In recent years, an opinion has shaped that bitcoin has finally become a safe haven for capital at the time of upheavals. However, there is no doubt that in light of the current geopolitical and macroeconomic developments, demand for the flagship cryptocurrency decreased sharply. While BTC is still in the consolidation phase, it is time to analyze the current state of the cryptocurrency and the main reasons for its fall.

Here is an example of how bitcoin stabilized in the $29k-$30k range. This week, Fed Chairman Powell delivered a speech and the FOMC Minutes were released. The comments and the report both cast light on the current state of markets, making it possible to assume that the main headwinds are now behind. The Fed's chief said that interest rates would be raised by 0.25%-0.5%. The FOMC report also mentioned the plan to return to the neutral rate as soon as possible. This information shows us that the central bank is fully aware of the current state of markets.

From the fundamental point of view, this is definitely a positive factor, indicating a gradual stabilization of the situation. However, this does not mean that everything will go as planned. The conflict in Ukraine goes on, and any escalation of tensions or the use of prohibited weapons will instantly affect the economic well-being of leading countries. Although Europe eased sanctions pressure, it does not mean new restrictions would not be introduced should the conflict escalate.

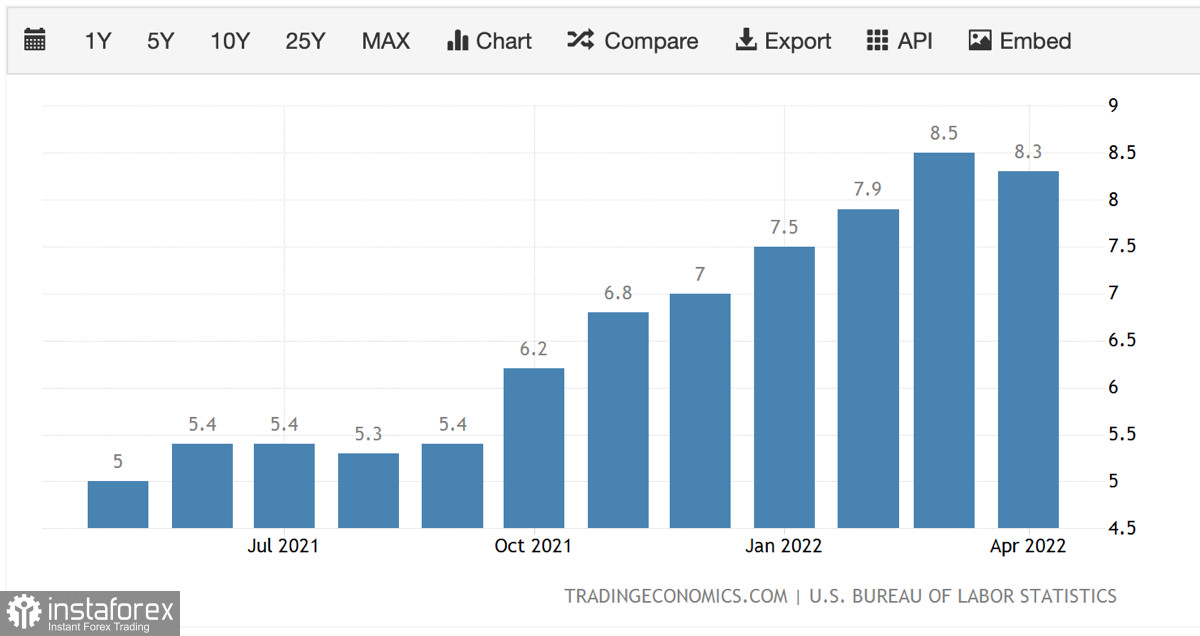

In addition, the global food problem gets more acute, and the monkeypox virus threatens economic comeback plans. Thus, Belgium became the first country to introduce mandatory 21-day monkeypox quarantine. All these factors should be taken into account because if the situation gets worse on any of these fronts, the Fed's stance on inflation and monetary policy might change.

Under such circumstances, investors do not want to consider potential safe-haven assets as the situation may change at any time. That is why most of them now turn to the US dollar, which may well become the main safe haven in the coming months. In light of current geopolitical and economic developments, bitcoin failed to become a valuable asset. The coin turned out to be as vulnerable as stock indices and precious metals. The lack of understanding and analysis when investing in BTC is confirmed by JPMorgan placing bitcoin's fair price at $38k.

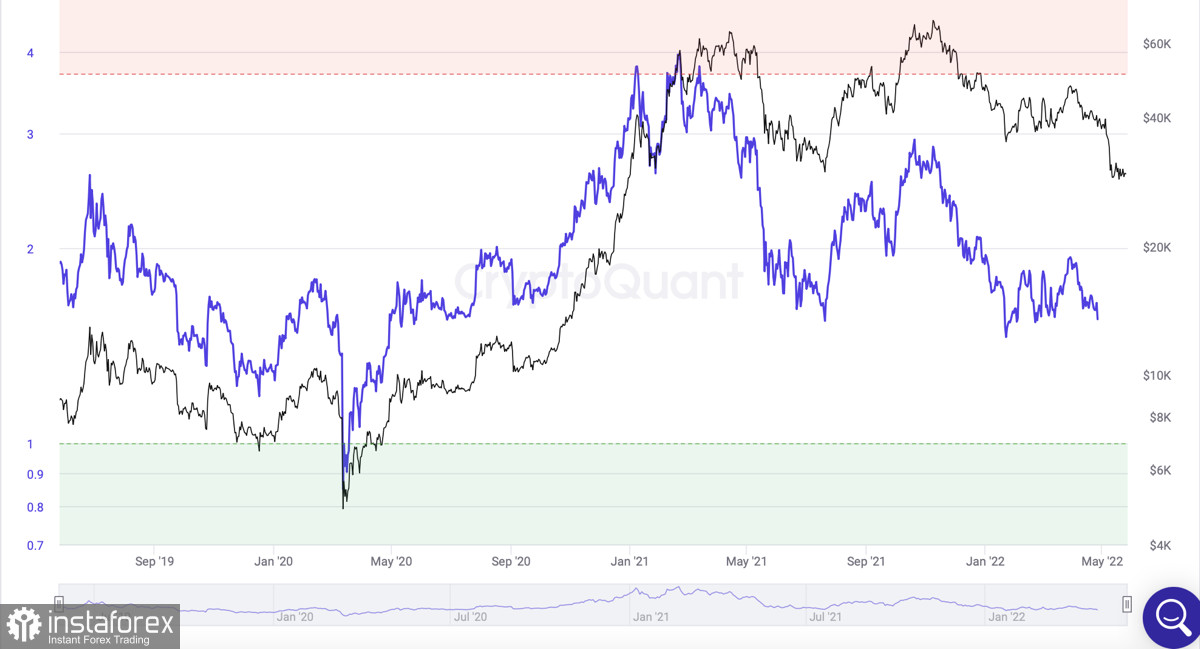

In the short term, the swing low of BTC/USD is seen in the $20k-$30k range. On May 26, the asset trades at $30k. When the trough was reached at $24k, bitcoin on-chain activity did not turn green. This means that the price may well enter the range of $20k-$25k. This is likely to happen when the Fed starts to remove liquidity. The situation in the market has stabilized. However, it is still unknown exactly how the Fed will be withdrawing liquidity. Therefore, it is important to be prepared for investors' impulsive and hasty actions, which could spark an increase in volatility.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română