EUR/USD

Analysis:

The direction of movement of the Euro has been set in a downtrend since the beginning of last year. Quotes have reached their lowest values of five years ago. A strong potential reversal zone runs through here, from which the Euro has been retracing its upward trend for the past three weeks. The structure of this correction has an irregular shape, with the beginning on March 7.Outlook:

During the nearest week, the upward movement vector is expected to continue, up to its full completion. In case the upper boundary of the nearest support is broken through, the upward trend can be expected to continue till the next zone. This will be followed by a reversal and a return to a downward movement.

Potential reversal zones

Resistance:

- 1.1110/1.1160- 1.0840/1.0890

Support:

- 1.0560/1.0510

Recommendations:

Opening long positions in the Euro in the near term could lead to losses and is not recommended. The best strategy in the coming days would be to ignore market entry until there are selling signals around the estimated resistance.

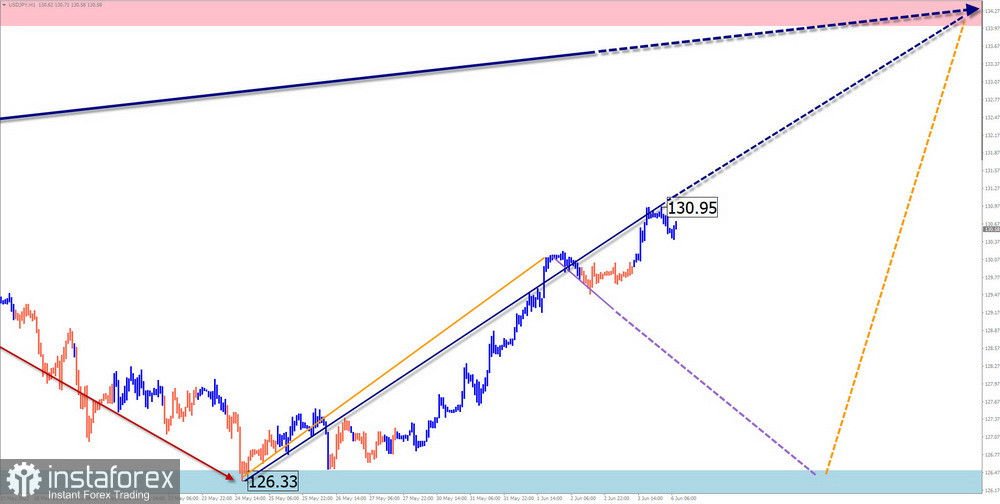

USD/JPY

Analysis:

The incomplete wave of the main Japanese Yen pair today traces back to March 2020. By now, the price is approaching the lower border of a powerful potential reversal zone. In a larger wave structure, this section completes the ascending wave zigzag. Its structure looks formed. There are no signals of an imminent reversal on the chart.

Outlook:

In the coming week period, the upward movement of the pair is expected to complete, the formation of a reversal and the start of a downward price move. The estimated support shows the lower border of the expected weekly range of the pair's move.

Potential reversal zones

Resistance:

- 134.00/134.50

Support:

- 126.50/126.00

Recommendations:

In the coming week, trades will only be safe within individual sessions with fractional lots. Opening short positions will be possible after reversal signals confirmed by your trading system in the resistance area.

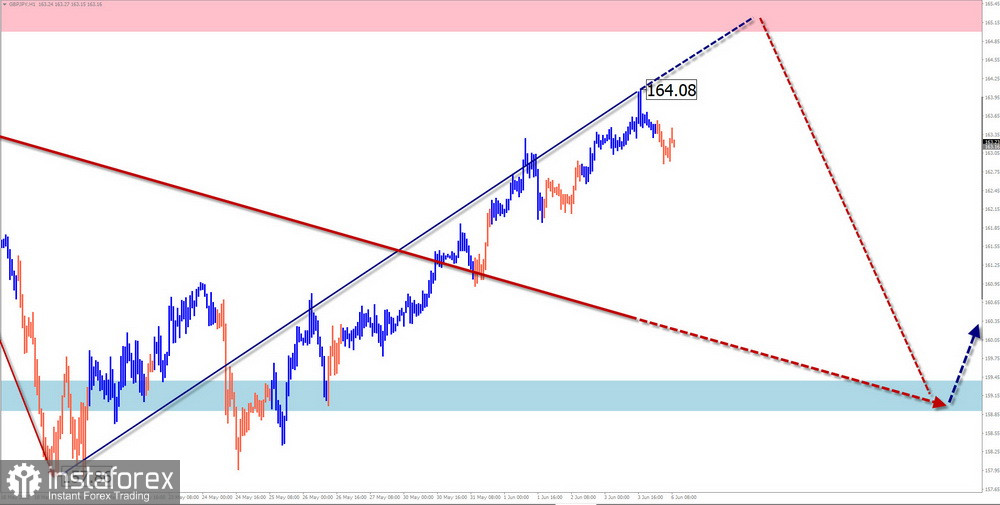

GBP/JPY

Analysis:

