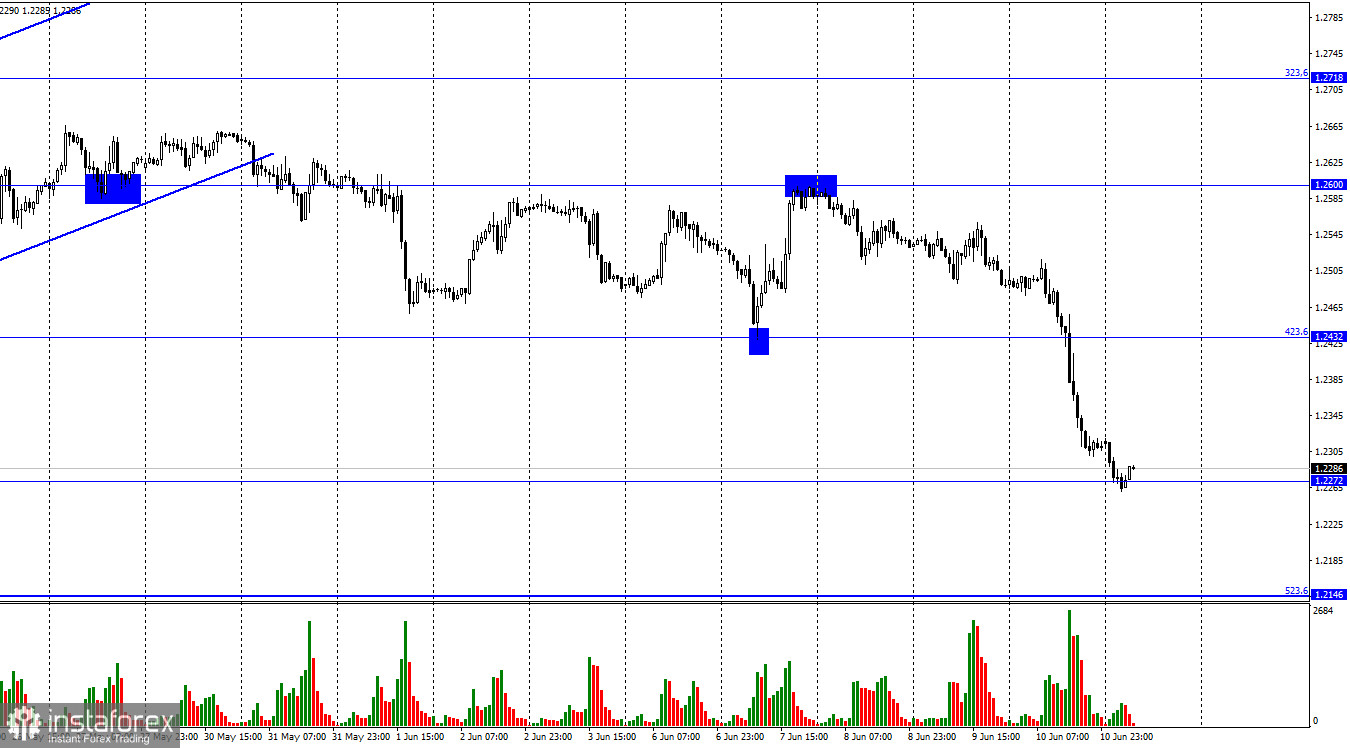

According to the hourly chart, the GBP/USD pair closed under the corrective level of 423.6% (1.2432) on Friday, and on Monday it fell to the level of 1.2272. The rebound of quotes from this level will allow us to count on a reversal in favor of the British and some growth in the direction of the level of 1.2432. Fixing the pair's rate below the level of 1.2272 will increase the chances of a further fall towards the next Fibo level of 523.6% (1.2146). Everything that can be said about Friday is related to the report on American inflation. Although the fall of the British began before the release of this report, it left the side corridor at the moment of its release. Thus, the mood of traders is now again characterized as "bearish", and a downward trend corridor may be built in the near future. There will be a lot of interesting events this week that will concern both the pound and the dollar. I have already talked about the Fed meeting, but there will also be a meeting of the Bank of England. And the British regulator is also going to raise the interest rate by 0.25%.

