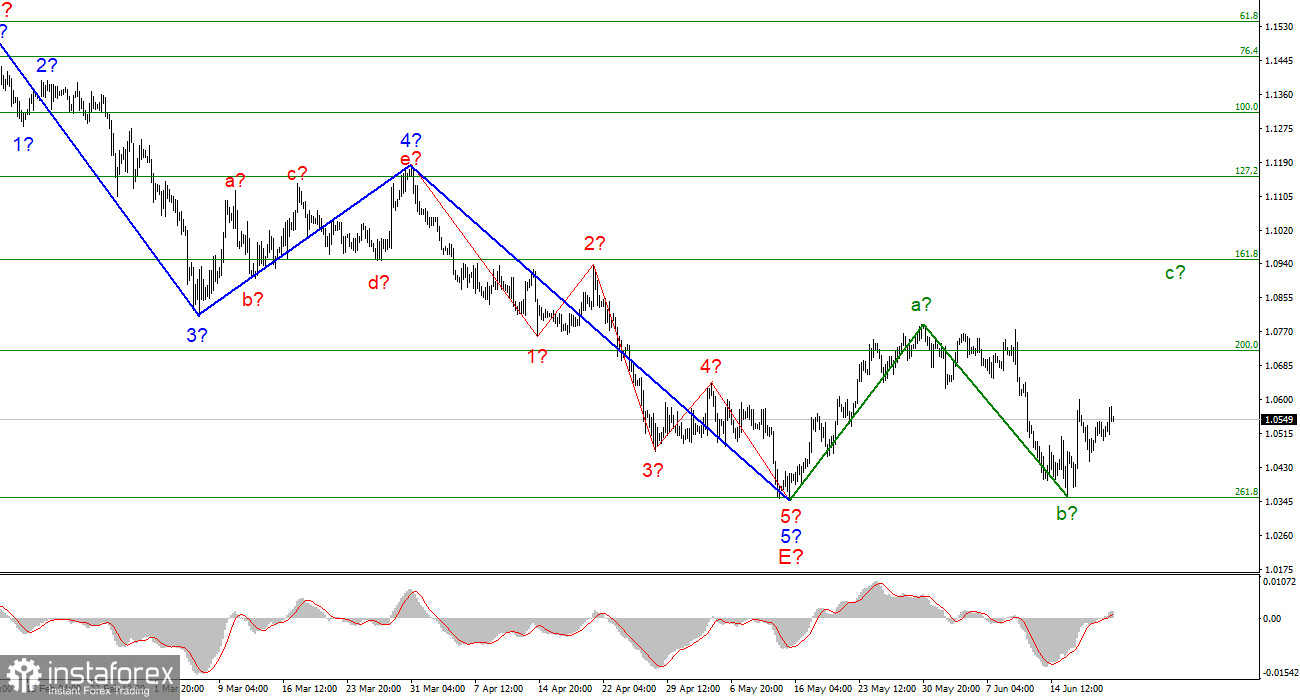

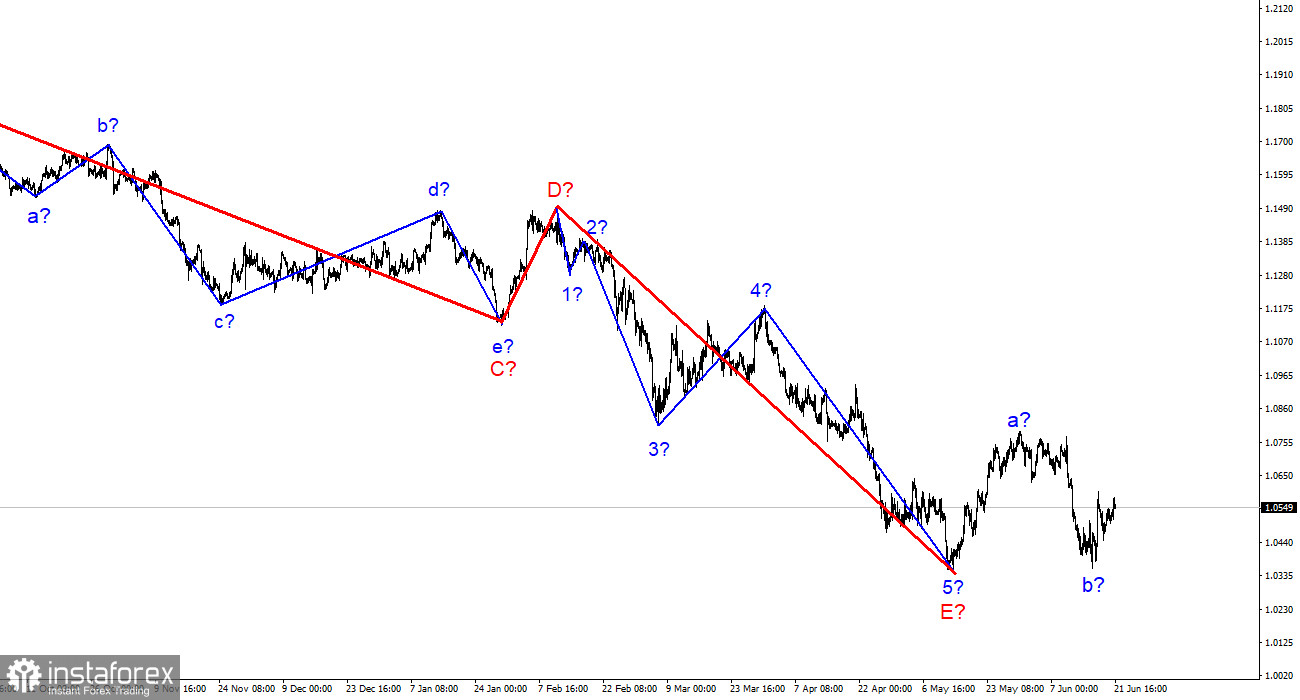

A wave layout for EUR/USD still looks convincing on the 4-hour chart and does not have to be revised. The trading instrument completed a downward wave 5 in E which is the last one in the layout of the downward trend section. If the ongoing wave layout is true, it means that a newupward trend section is already underway. It might consist of three waves or it might turn out to be impulsive. For the time being, we can find out two waves of the new trend section. Wave a is complete. Wave b is also supposedly complete. If this assumption is true, upward wave c is already being built or is about to begin soon. The currency pair has not declined yet below the downward trend section. So, the wave layout still sustains its integrity. Importantly, the downward trend section could complicate its inner wave layout and take a more elongated shape. Unfortunately, the highly promising wave layout could be ruined due to the news environment that weakened demand for the euro. Nevertheless, there is a fair chance of developing upward wave c.

Tomorrow Fed's Chairman will make his first testimony before Congress

On Tuesday, EUR/USD climbed 35 pips. Thus, demand for the euro is improving slowly but surely. Let me remind you that demand for the euro should increase to make the current wave layout valid. The single European currency should appreciate at least 250-300 pips. Only in this case, we can consider wave c complete and we can view the upward trend section as correctional and well-rounded. Thus, this is the only scenario for the current wave layout of EUR/USD. The euro has to grow further but it is a real challenge. Tomorrow, Jerome Powell will make his first testimony at Capitol Hill.

