. From June 1, for Treasury securities, the investment cap will initially be set at $30 billion per month and after three months will increase to $60 billion per month.

Risky assets showed a positive reaction to the Fed minutes. For the European currency to keep rallying, the buyers need to get above 1.0700. This will lead to a new surge of the pair to the level of 1.0740 and 1.0780. Given the overbought conditions of the trading instrument on the shorter term timeframes, the bulls will once again face some serious problems there. If there is pressure on the Euro, the bulls will obviously try their best to defend 1.0650. If it is missed, the bears are likely to drop the trading instrument to lows of 1.0600 and 1.0560.

Pound buyers have just recently regained 1.2540. This allows them to expect a continuation of the rally. In the short term, the bulls will probably look for a move beyond 1.2600, which will reinforce the Pound's gains. A breakout of 1.2600 level would lead to an immediate jump of the trading instrument to 1.2640 and 1.2690. A breakout of 1.2540 will put pressure on the pound. This will open the way to the lows of 1.2500 and 1.2450. In the current situation, the furthest target will be the support at 1.2390, which will be renewed in case of a rather weak fundamental statistics expected this week.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română