The week on world markets ended in generally negative territory. Investors continue to be under pressure from negative factors that do not allow them to perceive the situation and choose the direction of movement.

It is important that the fact of continued inflation growth, primarily in the United States and Europe as economically important regions, has a strong impact on the dynamics of asset values, and the pressure from the dollar, supported by an increase in the yield of American treasuries (government bonds), only contributes to this. On the other hand, the markets receive signals in the form of "hints" from some members of the Fed, as, for example, did R. Bostic, who at first spoke about the likelihood of a pause with the beginning of autumn in raising rates, but then retracted his words, which led to the resumption of the fall of the American stock market, and then other local markets. All this, of course, is the reason for high volatility and nervousness in the markets.

Undoubtedly, this week, which will be filled with important events, and first of all it is the outcome of the ECB monetary policy meeting and the publication of fresh data on consumer inflation in America, we should expect noticeable movements in all markets without exception.

Let's start with the possible outcome of the ECB meeting. According to the consensus forecast, it is assumed that the regulator, despite the rhetoric of Lagarde and some other representatives of the bank that a decision may be made to raise rates, will leave them unchanged. If this is the case, then the single currency will be under noticeable pressure, primarily against the US dollar, and may, paired with it, rush back to the recent low of 1.0350. But the resumption of strong inflation growth in the euro region, which data showed last week, and this is an increase in inflation in annual terms to 8.1% from 7.4%, and in May by 0.8% compared with the April increase by 0.6%, may, on the contrary, force the ECB to raise rates this week.

This dilemma is extremely difficult for the ECB because both raising rates and doing nothing are dangerous. Therefore, until Thursday, most likely, the pairs where the euro is present will consolidate in narrow ranges, and after the ECB decision, it will be possible to observe, with a high probability, strong movements.

The next important event this week is the publication of data on consumer inflation in America. It is no secret that it is the dynamics of inflation that have a dominant influence on the markets. The figures will be released on Friday and will set the markets in motion.

The consensus forecast assumes stabilization of consumer inflation in annual terms at the level of 8.3% but at the same time its sharp increase in May by 0.7% against the April growth of 0.3%.

How will the market react to the likely possible stabilization of inflation in America?

If this takes place, it will be possible to observe a local recovery in demand for company shares, or, in other words, a local rally, in which growing American stock indices will pull up the world. In this case, the expectation will return to the market that after two increases at the next meeting, the Fed may pause in further interest rate increases in the fall.

How will this scenario affect the dollar exchange rate?

We believe that such a picture will support the demand for risky assets (stocks), while there will be a decrease in the yield of treasuries, which will put pressure on the dollar exchange rate, which, as we have repeatedly pointed out, has already played out the entire current scenario. In this case, the assets traded in dollars will begin to grow in value, and the currency pairs where it is present will strengthen against it.

But another opposite scenario is also possible, in which the continuation of inflation growth, on the contrary, will support the dollar and lead to a new wave of sales in the stock markets and an increase in the yield of treasuries.

Forecast of the day:

A pair of AUDUSD.

The pair is trading below the 0.7350 level, a break below which will ensure that it continues to grow locally to 0.7340 within the monthly upward trend.

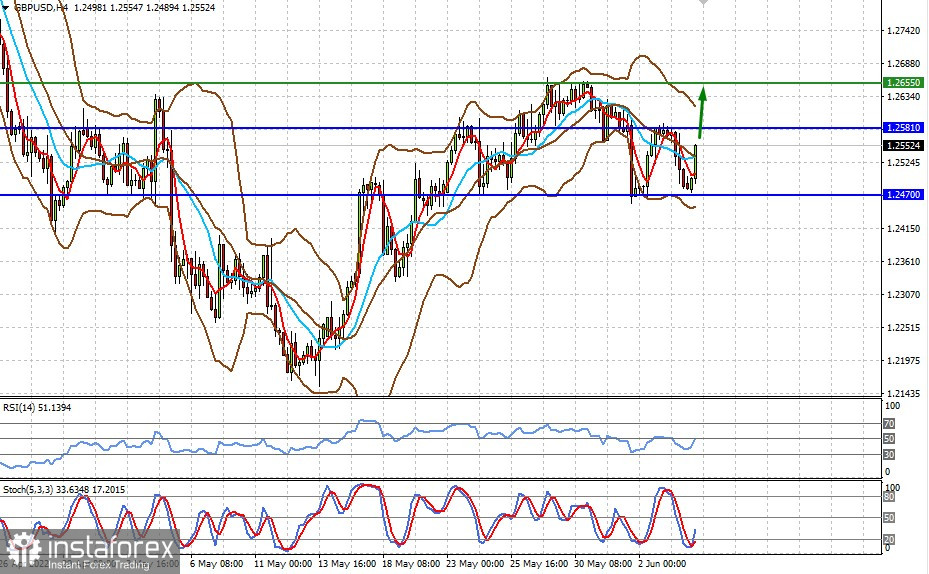

GBPUSD pair.

The pair is trading below the 0.7350 level, a break below which will ensure that it continues to grow locally to 0.7340 within the monthly upward trend.GBPUSD pair.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română