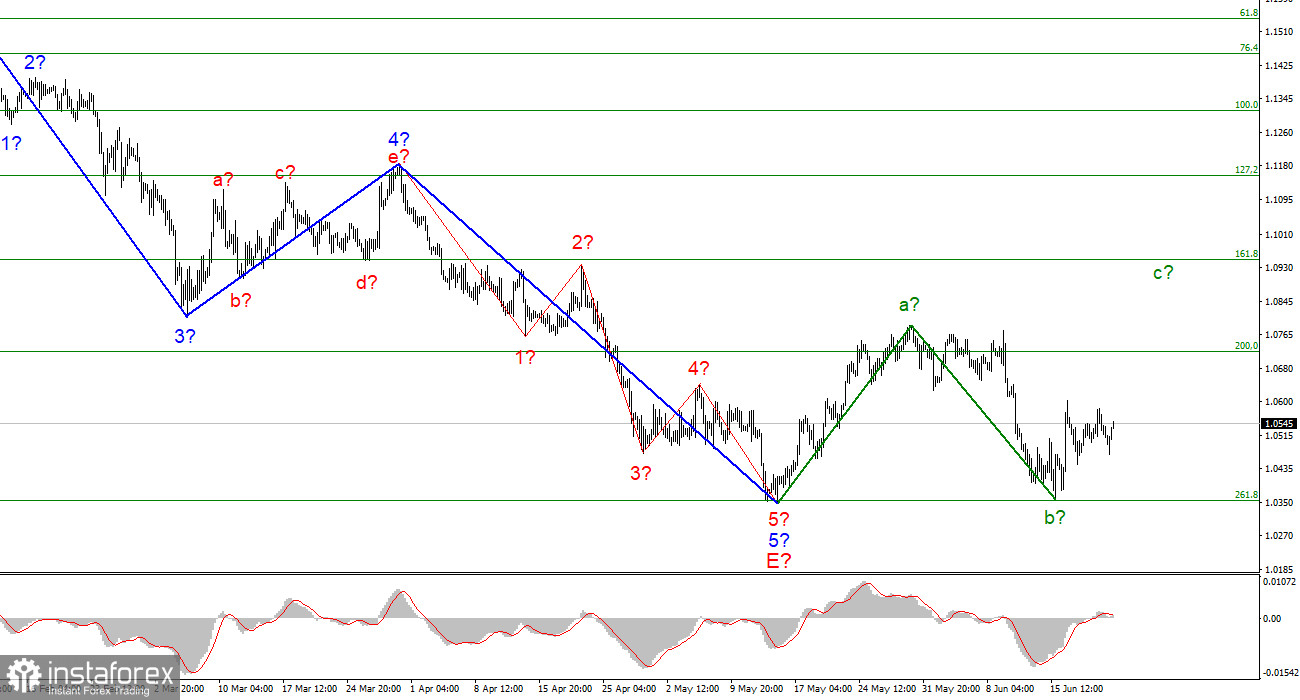

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing and does not require adjustments yet. The instrument has completed the construction of a downward trend segment. If the current wave marking is correct, then the construction of a new upward trend section has begun at this time. It can turn out to be three-wave, or it can be pulsed. At the moment, two waves of a new section of the trend are visible. Wave A is completed, and wave b is also presumably completed. If this is indeed the case, then the construction of an upward wave with has now begun. The instrument has not declined under the low of the downward trend section, so the wave marking still retains its integrity. However, I note that the downward section of the trend may complicate its internal wave structure and take a much more extended form. Unfortunately, a very promising wave markup may be broken due to the news background, which led to a strong decline in demand for the euro currency. But at the moment, the chances of building an upward wave c remain. Only the news background can interfere.

Jerome Powell is likely to confirm his intention to raise the rate in July

The euro/dollar instrument rose by 10 basis points on Wednesday, although it declined by 65 during the day. There was no news background in the first half of the day, but within the next hour, Fed President Jerome Powell's speech before the US Senate Banking Committee will begin in America. According to many analysts, Jerome Powell will confirm the Fed's readiness to raise the interest rate again in July by 0.5-0.75% at once. Markets are more inclined to increase by 0.75%, as US inflation continues to rise. Consequently, tougher steps are needed on the part of the regulator, which will finally lead to the fact that the indicator will begin to slow down. I don't see any other options for rhetoric right now. What else can Jerome tell you? It is unlikely that he will say that the Fed is abandoning its plans and now will not raise the rate at the planned pace. Thus, the Fed Director's rhetoric will be characterized as "hawkish" in any case. But how much it will be "hawkish" is a big question.

