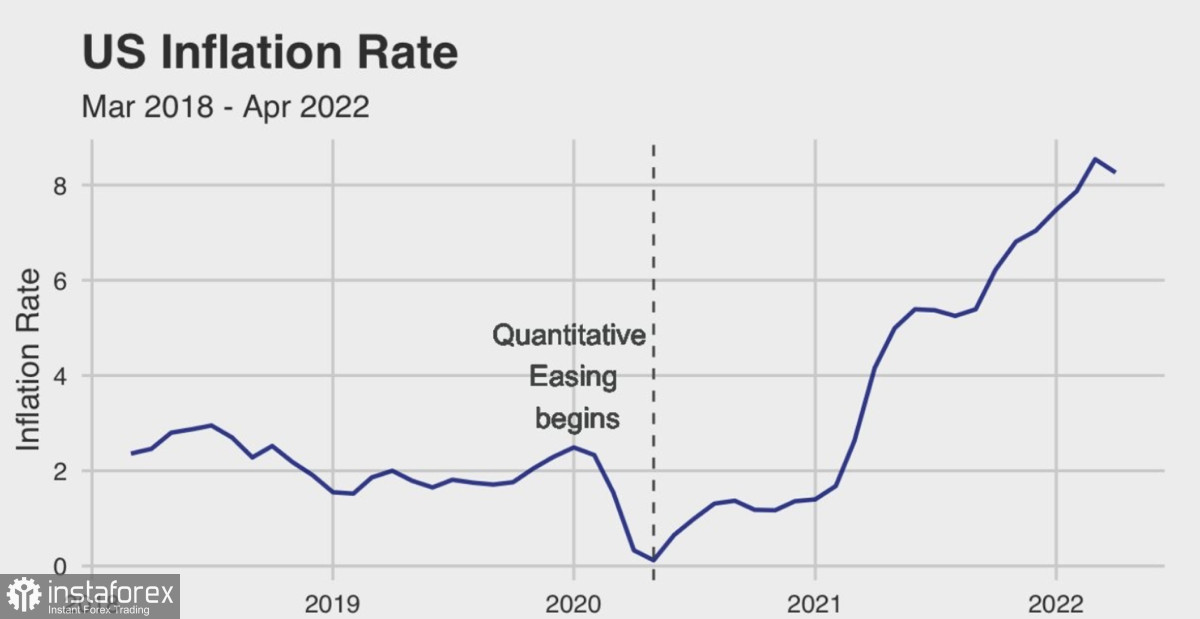

For the sixth month, the world economy has been steadily sliding into a full-scale crisis, which is effectively accelerated by additional factors. But even taking into account the catastrophic consequences of the war in Ukraine, it was the coronavirus crisis that became the main catalyst for the difficult economic situation. As a result of the quantitative easing policy, at the end of 2020, global debt exceeded 225% of global GDP, and US government debt exceeded 99%.

Naturally, such a generous distribution of money has resulted in record inflation rates for the United States and the European Union. As a result, negative processes have spread to many corners of the world. There is a new surge of coronavirus in China, which increases the decline in the global economy. Inflation continues to rage in Argentina and Turkey, which has a positive effect on the interest of cryptocurrencies, even with the tough position of the governments of the countries.

The European Union also recognized that the growth of interest in cryptocurrencies is inevitable, given the record inflation in the region of 8.1%, with a projected 7.7%. But at the same time, the departments of most countries continue to fight hard for a happy future of the fiat system. To do this, the US is reducing balance sheets by trillions of dollars in 2022, and the central banks of most countries are raising the key rate. An increase in interest rates means that the burden on debt obligations increases. It is becoming more difficult for states and ordinary people to borrow funds, as a result of which there will be less income, and consequently less expenses.

This leads to a gradual decrease in the inflation rate in the long run. However, there is another opinion. An increase in key rates and a reduction in USD volumes can negatively affect the state of the economy of developing countries. As we have already noted, the coronavirus crisis provoked a real BOOM in the debt market due to the easing of the key rate. Now many large debtor states may face significant difficulties in repaying their debts. This can lead to default and devaluation of the national currency. The first country that could not withstand the impending stagflation was Sri Lanka which announced the impossibility of repaying a debt of $50 billion.

In the long term, the country's default and currency devaluation may have a positive impact on the cryptocurrency market, as happened in Turkey and Argentina. The situations in these countries have shown that Bitcoin and digital assets are the main alternative to fiat funds. In this case, the central banks of countries with weak economies need to take into account the factor of probable default and devaluation of the national currency. However, taking into account current trends, there is no doubt that cryptocurrencies are beginning to find a middle ground and receive dividends both with a high level of inflation and with an excessively tight monetary policy.

