#Bitcoin

Analysis:

Bitcoin's trend direction since last October is set by a downward wave algorithm. The structure is incomplete at the moment. In the last section on March 28, the instrument price has been forming a flat correction for the whole of last month. The structure of the movement lacks a final section.

Outlook:

On the forthcoming week, the instrument price expects completion of the pullback upwards. Formation of reversal and resumption of bearish course is more likely in the second half of the week. Support levels show the lower border of the instrument's expected weekly move.

Potential reversal zones

Resistance:- 31600.0/33100.0

Support:- 25000.0/23500.0

Recommendations:

Opening long positions in Bitcoin is premature. It is recommended to refrain from trading in this cryptocurrency until the upcoming pullback is completed. Opening short positions is optimal in the area of estimated resistance.

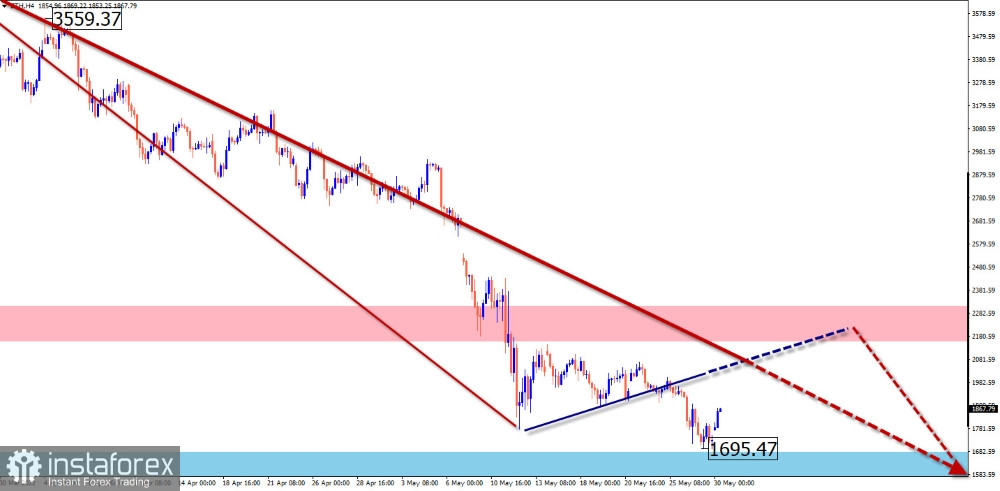

#Ethereum

Analysis:

A horizontal stretched plane has been forming on the Ethereum chart since last May. The wave structure has started its final phase. Within the last stretch from April 1, a counter pullback has been developing for the last three weeks. After its completion, the main trend will continue.

Outlook:

In the coming days, the price of Ethereum will continue its gradual rise. The most probable completion zone is the border of the estimated resistance. Then, it is possible to wait for the formation of the reversal and change of the course. In case of renewed decline on the background of increased volatility, we can expect a return to the levels of estimated support.

Potential reversal zones

Resistance:- 21600.0/2210.0

Support:- 1680.0/1530.0

Recommendations:

Buying Ethereum in the coming days could carry higher risks and lead to losses. It is recommended to refrain from trading in this cryptocurrency until the current uptrend is completed, and confirmed sell signals are formed.

$ (USDollar) Index

Analysis:

The US dollar's rally over the last year and a half has brought quotations to the area of strong resistance. Since the end of April, the chart is showing a downward movement, which in terms of its wave level is not beyond the correction of the last part of the trend. The structure looks like a stretched plane. In the last decade, a counter pullback is formed.

Outlook:

The general flat nature of the dollar's movement and the rise in the index values is possible in the next 2-3 days. There is a high probability of an increase of volatility and a return to a descending rate. In the area of estimated support, there is an upper boundary of rather powerful potential reversal zone, which will be difficult for USD quotations to sell at once.

Potential reversal zones

Resistance:- 102.00/102.50

Support:- 100.60/100.10

Recommendations:

The weakening of the US currency in the second half of the current week will allow more active buying of national currencies in the major pairs. This trend will be valid for at least another week.

Explanation of figures: The zones marked on the charts are used as critical areas where the probability of a change in direction is significantly increased. The closer the arrow is to the price in the figure, the earlier the instrument is expected to move in the marked direction. The solid background of arrows indicates the expected direction. The dotted one indicates the possible direction.

Attention: The described algorithm shows the sequence of movements of an instrument without regard to their duration over time. The forecast is not a trading signal! Confirmation of the trading system you are using is required for trading.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română