Let me remind you that the current wave markup implies an increase in demand for the European currency. And for this, the US dollar should not receive the support of the news background. And for this, Jerome Powell should make a neutral statement today that will not strengthen the market's desire to buy the dollar. If Powell questions the expediency of a 0.75% rate hike, this could already help the European currency, which is currently struggling for a correction. And now there is nothing more to say about this. The growth potential, according to the current wave markup, is about 300 basis points, but if the news background remains in favor of the dollar, it is more likely that the downward section of the trend will complicate its structure and take an even longer form.

General conclusions

Based on the analysis, I conclude that the construction of the downward trend section is completed. If so, then now you can buy a tool with targets located near the estimated mark of 1.0947, which equates to 161.8% Fibonacci, for each MACD signal "up". Wave b is presumably completed. An unsuccessful attempt to break through the level of 261.8% indicates that the market is not ready for new sales of the instrument.

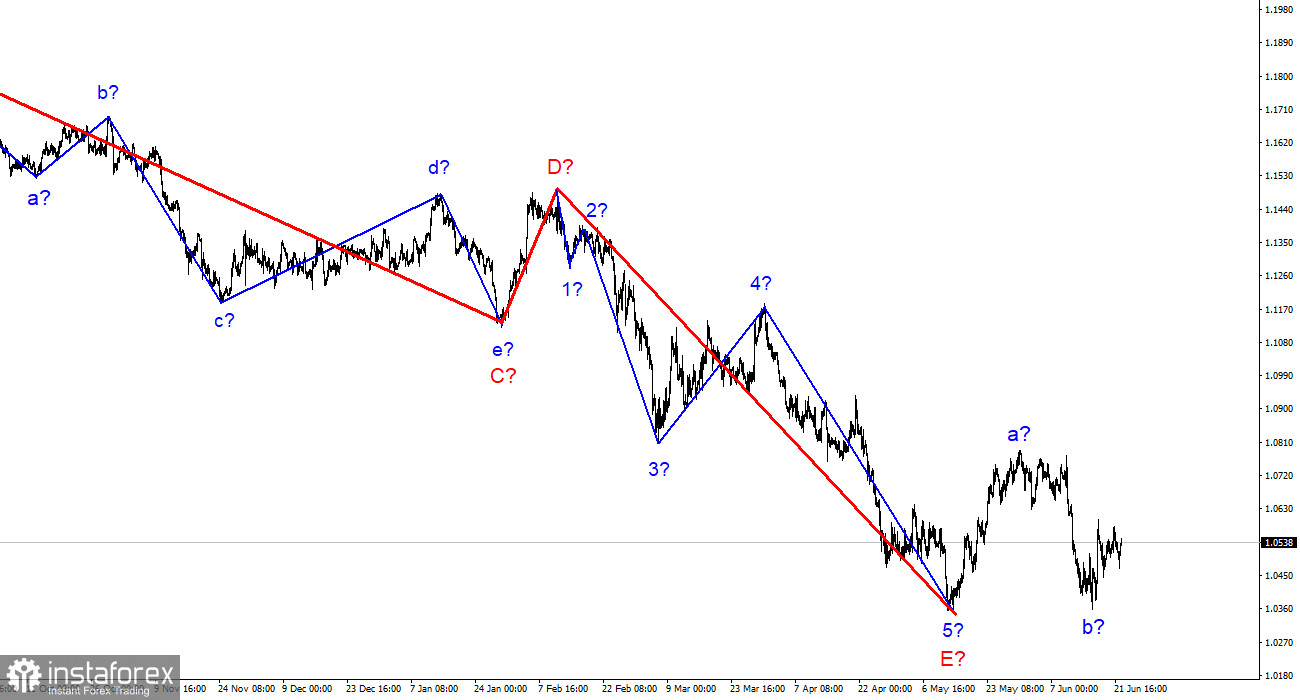

On a larger scale, it can be seen that the construction of the proposed wave E has been completed. Thus, the entire downward trend has acquired a complete look. If this is indeed the case, then in the future for several months the instrument will rise with targets located near the peak of wave D, that is, to the 15th figure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română