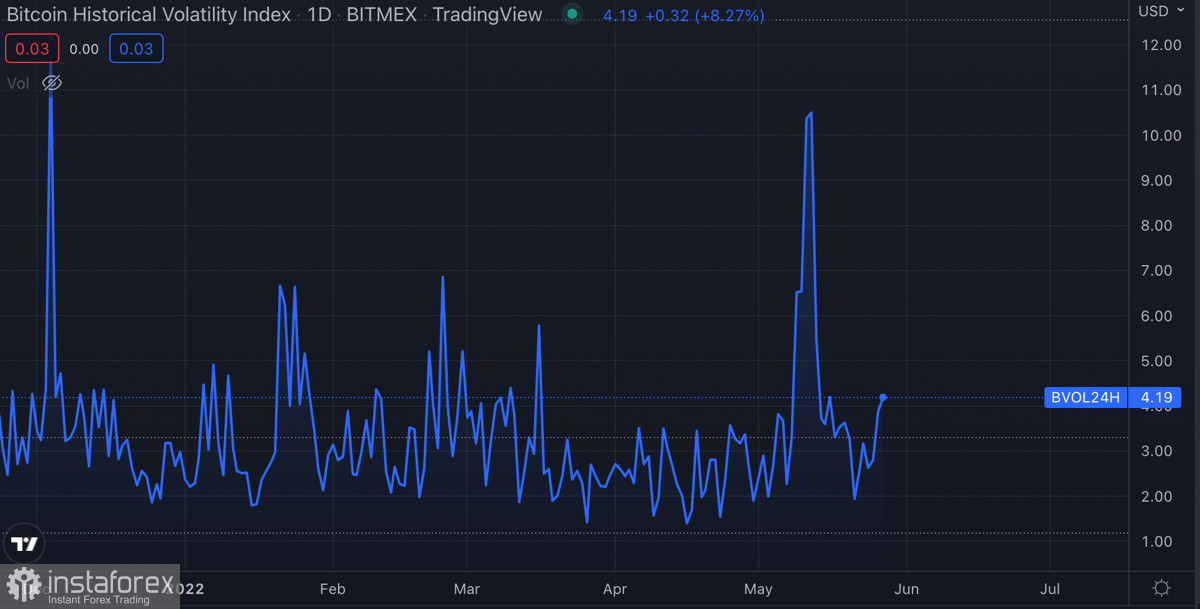

Bitcoin completes a week of stabilization period and consolidates in the $29k–$30k area. At the same time, both positive and negative signals appear on the market. On the one hand, stock indices have begun a local upward movement, which may spoil the similar dynamics of Bitcoin. On the other hand, there is an increase in volatility and the level of BTC dominance in the crypto market. The Fed also confirmed that balance sheet cuts will begin on June 1st. These signals indicate that the Bitcoin consolidation will soon be completed.

The prospects for the cryptocurrency market due to the reduction of the Fed's balance sheet are vague. Investors do not understand what to expect and transfer capital to safer assets. Fed members also do not give clear instructions and say that the consequences of the balance sheet cut are vague. Against this background, the price of BTC begins to narrow within the $29k–$30k consolidation range, which provokes an increase in volatility. At the same time, an upward spurt in stock indices can provoke the same reaction in cryptocurrencies. But in general, investors should not expect positive changes after the start of the program to withdraw liquidity from the economy.

Despite this, JPMorgan experts are confident that in the medium term, the cryptocurrency market and Bitcoin have good prospects for returning to growth. Experts are sure that the main failure of May 2022 was the collapse of the UST stablecoin and the Terra project. The painful blow to the crypto industry was expected to increase investment outflows and exacerbate bearish sentiment in the market. However, the bank's experts did not see any signs of a reduction in venture investment in projects based on digital assets.

According to JPMorgan, after Luna's fall, the market received another $25 billion in venture capital investments. With this in mind, the bank's analysts are confident that at the current pace, the crypto winter will not repeat, and in the medium term, the industry will resume the upward trend. We can also note the activation of the largest stablecoins USDT and USDC. Projects began to actively strengthen their positions in the market by publishing reports and moving capital. And we have to admit that this calmed the market.