However, the meeting of the Bank of England will be held only on Thursday, and today in the coming hours, reports on GDP and industrial production will be released in the UK. The second report will not be a priority for traders, but the first one may show that the British economy is stalling in place. The report will be monthly, for April. By the end of March, GDP decreased by 0.1%, and by the end of April, it may be in the range of 0-0.1%. If GDP growth happens, it will be minimal. This means that the UK economy is not growing, but at the same time the Bank of England has already raised the rate four times and this week may do it for the fifth time. I believe that such measures can lead to a slowdown in the economy, but the regulator has nothing to do - inflation in Britain is already higher than in the United States, and something needs to be done about it. The situation is complicated, but it is also complicated in the United States, where GDP lost 1.5% in the first quarter. However, only the dollar is still growing.

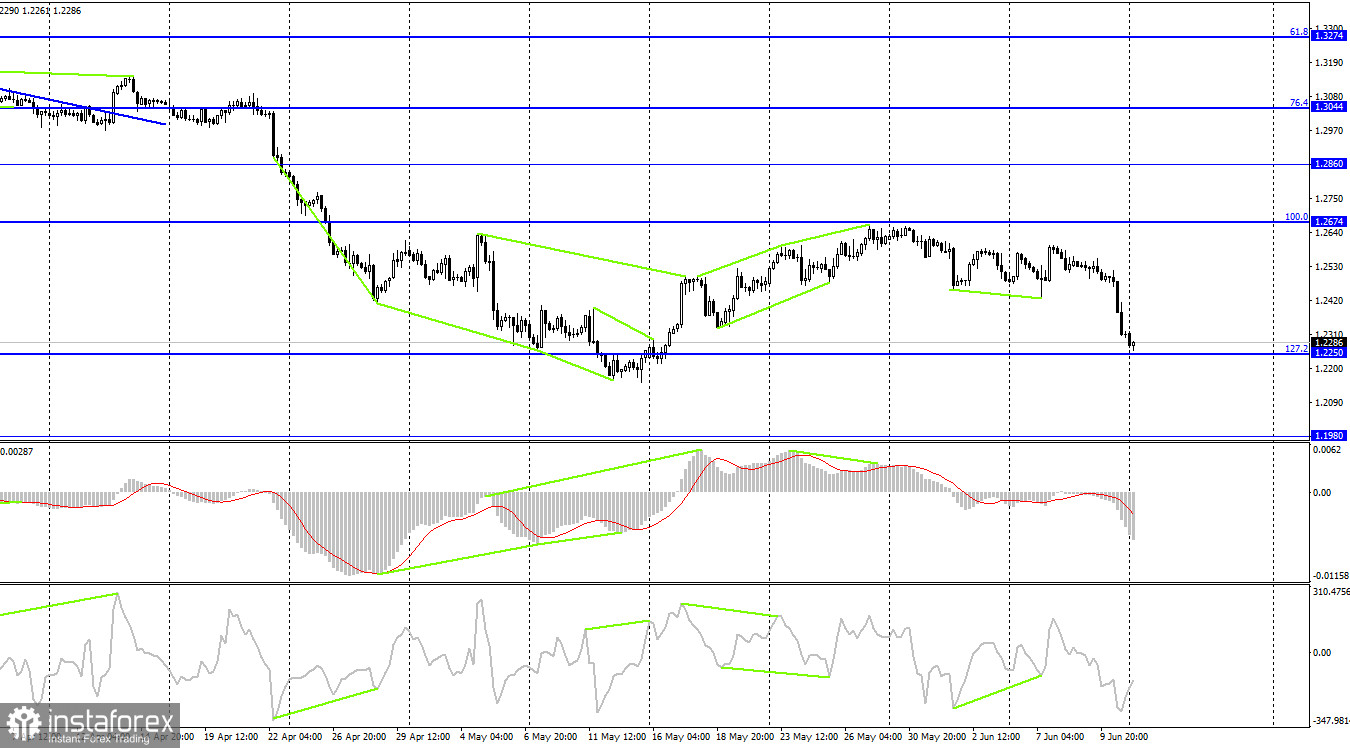

On the 4-hour chart, the pair performed a reversal in favor of the US currency and began a new process of falling. The rebound of quotes from the Fibo level of 127.2% (1.2250) will work in favor of the pound and the beginning of growth in the direction of the corrective level of 100.0% (1.2674). The consolidation of quotes under 1.2250 will increase the probability of a further fall towards the next level of 1.1980. Emerging divergences are not observed in any indicator today.

