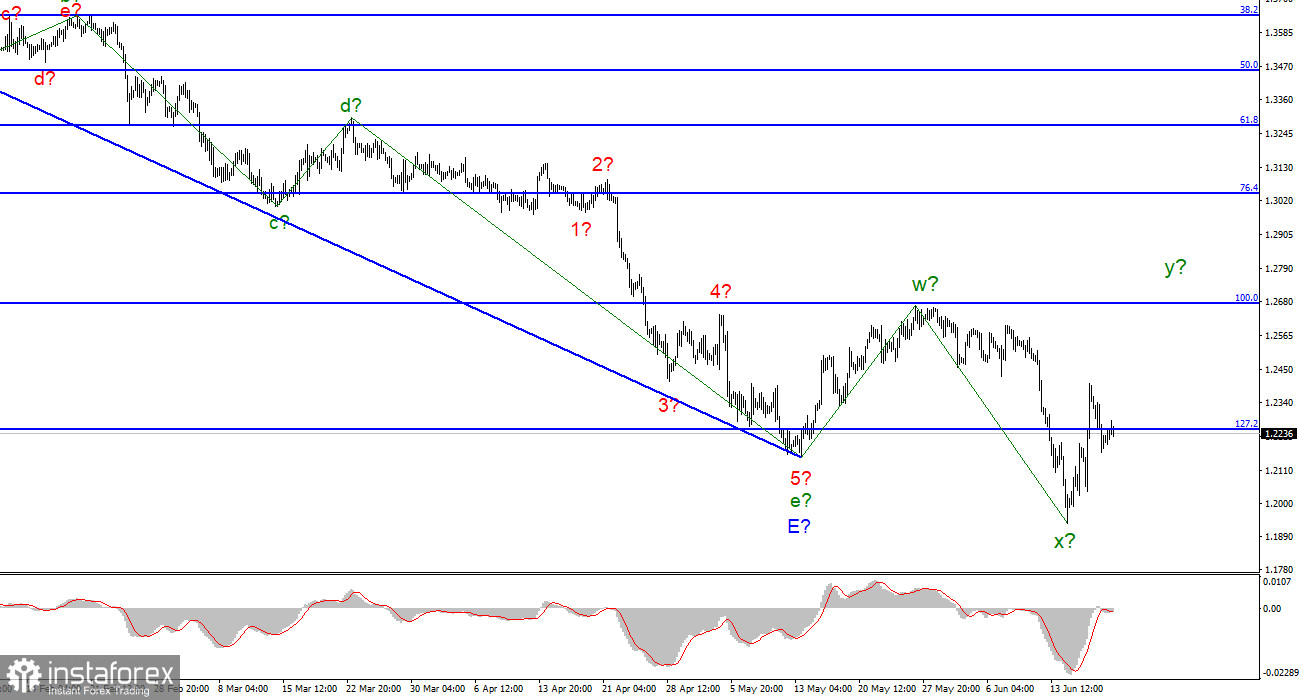

For the pound/dollar instrument, the wave markup already requires additions and adjustments, but it may still take on a more or less digestible form. At the moment, the last downward wave has gone beyond the low of the expected downward trend segment, which I consider completed. Thus, we will no longer see the classical correction structure a-b-c. Nevertheless, wave analysis allows the construction of various correction structures, so a more complex three-wave formation w-x-y can be constructed. Anyway, the pound and the euro continue to show a very high degree of correlation, and both instruments should build approximately the same structures. At the same time, according to the euro currency, it can be a classic a-b-c, and according to the pound, a rarer w-x-y. But in both cases, the instruments should now build an ascending wave, which should go beyond the peak of the previous ascending one. The wave marking on the British now looks not quite unambiguous, but still has the right to life. The fact that a stronger appreciation of the US currency did not begin after the Fed meeting is encouraging and gives chances for building the necessary upward wave.

The European Commission threatens to file a lawsuit

The exchange rate of the pound/dollar instrument increased by only 20 basis points on June 20. Market activity today was low for the first time in a long time. Markets in the US are closed, and there is no news background in the UK. However, the absence of economic news does not mean that there is no news at all. On Monday, it became known that the European Commission is launching a procedure against the UK, as it was not possible to agree on the controversial protocol on Northern Ireland, and London is threatening to withdraw from the Brexit agreement. The European Union believes that Britain has no right to unilaterally withdraw from international communications absolutely without consequences and sanctions. "Despite all our requests to adhere to the implementation of the Protocol, which was signed, including by London, the UK government shows that it is not going to do this. This is a violation of international law. We consider it possible to start a procedure aimed at restoring those areas where the UK does not adhere to the agreement," the European Commission said in an official statement.