The first speech will be delivered to the Financial Services Committee. I would like to be puzzledin the run-up to this event. However, the intrigue is not the case this time. The Fed leader is likely to speak again about high inflation and about how the Federal Reserve is determined to push it down to the target level at any cost. He will also confirm the Fed's intention to raise interest rates and will expand on unpredictable inflation acceleration on the back of various global headwinds. The Fed's Chairman is sure to stick to the hawkish rhetoric that releases the central bank from responsibility for cracks in the domestic economy. At the same time, Powell will indicate that the regulator will make every effort to ensure price stability according to the Fed's mandate. Nowadaysany hawkish Powell's remark is considered to be an excuse to buy the US dollar. Therefore, demand for USD could grow on Wednesday and Thursday, thus making EUR an outsider. This is an unwanted scenario under the current wave layout. The only hope for EUR is that the market might neglect the content of Powell's testimonies. Indeed, it is no secret that the Federal Reserve will go ahead with more rate hikes. This agenda has been already confirmed by Jerome Powell and other policymakers. That's why it does not make sense to respond to every speech thatduplicates the previous one.

Conclusion

Based on the above wave analysis, I make a conclusion that the downward trend section has been completed. If so, we can buy EUR/USD with the target at about 1.0947 which corresponds to the 161.8% Fibonacci level. We can open long positions at every MACD signal directed up. Wave b is supposedly complete. A failed attempt to break the 261.8% Fibonacci level indicates that the market is not ready to sell the trading instrument.

At a larger scale, we see that the hypothetical wave E is complete. To sum up, the whole downward cycle looks well-rounded. If so, EUR/USD is likely to grow in the next few monthswith the targets located close to the peak of wave D, i.e. at about 1.15.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română