On Wednesday, the US Federal Reserve raised its base rate from 1.00% to 1.75%, in line with bold expectations. The majority of investors expected an increase to 1.50%. The sharp increase in the rate led to massive purchases of US government bonds, the yield on 5-year securities fell from 3.60% to 3.37%, which led to the fall of the dollar instead of the expected growth.

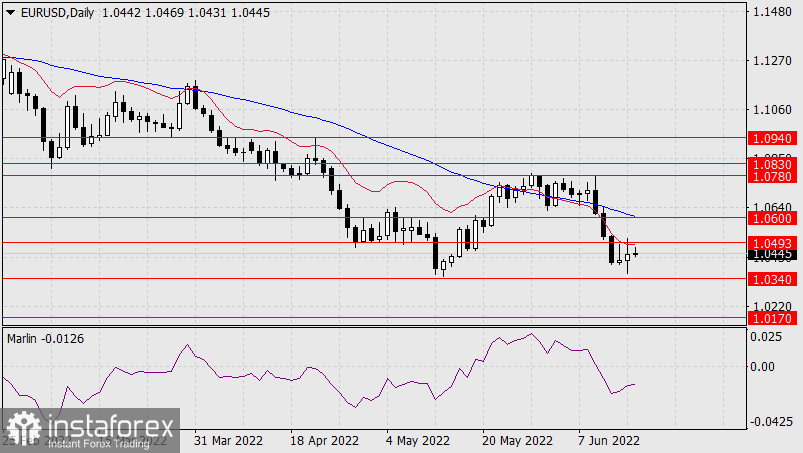

Yesterday, the euro traded within the range of target levels 1.0340-1.0493. Its growth is visually perceived as a correction. We believe that the imbalance of the single currency due to a strong rate hike will end today, so we are waiting for the closing of the day with a decrease. And then we are waiting for the price to leave under the support of 1.0340 and advance to 1.0170.

On the four-hour chart, the Marlin Oscillator shows the intention to turn down from the border with the growth territory. It is very similar to the fact that the oscillator is forming a short-term range in the negative zone. And this is consolidation before the next decline.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română