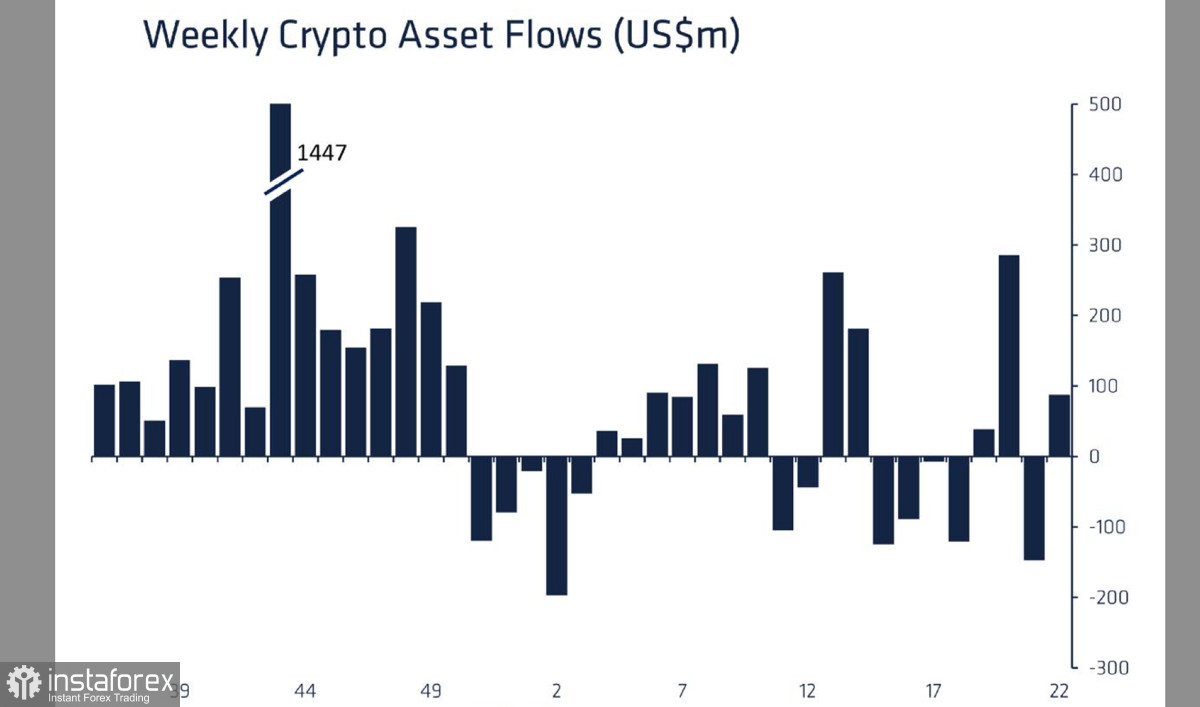

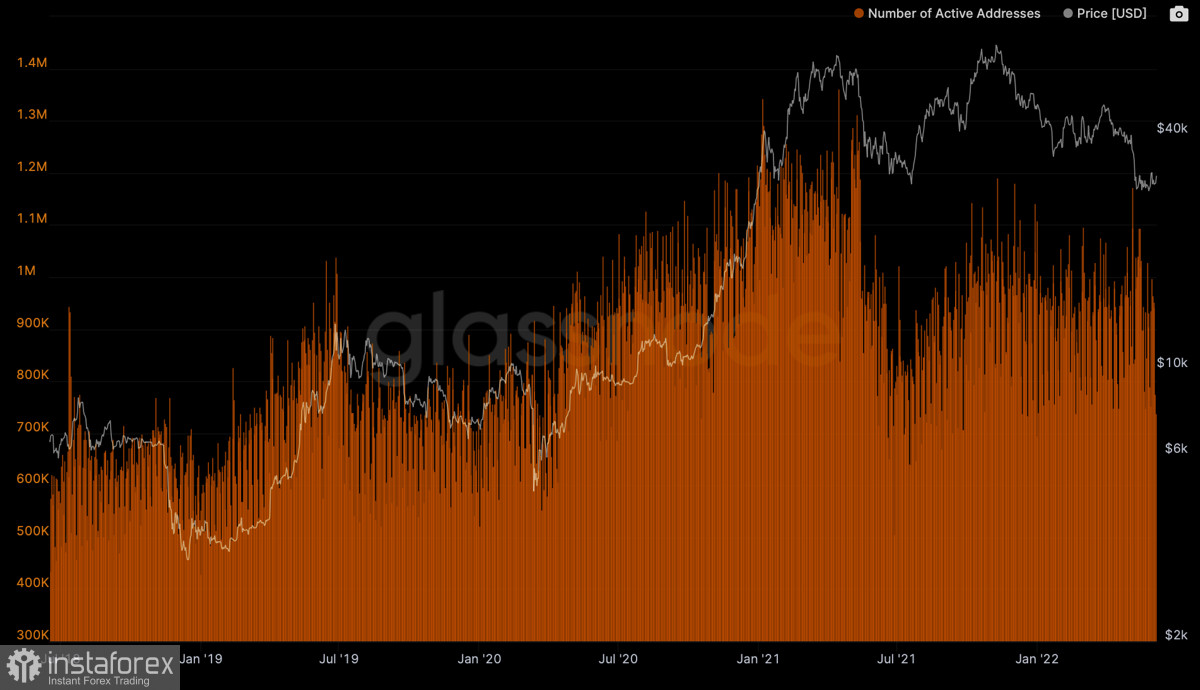

Despite the likely surge in trading activity and interest in cryptocurrencies, the retail audience will not be able to make a significant impact on the market. Fluctuations in the price of various digital assets do not negate the fact that the global market is in consolidation as part of a bearish trend. In the local perspective, capitalization shows signs of growth. RSI and stochastic oscillator are gaining upward momentum, which indicates the growth of investments. The MACD is still moving deep below zero, but has also taken on an upward direction.

The alarm is caused by the low buying activity of Bitcoin, which has again strengthened in the status of the main asset in the market. This suggests that when planning investment ideas in altcoins, it is important to keep an eye on Bitcoin.

However, even with growing interest among institutional and retail investors, cryptocurrencies have a long way to go to stabilize and further restore quotes.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română