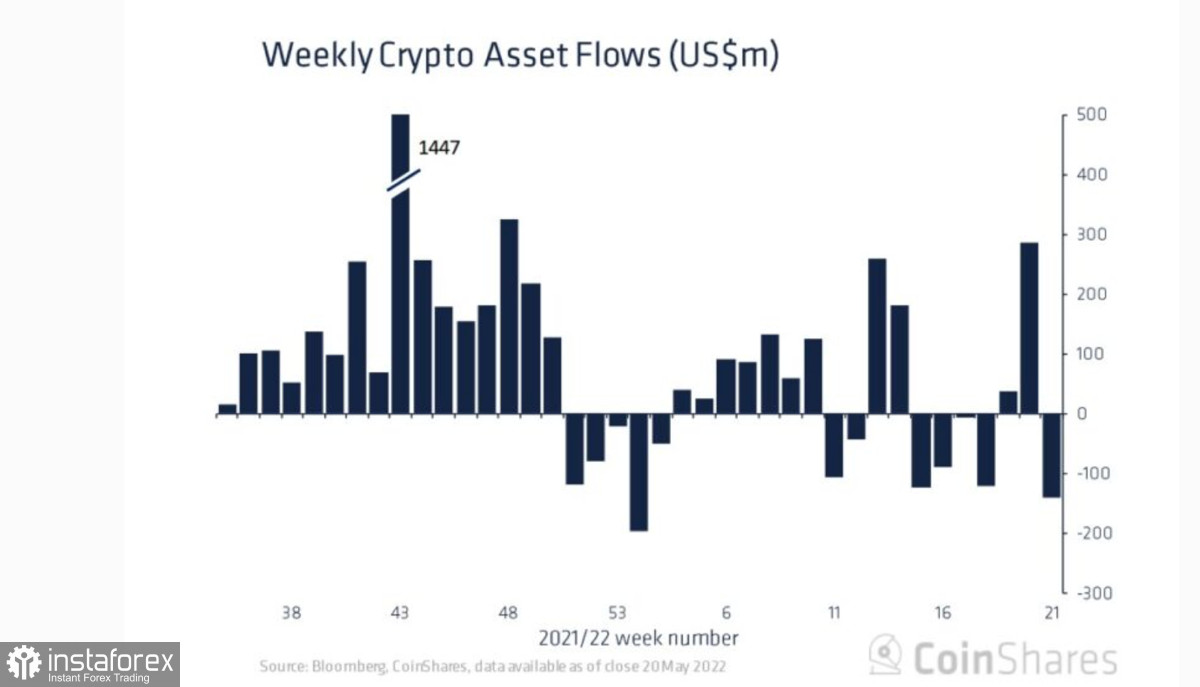

However, it is worth noting that the asset has been in a downward trend since November 2021. For seven months, the crypto market has been in a state of decline. And a drop in the price of cryptocurrencies as a percentage indicates that this is indeed a bear market. CoinShares claims that over the past week, the crypto market has lost about $150 million in investments. The outflow of funds occurred in the main North American market. This suggests that with significant jumps in volatility and an increase in sales volumes, investors have a lower level of confidence in digital assets.

In addition, the bulk of investments is in DeFi projects, which does not drastically affect the market capitalization. The main decentralized projects are in the area of responsibility of large altcoins, which, as of May 27, are falling in price. At the same time, the market dominance of Bitcoin is growing, which directly indicates the current state of affairs in the market. With this in mind, investment flows in DeFi projects do not change the situation in a fundamental way.

In the current situation, Bitcoin is becoming more and more of a defining asset. The level of dominance in the region of 46% indicates a gradually growing interest in the main asset. At the same time, there are prerequisites for a possible drop in the correlation with stock indices. If these forecasts are confirmed, then it is likely that the dynamics of the crypto market will once again fully depend on BTC/USD.

On the other hand, you need to be ready for the second dive to the bottom in the $24k–$27k area. Rising levels of volatility and price tightening before the start of the program to reduce liquidity hint at the market's readiness to act. With this in mind, we will see an active phase of price movement over the next two weeks. During this period, the impact of the liquidity withdrawal program will become clear. The phase of passive accumulation of BTC coins continues, but even with the falling pressure on Bitcoin on the exchanges, as well as the preservation of venture capital flows, there are no clear signs of the end of the crypto winter in the near future. The market expects at least one more $24k retest and a subsequent recovery in the $20k–$30k area.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română