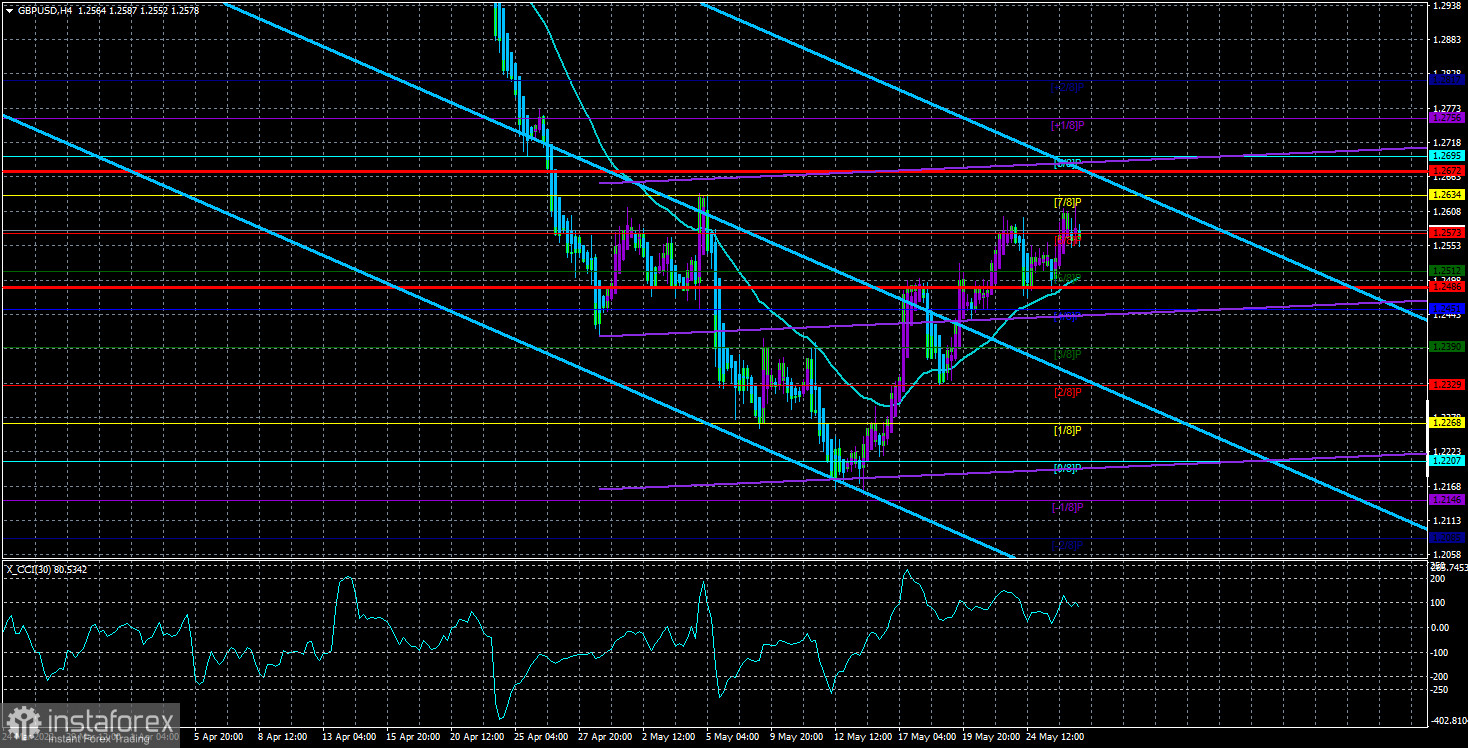

The GBP/USD currency pair continued to be located above the moving average line on Thursday, thus maintaining an upward trend. Also, the British pound continues to be located below its last local maximum, which is near the Murray level of "7/8"-1.2634. In the article on the euro currency, we said that in global terms, the whole movement of the last two weeks looks like a simple correction. By the pound, this is not quite true. The whole movement of recent weeks looks like a banal rollback. Thus, as much as I would not like to expect the formation of a new upward trend now, too little time has passed since its possible start. And the pound has moved away from its 2-year lows too close to talk about an unambiguous reversal of the downward trend. Recall that the pound is now growing thanks to "technology". The same need to adjust against the downward trend, which has lasted for more than a year and a half. Therefore, if there are no factors to support the pound, then it also has no special prospects.

Recall that it was in the UK that the most serious macroeconomic changes took place. The Bank of England has already raised the rate four times and is not lagging behind the Fed in this matter, but the pound has been calmly declining all this time while the BA was agonizing over the rate. Inflation in the UK has risen to 9%, and BA expects it to rise to 10.25% this year. And if the regulator says about 10.25%, then in fact we will see 12%. And this acceleration of the consumer price index is again taking place against the background of tightening monetary policy. That is, the inflation indicator seems to be telling the Bank of England now: I don't care about your efforts. And why? Because inflation is now influenced by external factors that do not depend at all on the monetary policies of the Central Bank. This has already been openly stated by the head of BA, Andrew Bailey, and it is. The geopolitical conflict in Ukraine, unprecedented sanctions of the whole world against the Russian Federation, which are destroying trade chains, business ties, food shortages, rising energy prices, and trillions of dollars, which during the two years of the pandemic were poured into the world economy by central banks under the QE program. How can this all be offset by a couple of rate increases?

