The main event of Thursday, and by and large of the last few weeks, was the European Central Bank meeting, the results of which were supposed to determine the mood of market participants for the next couple of months. In principle, the ECB has coped with this task. But not as expected. Investors had hoped that ECB President Christine Lagarde would announce a 0.50% increase in the refinancing rate in July. And just at the next meeting, an increase in all interest rates is planned, but only by 0.25%. Also, during the September meeting, it is planned to consider the issue of an increase by another 0.25%. Given the simply catastrophic situation with inflation, the market was waiting for something more. Moreover, the ECB has finally revised its inflation forecasts for the next three years, raising them significantly. It turns out that inflation will be higher than expected, and interest rates will be lower. Naturally, the single currency immediately began to lose its position.

Given that inflation is now almost the most significant indicator, its publication in the United States is of great importance. Moreover, it should remain at the same level of 8.3%. That is, inflation in the United States stops growing, and the risks are gradually decreasing. And this is happening amid a significant increase in the inflation forecast in Europe. This will further strengthen the position of the US dollar, and the euro will finally break out of a prolonged stagnation. But having overcome not the upper limit of the range, but the lower one.

Inflation (United States):

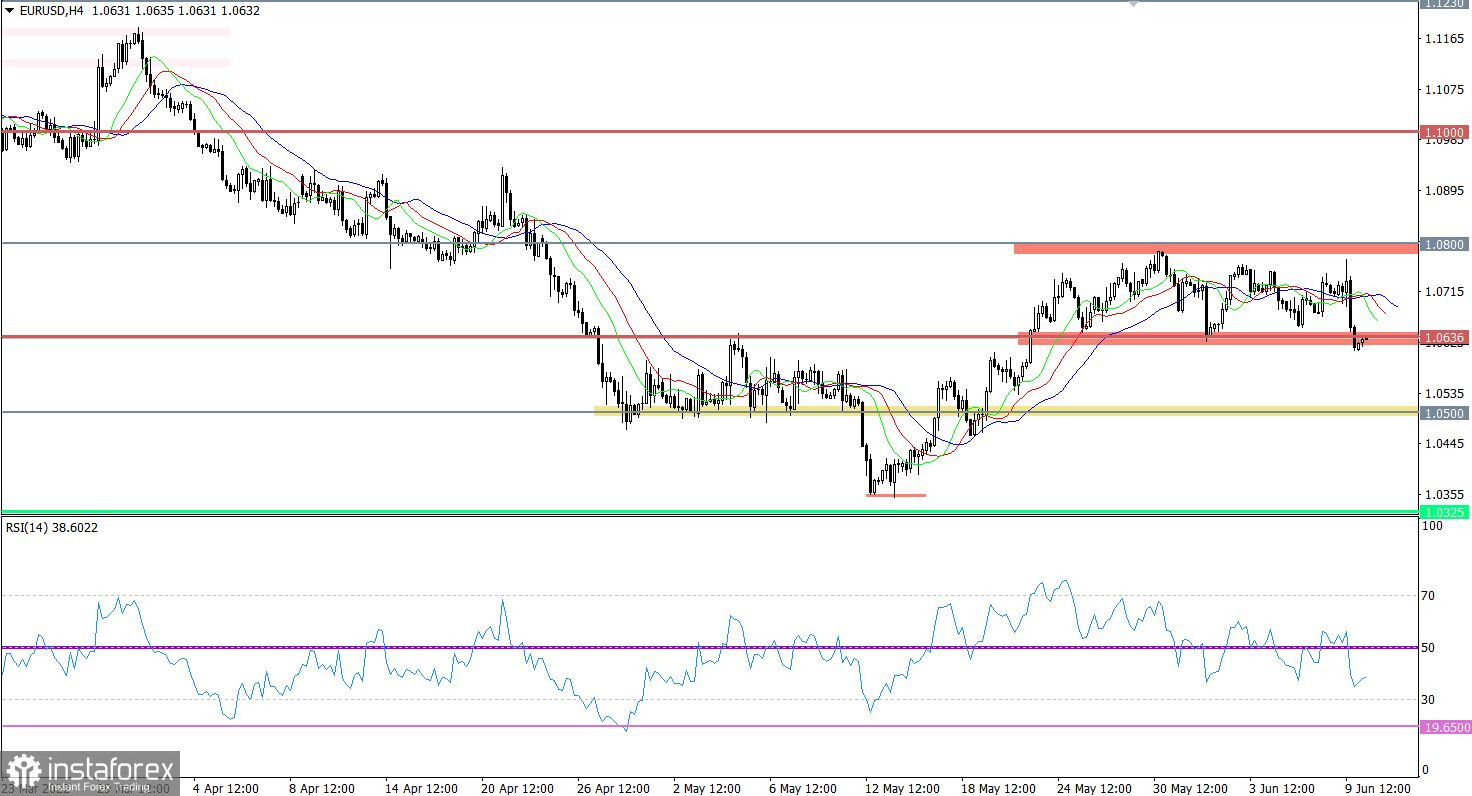

The EURUSD currency pair overcame a path of more than 120 points during an intense downward momentum. This movement led to a breakdown of the lower boundary of the horizontal channel at 1.0636/1.0800. Based on the price's behavior, we can state the fact of speculation in a given period of time.

The RSI technical instrument locally crossed the 30 line from top to bottom in the short-term and intraday periods. This indicated a signal that the euro was oversold, which subsequently led to a technical pullback. RSI D1 crossed the 50 line from top to bottom, this is a positive signal of a possible change of trading interests from an ascending cycle to a descending one.

The MA moving lines on the Alligator H4 have a lot of interweaving with each other, despite the fact that at this time the indicator is pointing downwards. Alligator does not have a stable signal in the short-term and intraday periods.

Expectations and prospects:

The technical rollback is still relevant in the market due to local overheating of short positions in the euro. This movement can temporarily return the quote to the boundaries of the previously passed flat.

A subsequent downward move is expected in the market after keeping the price below the value of 1.0600. This step will lead to a gradual recovery of dollar positions relative to the recent corrective course.

A comprehensive indicator analysis has a signal for short positions in short-term and intraday periods due to the recent downward momentum.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română