For most of its recent history (2018–2022), Bitcoin was considered a viable alternative to existing financial instruments. Analysts predicted that the cryptocurrency will win the competition with gold for the title of reserve asset, and a high level of volatility is a distinctive feature that should soon disappear. But in 2022, we see that Bitcoin has joined the evil instead of fighting it. Over the past 8 months, the asset has been increasingly assimilated with classical financial instruments, and this has had a negative impact on the properties of the cryptocurrency.

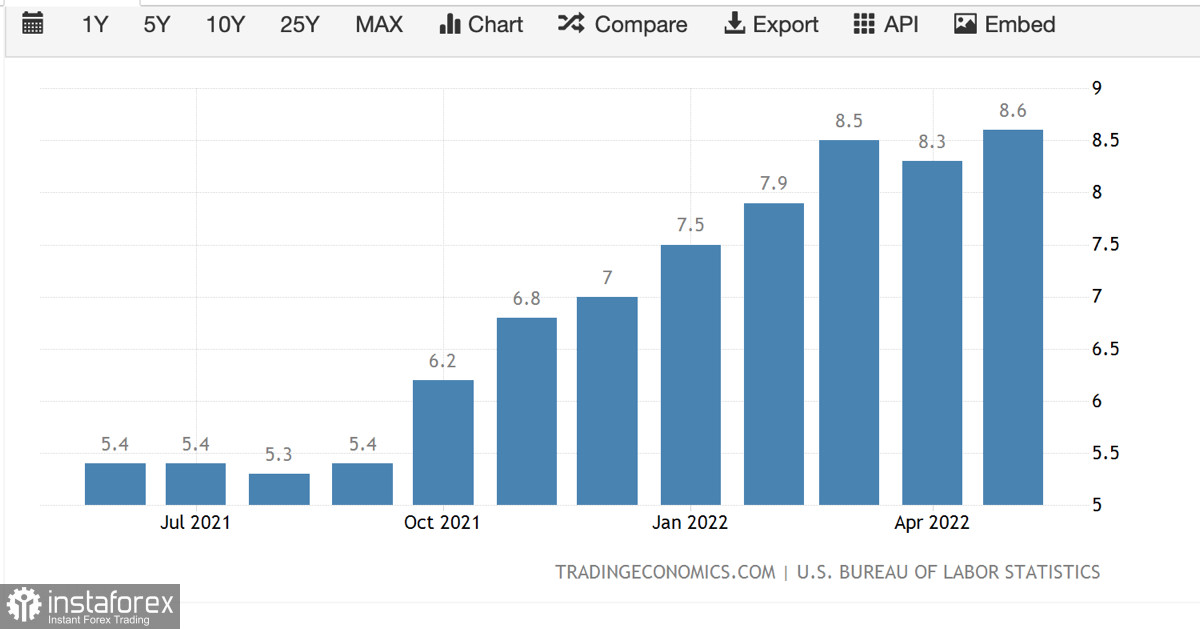

Bitcoin has definitely ceased to be a direct alternative to conservative investment assets. This was influenced by many factors, among which it is worth highlighting the dependence on the Fed's policy, the market situation, and the fall in volatility. The main cryptocurrency is largely hostage to the actions of the Fed. Bitcoin is very sensitive to the tightening of monetary policy, which could be seen back in 2018. The current policy of the Fed is becoming much more aggressive, and BTC is reacting accordingly.

Here, a logical connection immediately emerges, which leads us to the dependence of Bitcoin functions on the market situation. The Fed's policy exacerbated the problem with access to liquidity, as a result of which the asset began to lose investment. This led to a general decline in investment activity and, consequently, the level of volatility. As a result, Bitcoin further aggravated the negative around itself, starting to correlate with stock indices. This happened due to two mutually exclusive circumstances.

The first is that Bitcoin has ceased to be used as a reserve tool and an alternative to gold. The main advantage of the digital asset over the precious metal was its super profitability. However, the cosmic profits from simple accumulation were the result of heavy trading activity on the cryptocurrency network, which increased the level of volatility. As a result, Bitcoin lost its main advantage over gold and was no longer used as a reserve asset.

The second circumstance that contributed to the growth of the correlation with stock indices was the perception of BTC as a high-risk instrument. This is because the value of Bitcoin is inversely correlated with bonds. The growth in the value of government securities has a negative impact on interest in BTC.

As a result, the asset in the midst of a bear market strengthened its correlation with stock indices and began to decline along with them. This suggests that Bitcoin, despite its independence and uniqueness, remains hostage to the Fed. The properties of BTC are used by investors who buy it, and in the current conditions, the value of Bitcoin in many components is lost. However, the key idea is that the main cryptocurrency loses most of its functionality precisely within the bear market. In the dawn of liquidity, loose monetary policy, and a high level of trading activity, BTC is once again in demand.

In 2022, the situation is changing dramatically due to unprecedented fundamental factors. Despite a significant tightening of monetary policy, the level of consumer prices is rising, and the related crises provoked by the war are getting worse. All this leads to a decline in the economy and a gradual decrease in the purchasing power of investors. The peak point of this process has not yet been passed, but there is no doubt that the Fed will stop aggressive monetary policy in order to save the economy from a full-fledged recession or stagflation.

It is this moment that will become the starting point for the recovery process of Bitcoin. As of June 22, the situation remains unpredictable due to a large number of uncontrollable fundamental factors. This means that the $17k mark may just be a stop on the way to the real bottom of the current bear market. As we noted, the current drop is 75% of ATH. This fits into the historical context of the crypto winter, but throughout history, BTC has fallen by more than 80% four times. And this means that we can expect a fall to the $10k–$15k area.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română