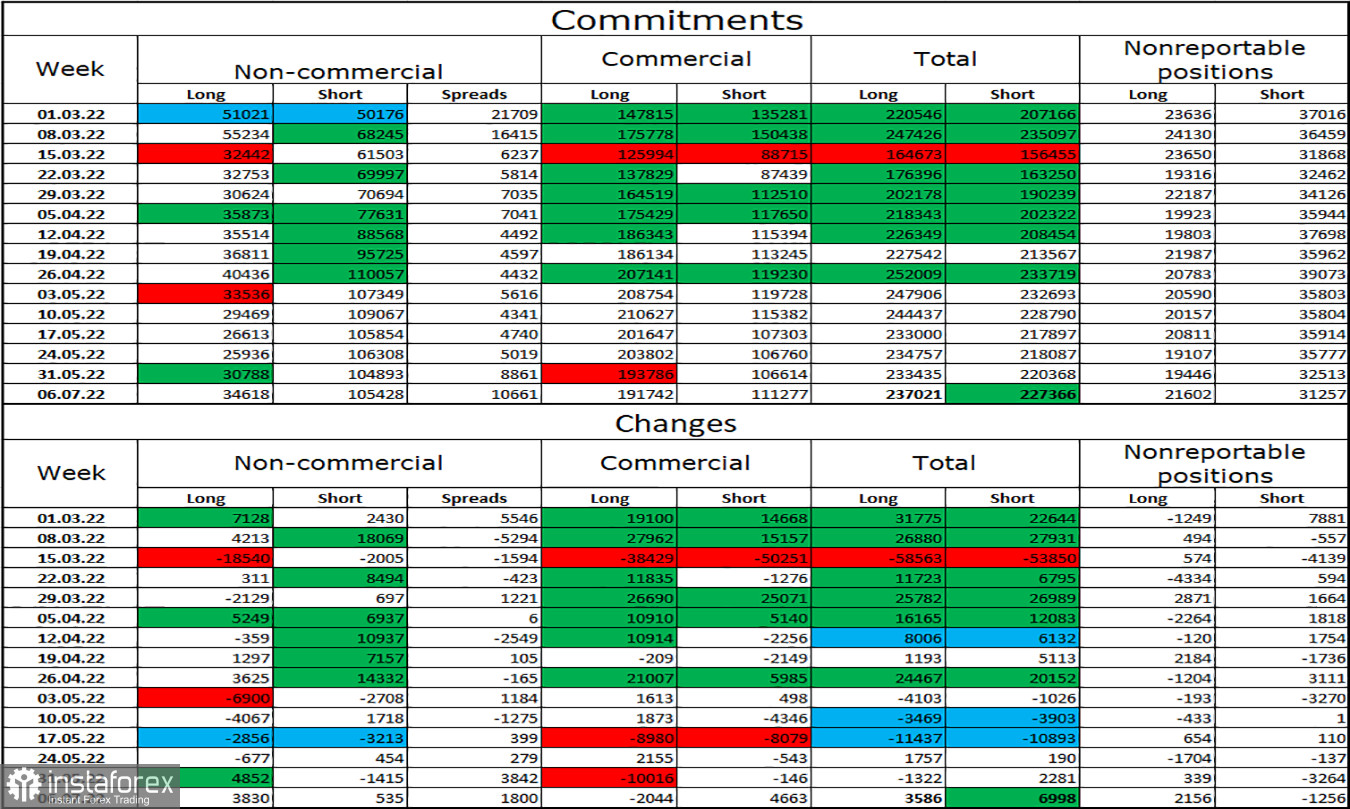

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has become a little more "bullish" over the past week. The number of long contracts in the hands of speculators increased by 3,830 units, and the number of short - by 535. Thus, the general mood of the major players remained the same - "bearish", and the number of long contracts exceeded the number of short contracts very much. Major players continue to get rid of the pound for the most part and their mood has not changed much lately. So I think the pound could continue its decline over the next few weeks. A strong discrepancy between the numbers of long and short contracts may indicate a trend reversal, but the information background is more important for major players now. So far, in any case, it makes no sense to deny that speculators sell more than they buy.

News calendar for the USA and the UK:

On Monday in the UK and the US, the calendars of economic events do not contain a single interesting entry. The information background will not have any impact on the mood of traders today.

GBP/USD forecast and recommendations to traders:

I recommended selling the British at the close under the level of 423.6% (1.2432) on the hourly chart with a target of 1.2272. This level has been reached. Now I recommend selling at a close below the level of 1.2272 with a target of 1.2146. Purchases of the British dollar will be possible when rebounding from the level of 1.2272 with a target of 1.2432.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română