Over the past three days, Bitcoin has experienced two of the biggest drops since May 2022. The volume of liquidated funds reached one billion, and mainly accounted for long positions. The main cryptocurrency updated the local low at $24.6k, which threw the entire market into chaos. Shortly before the fall, the level of BTC dominance in the market reached a six-month high at around 47%. This set off a chain reaction and the altcoin market also began to decline.

Over the past day, the total capitalization of the crypto market has decreased by 7.5%, and has reached a local bottom at around $1 trillion. The last time the total value of all digital assets reached such low values was before the start of the bull market in February 2021. At the same time, a repetition of last year's scenario should not be expected, since the situations are incommensurable in their scale and consequences. Despite this, the total capitalization of the crypto market has reached another strong support zone, and there is every reason to believe that further decline can be avoided.

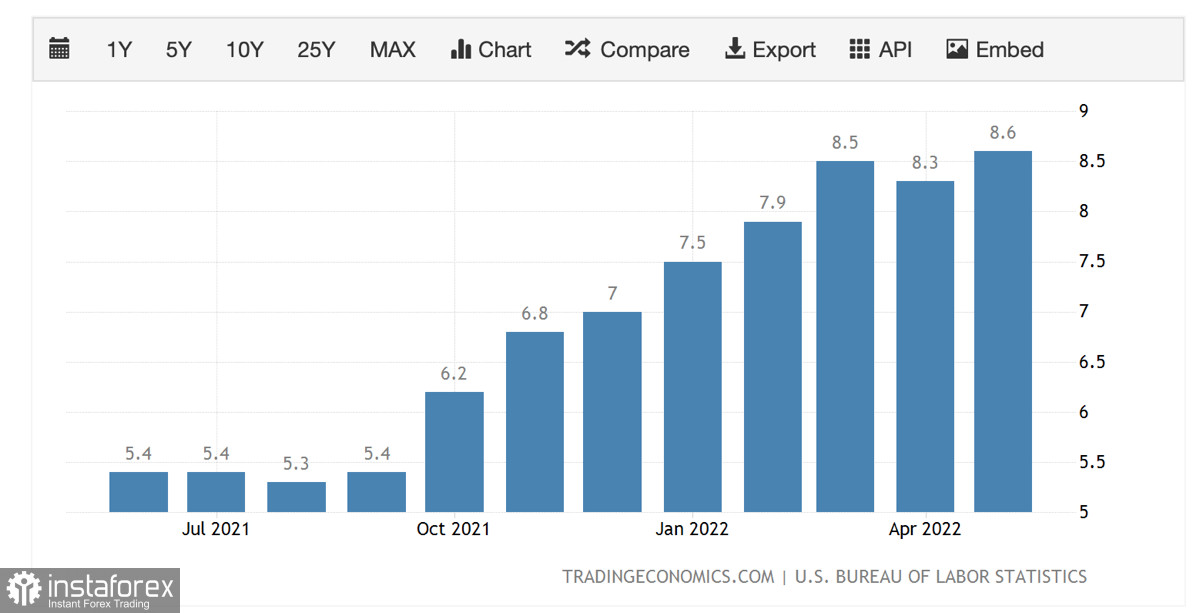

The main catalyst for the fall of Bitcoin and the entire market was the publication of inflation reports in the United States. The level of growth in consumer prices reached 8.6%, and the market was not ready for such a sharp increase. Leading analysts predicted inflation to fall to 7%, and the market behaved accordingly. Subsequently, it turned out that the consumer price index reached record levels over the past 40 years. It was the effect of surprise that provoked such a negative reaction of the market.

The stock and cryptocurrency markets need to prepare for a protracted correction provoked by fundamental factors. The main reasons for rising inflation were the growing threat of a food crisis, the war in Ukraine, and the growing energy crisis. All these factors have a negative impact on US dollar inflation, which is growing despite the best efforts of the Fed. In the long term, the market should prepare for even more tightening of monetary policy and a more aggressive increase in the key rate.

However, in the short term, a local recovery period for BTC/USD quotes is expected. The asset reached a new local low at $24.6k, but managed to recover to the previous value of $25.2k. The negative background caused a massive sale, which increased the volume of coins on the market. The $25k level is an important psychological value where there is massive consolidation and absorption of volumes.