European Commission President Maros Sefcovic said that documents have been handed over to Britain that resolves the problem of cargo movement between it and Northern Ireland. If London continues to violate international law and does not respond to the EU's proposals within two months, the EU will go to Court. If the European Court of Justice takes the side of the EU (which there is no doubt), compensation and penalties will follow. Thus, relations between the EU and Britain are beginning to heat up, although they were not the best before (after Brexit). So far, no measures have been taken yet, so there are still chances that the parties will be able to agree on everything through diplomacy. But the negotiations have been going on for about a year, and there is no result. However, I do not rule out the possibility that London and Brussels will be able to agree at the last moment, as it was with the signing of the Brexit agreement, almost under the chimes and 5 minutes before the UK officially left the EU.

General conclusions

The wave pattern of the pound/dollar instrument has become clearer. I still expect the construction of an upward wave within the corrective upward structure. If the current wave marking is correct, then the instrument's increase will continue with targets located above the calculated mark of 1.2671, which corresponds to 100.0% Fibonacci. I recommend buying on each MACD signal "up".

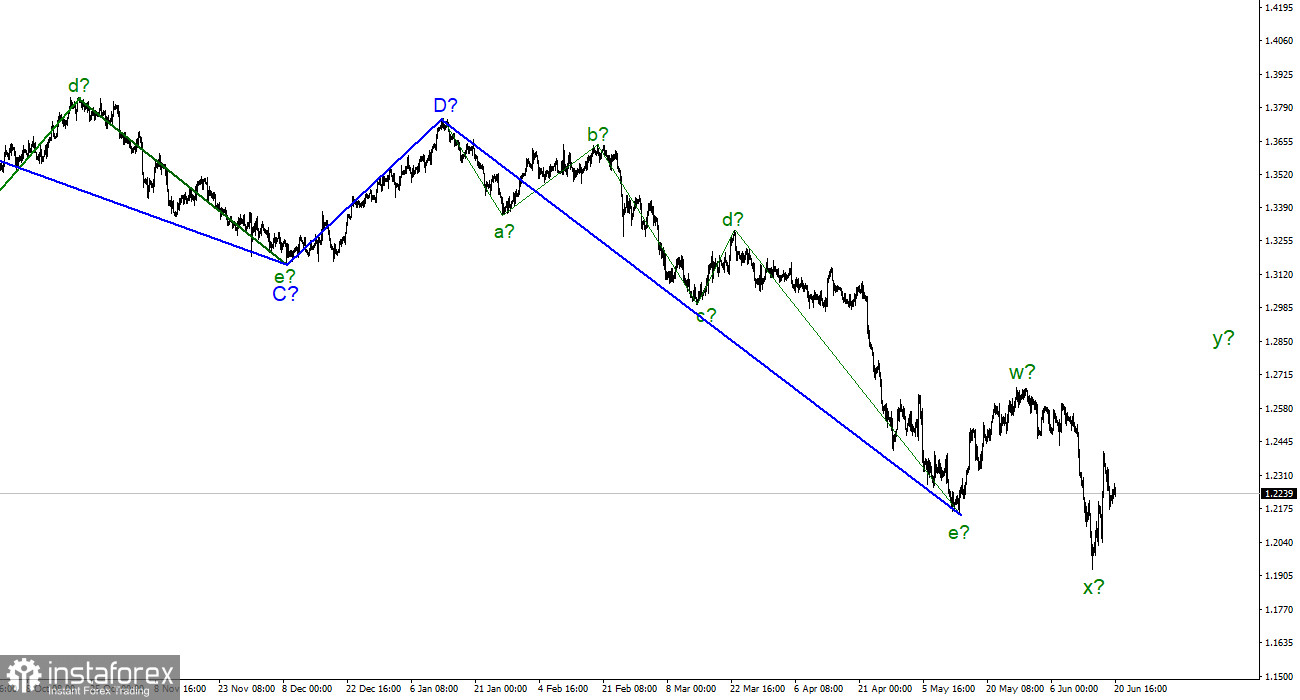

At the higher scale, the entire downward trend section looks fully equipped but may take on a more extended form. If the current correctional structure still takes an even more non-standard form, then adjustments will have to be made.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română