The latest increase in US interest rates by 75 bps forced the Bank of England to change the plate. Now the hawkish notes have become more distinct, but this is unlikely to change the minor sentiment against the pound.

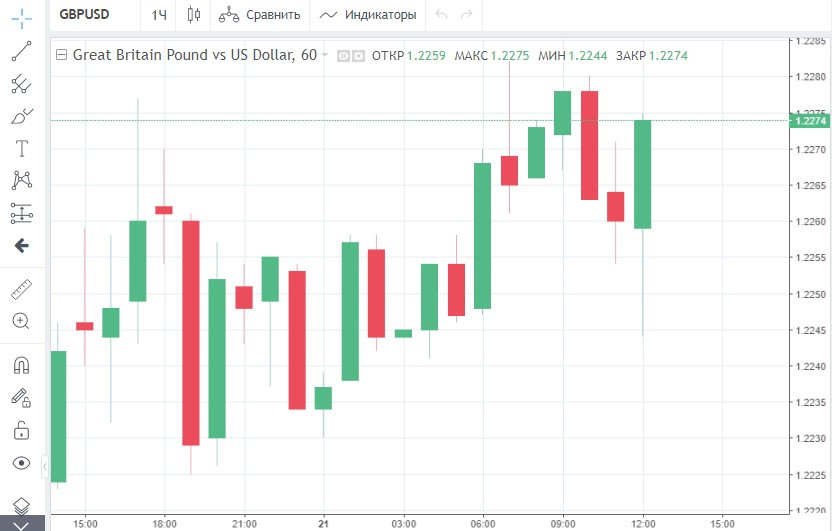

At the beginning of the week, the British currency managed to firmly settle at $1.227 and thereby significantly increase the gap from the 2-year low of the last seven days – the mark of $1.193.

On Monday, several factors contributed to the growth of the GBP/USD pair: the decline in the dollar index amid the return of investors' appetite for risk and the more hawkish tone of the representatives of the BoE.

Recall that last week, the central bank increased interest rates for the fifth time in the current tightening cycle. As before, the BoE increased the indicator by 25 bps.

At the same time, officials said that in the future they will act more "decisively" if inflation indicators do not begin to level off. According to analysts, this indicates a rate increase of 50 bps in the foreseeable future.

Yesterday, expectations that the BoE will take a broader step towards tightening next time has increased significantly. The reason for this was the announcement of the largest strike of railway workers in the last 30 years.

The British Trade Union of Railway and Maritime Transport workers has already put forward demands, the main of which is an increase in the wages of its members by at least 7%.

There are also reports that teachers, airport employees and other public sector workers who are dissatisfied with low salaries in the face of soaring prices may join the strike.

Huw Pill, chief economist at the BoE, fears that if employers eventually give in, it will lead to a significant increase in wages in the coming months.

Higher remuneration for labor can accelerate inflation even more. In this case, the BoE will have no choice but to act aggressively.

Catherine Mann, a member of the Monetary Policy Committee of the BoE, also spoke about the importance of adopting a more active approach to managing interest rates yesterday.

According to the official, the BoE cannot afford the luxury of taking a cautious approach to raising interest rates, given the high bar set by the US Federal Reserve last week.

Not only did the US central bank raise rates by 75 bps at once, but it also hinted at further tightening at a given pace. This is a great incentive for the growth of the US currency.

The strengthening of the dollar may lead to an even greater rise in the price of imported goods and have a strong inflationary impact on the British economy.

To prevent this from happening, the BoE needs to reduce the gap between interest rates in the UK and the US as soon as possible, Mann believes.

As you can see, the comments that BoE representatives now allow themselves are strikingly different from the statements of a month ago. Despite this, many analysts do not see any prospects for the growth of the GBP/USD pair.

As an example, let's take the latest forecast from Rabobank. Dutch strategists expect that in the next three months the exchange rate of the pound to the dollar will return to the level of 1.20, and possibly fall even lower.

The weakening of the GBP/USD pair will be facilitated by a significant increase in demand for the dollar. According to Rabobank, the US currency should benefit from the slowdown in economic growth in the US.

A series of large-scale interest rate hikes, which the Fed has started, will trigger a recession in America, which will have negative consequences for the global economy.

Against this background, risky assets, which include the British pound, are unlikely to be in demand, unlike the protective dollar.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română