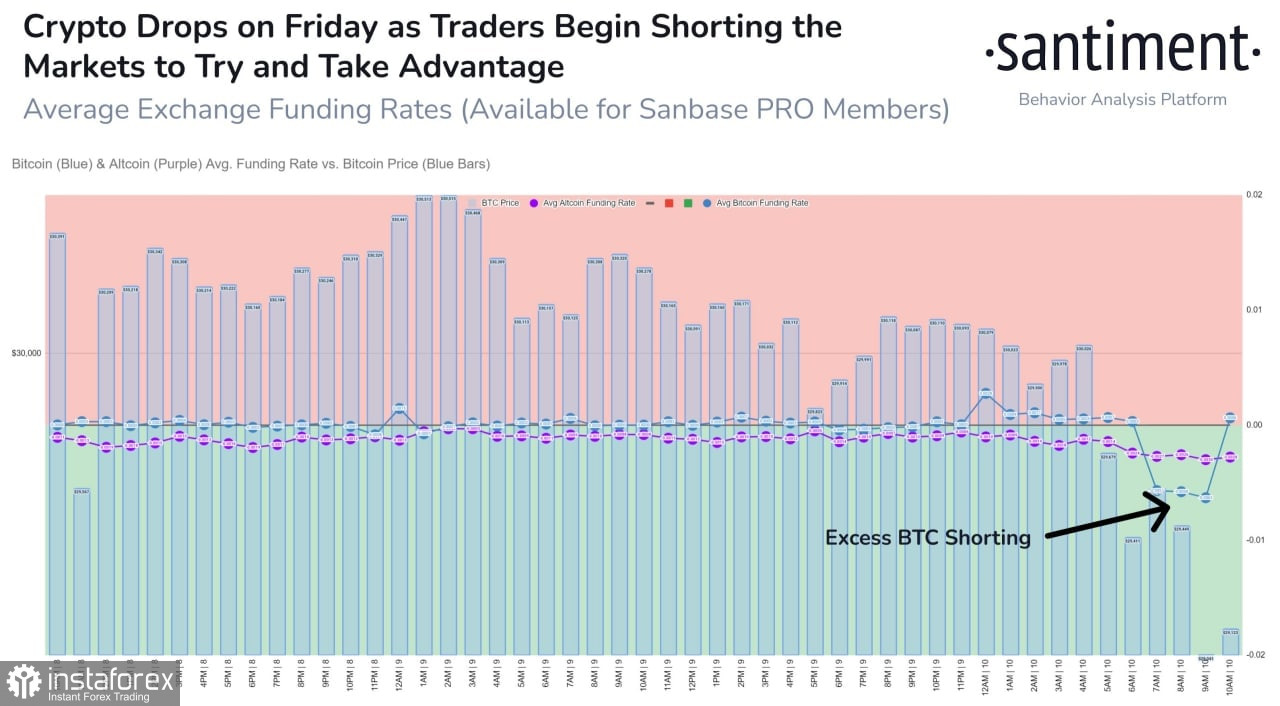

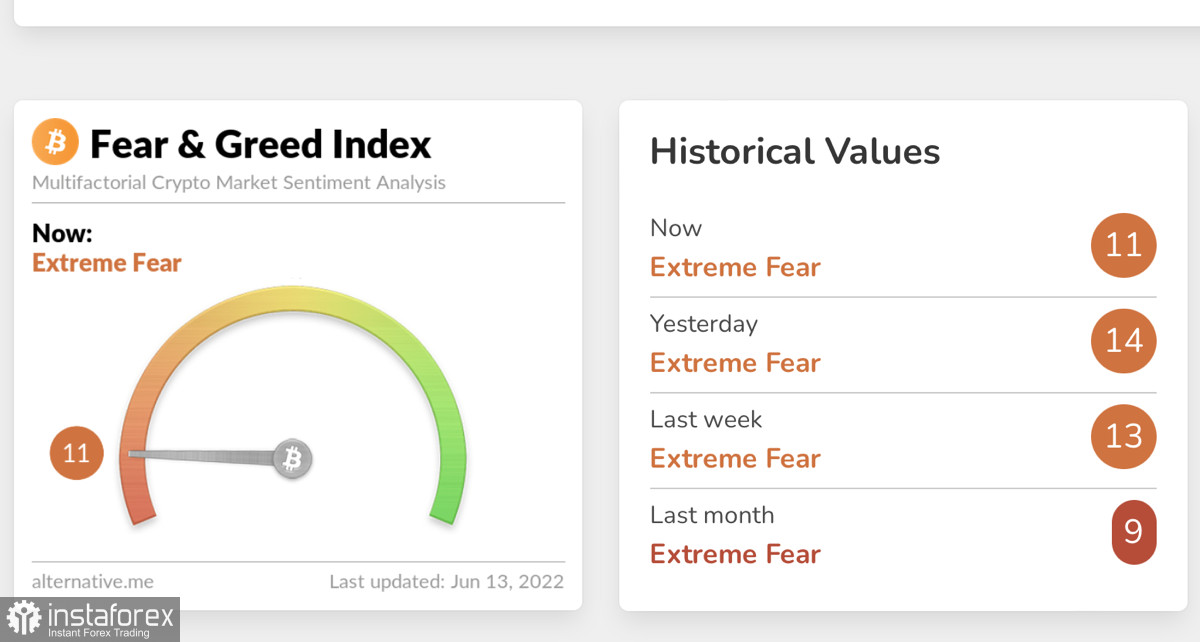

Santiment experts report a high level of fear, which provoked the wholesale opening of short positions. The number of short positions on the exchanges is also starting to increase, which may cause a backlash, due to which the asset can recover to the $27k level.

However, the upward rebound cannot be perceived as a rapid recovery of Bitcoin. The level of volatility has jumped, but is within the normal range, and therefore one should not expect such sharp changes in the trend. If you look at the nature of the formation of a new local bottom, you can see that buyers did not buy back the fall until the breakdown of $25k, where buy orders are concentrated.

Reaching $24.6k didn't look like a local bottom, as classically this pattern looks like a candlestick with a long lower shadow. In other words, the initiative is entirely up to the sellers, and we have yet to find out where the final local bottom of this bearish cycle will be formed.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română