The euro collapsed at the end of last week. The single currency entered the new week with heavy losses and a high probability of testing new lows – we are talking about parity with the dollar again. On Monday, the EUR/USD exchange rate remains under pressure near the 1.0450 mark. Going below 1.0515 set the pair to test the low of May 13 near 1.0350. If the bears manage to break down this bar, we can safely talk about a further decline towards parity, BBH economists write.

The main catalyst for such a movement, in their opinion, is the "growing risks of fragmentation." So, what is the picture for EUR/USD today and what to expect from the quote during the week?

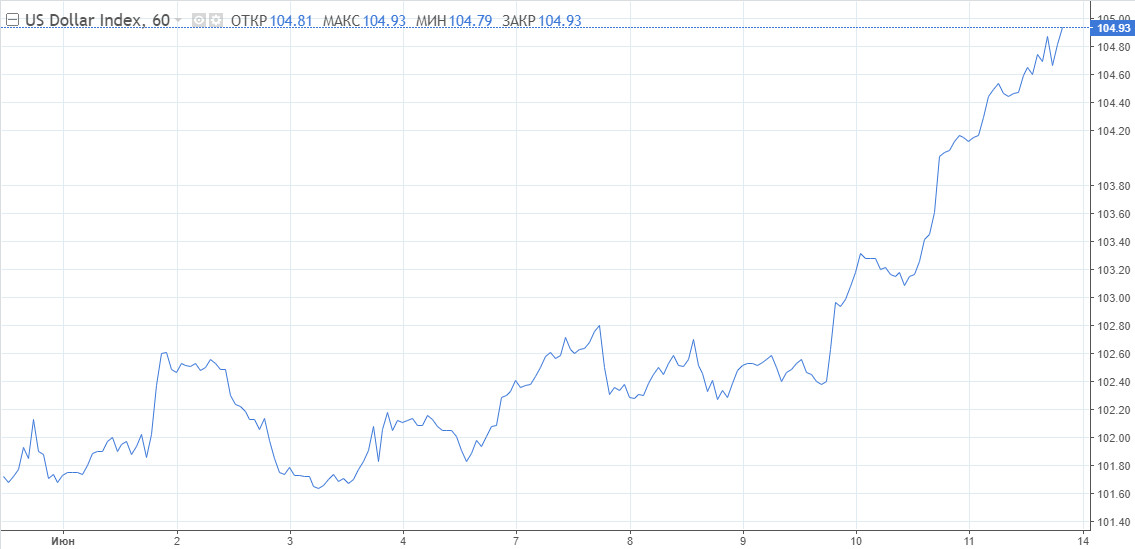

The euro is expected to remain under pressure in the coming sessions if US bond yields and the Federal Reserve's policy outlook continue to reduce risk appetite in global markets. A new inflation report released last week surprised the market and prompted a revision of the Fed's interest rate forecasts in the coming months.

The new record inflation rate became a catalyst for the growth of treasuries and the dollar exchange rate, while fueling an earlier sell-off on world stock exchanges, which strongly affected many currencies, including the euro.

The European Central Bank's landmark meeting last Thursday, which could have supported the euro, remained in the shadow of US inflation. And in general, the rhetoric of the central bank did not particularly lift the mood of bulls on the single currency. The ECB will start raising rates in July, which is already included in the quotes. In addition, the central bank expects a steady increase in the cost of borrowing in the coming months. Many analysts believe that this reflects the market's concern about the negative impact of higher rates on Southern European bonds.

The central bank also announced a plan to use the reinvestment of a 1.85 trillion euro bond portfolio acquired as part of the Pandemic Emergency Procurement Programme. This is aimed at preventing a disproportionate and destabilizing increase in financial costs for fragile members of the bloc.

This is unlikely to reassure investors, who are likely to continue to show concern about how peripheral European countries will develop in difficult conditions. Such concerns will put pressure on the euro, which is additionally vulnerable to a large-scale strengthening of the dollar.

There are practically no interesting and influential events on the euro exchange rate this week, with the exception of ECB President Christine Lagarde's speech at the London School of Economics on Wednesday. This means that the euro will be mainly at the beck and call of the dollar, the weather in the EUR/USD pair will be made by the Fed meeting this week.

The market is concerned about energy prices and the fact that the Fed will have to tighten policy even faster. A more aggressive step may be taken already at the June meeting. Barclays changed its rate expectations in favor of a 75 basis point increase.

Inflation may remain well above the Fed's 2% target for much longer than initially thought. The central bank will have no choice but to continue raising rates further in larger than usual steps until the end of the year. In this scenario, by January 2023, the US rate will rise to 3% or more, which will provide great support to the dollar and, accordingly, will become another heavy burden for the euro.

Not everyone adheres to the version of a more aggressive rate hike in the United States. According to Nordea economists, the rate will be increased, as predicted, by 50 basis points. However, uncertainty in this regard is very high and monetary surprises are quite possible and justified.

If Nordea turns out to be right, then the dollar will weaken this week. It is worth noting that now, from a technical point of view, it is close to being overbought. However, the barrier above 105.00 on the index will still be taken.

As for the EUR/USD pair, it already looks technically oversold on the four-hour chart. But even if the technical correction of the euro is launched, it will not be easy to return to the level of 1.0520. As long as it remains unbroken, bears will retain control over the situation.

The nearest support is located at 1.0450. If the session closes below this level, additional losses in the direction of 1.0400 and 1.0370 may be observed.

If bulls pull the quote above 1.0520, the following resistance levels will be activated – 1.0570 and 1.0600.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română