The uptrend of the English Pound/Japanese Yen cross since March 2020 moves to the north of the price chart. From the intermediate resistance zone since April 20, quotations are pulling back down, forming a correction zigzag. After its completion, the price rally will continue.

Outlook:

In the coming week, the pair's price is expected to move in the corridor between the nearest counter zones. At the beginning of the week, an upward trend is more likely. From the resistance zone, we can expect the formation of the reversal and the return of quotations to the area of the estimated support.

Potential reversal zones

Resistance:

- 165.00/165.50

Support:

- 159.40/158.90

Recommendations:

Cross market trades in the coming week carry higher risk. Trades are only possible within individual trading sessions if signals from the trading systems you use are confirmed.

USD/CAD

Analysis:

Over the past two years, the price of the Canadian dollar has been losing ground against the US currency. After a period of decline since last March, the price of the major pair chart has been moving mainly sideways. The structure of the correction does not look complete at the time of analysis.

Outlook:

Over the coming days, the current price decline of the last two weeks is expected to be completed. Then we can expect a reversal and resumption of the price rise.

Potential reversal zones

Resistance:

- 1.2930/1.2980

Support:

- 1.2530/1.2480

Recommendations:

Selling in the Canadian dollar market will have little prospect in the coming days. Opening long positions could be quite risky due to high probability of counter pullbacks. The best strategy is to stay out of the market for the upside and watch out for selling signals.

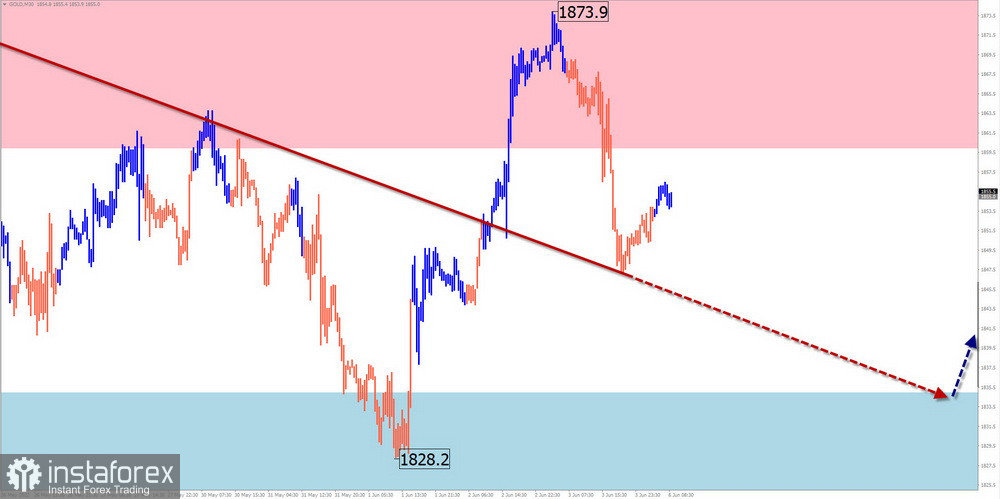

GOLD

Analysis:

Since March this year, gold quotations have been moving downwards. The wave structure is now complete. In the last two weeks, the price has been moving up, forming a correction. Its structure is close to completion.

Outlook:

In the coming week, the price is expected to move in a range between the closest areas of the counter direction. An upward vector is likely to occur in the coming days. By the end of the week, an increase in volatility and a resumption of the downward trend can be expected. A breakout beyond the borders of the settlement zones during the current week is unlikely.

Potential reversal zones

Resistance:

- 1860.0/1875.0

Support:

- 1835.0/1820.0

Recommendations:

Trading gold in the near term is risky and can lead to losses. Trades should be closed at the first reversal signals. It looks more promising to open short positions from the resistance zone.

Explanation: In simplified wave analysis, all waves consist of 3 parts (A-B-C). Only the last, unfinished wave is analysed on each timeframe. The solid arrow background shows the structure formed. The dotted line shows the expected movement.

Attention: The wave algorithm does not take into account the duration of movements of the instruments over time!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română