London is not looking for easy ways for itself.

But all this seems to be not enough for the United Kingdom. A couple of weeks ago, the issue of the "Northern Ireland protocol" surfaced again, and London again demanded a complete revision of it from Brussels, threatening to withdraw from the Brexit agreement. Interestingly, London was previously aimed at a trade deal with the United States when it was planning Brexit. Especially considering the friendship between Donald Trump and Boris Johnson. Now Joe Biden and his administration are demanding that Johnson comply with the agreement with the EU and, in turn, threaten to abandon negotiations on a deal with the United States if London continues to "muddy the waters" with the protocol. But that's not all. At such a difficult moment for the whole world, a trade war may break out between the EU and the UK if the parties do not come to a consensus. Some countries have already begun to understand what "smells like", and frankly ask London not to unleash a trade war with the EU. In particular, Irish Prime Minister Michael Martin addressed Boris Johnson, who said that his country and the entire European Union do not want a trade war, which would be a "shocking and unnecessary" development of events. He called on both sides to negotiate and said that the only unilateral steps in this matter were taken by the UK, which threatened to withdraw from the international agreement with the EU on Brexit. In general, a new series called "the Northern Irish Protocol" begins in Britain. Negotiations may take many months and worsen the situation for the British economy and the pound sterling.

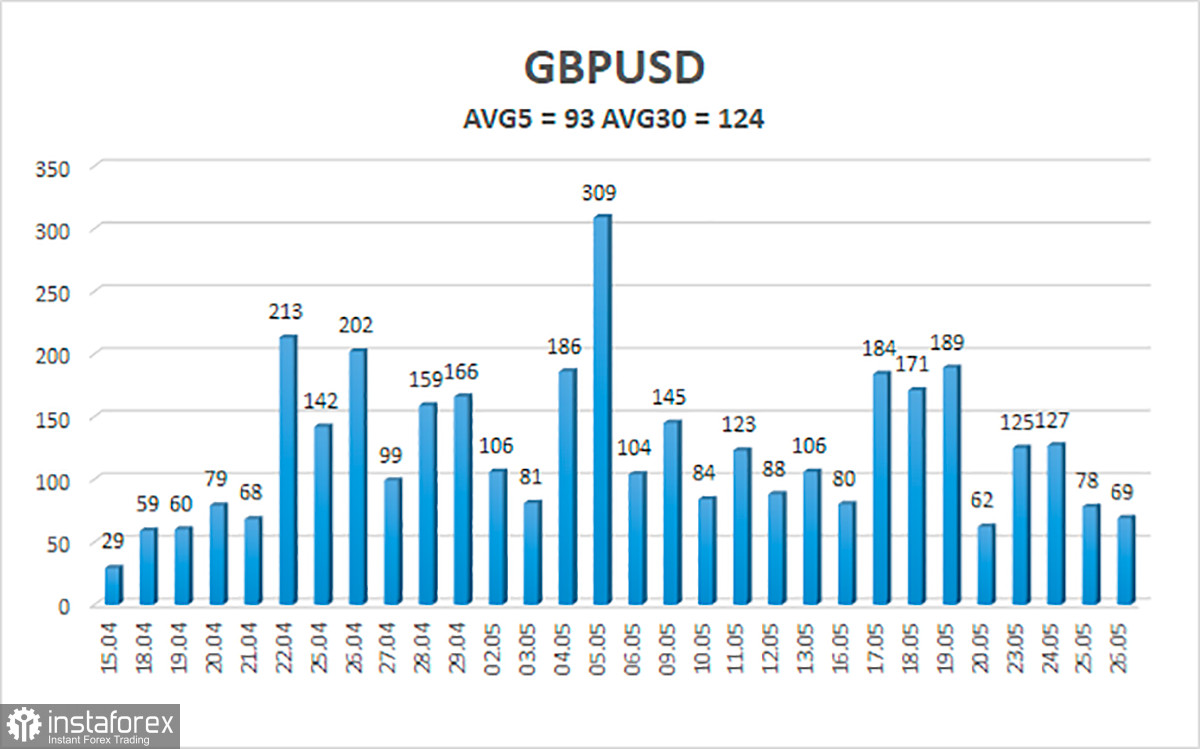

The average volatility of the GBP/USD pair over the last 5 trading days is 117 points. For the pound/dollar pair, this value is "high". On Thursday, May 26, thus, we expect movement inside the channel, limited by the levels of 1.2486 and 1.2672. The reversal of the Heiken Ashi indicator downwards signals a round of corrective movement.

Nearest support levels:

S1 – 1.2512

S2 – 1.2451

S3 – 1.2390

Nearest resistance levels:

R1 – 1.2573

R2 – 1.2634

R3 – 1.2695

Trading recommendations:

The GBP/USD pair continues to form a new upward trend in the 4-hour timeframe. Thus, at this time, you should stay in open buy orders with targets of 1.2634 and 1.2672 until the Heiken Ashi indicator turns down. It will be possible to consider short positions if the price is fixed below the moving average line with targets of 1.2451 and 1.2390.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română