The president of the United States has asked Congress for a fuel tax holiday of just three months, far less than expected. It was assumed that the tax holidays will last at least until the end of this year. In such a short period of time, no effect from this measure, in principle, should be expected. Especially since the federal tax on gasoline is only 18 cents per gallon, while the average cost of gasoline in the United States is over $5 per gallon. Of course, the president called on the state authorities to introduce tax holidays too. In addition, US President Joseph Biden asked Congress to try to avoid cuts to the Federal Highway Fund. And the tax on fuel goes just to finance the construction and maintenance of roads. And this despite the fact that the budget deficit of the federal government is already almost 1.6 trillion dollars.

Where to get money? Of course, by increasing the already astronomical public debt. All in all, Biden's proposal was a complete disappointment. There will be no effect on the economy. It certainly won't affect inflation. But the budget deficit will grow. Congress has not yet responded, but only accepted the proposal for consideration. However, given November's congressional and Senate elections, there is little doubt that this measure will be taken. Since in the election campaign it will be possible to loudly declare their concern for voters. The result was a sharp weakening of the dollar.

Nevertheless, the single European currency will lose its positions during the European trading session. The reason for this will be preliminary estimates of business activity indices. In particular, the manufacturing index may fall from 54.6 points to 54.0 points. The index in the services sector should fall from 56.1 points to 55.8 points. And the composite PMI is expected to fall from 54.8 to 54.2.

Composite PMI (Europe):

However, after the US trading session opened, the market will return to the values of the beginning of the trading day. After all, the United States is also expected to decline in all indices of business activity. The manufacturing index is likely to drop 57.0 points to 56.0 points. In the services sector, a decrease is expected from 53.4 points to 53.0 points. As a result, the composite index of business activity will fall from 53.6 points to 52.8 points.

Composite PMI (United States):

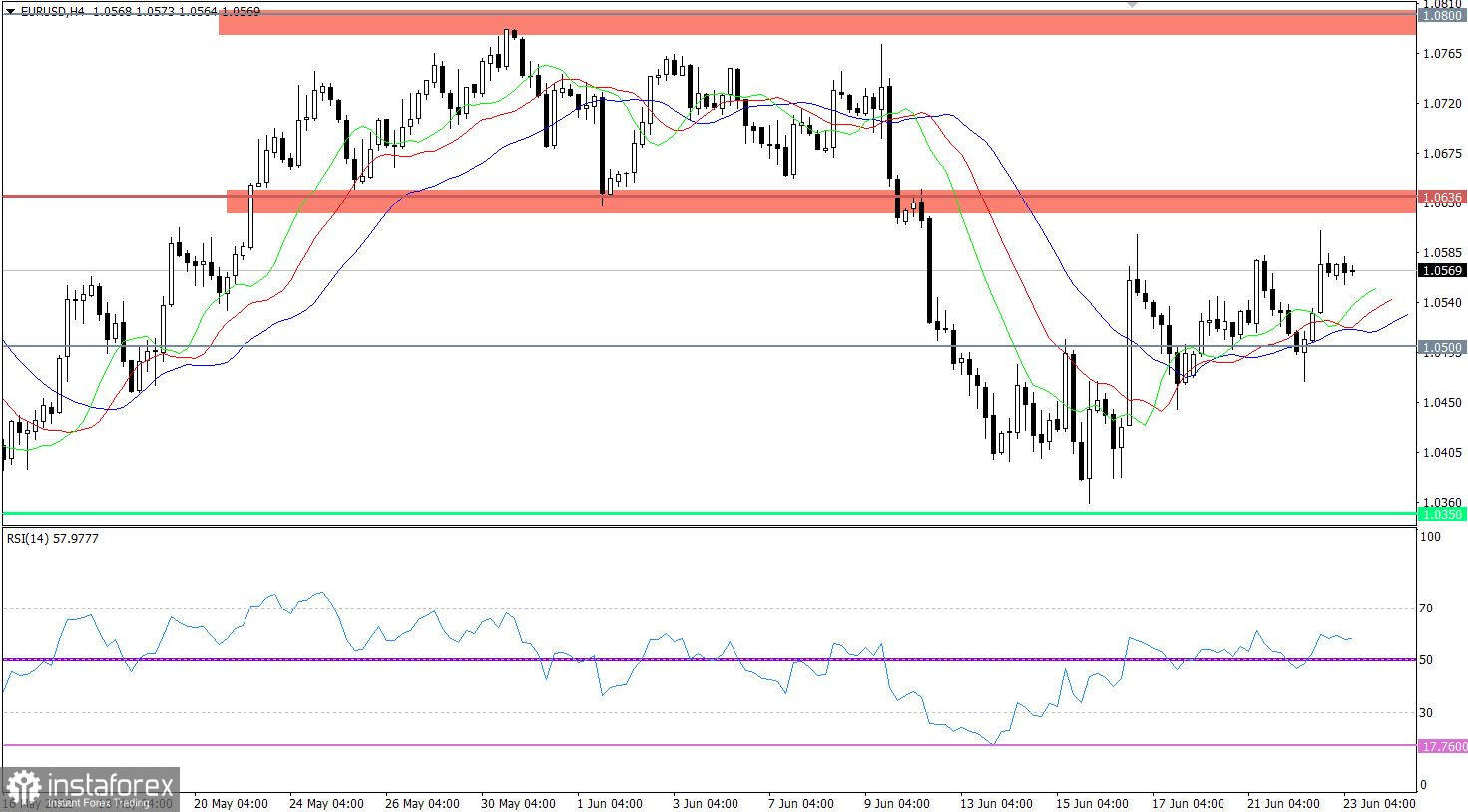

The euro exchange rate jumped in value by more than 130 points against the dollar. This intense inward move led to a prolongation of the corrective movement from the 1.0350 support area.

The RSI technical instrument does not signal overboughtness in the H1 and H4 periods. The indicator is moving in the upper 50/70 area, which indicates the rising interest of market participants.

Moving MA lines on Alligator H4 are directed upwards, which also confirms the relevance of the current correction. The Alligator D1 indicator is signaling a downward trend, which is in line with medium-term expectations.

Expectations and prospects

To confirm the signal about the prolongation of the correction, the quote needs to stay above the value of 1.0600 in a four-hour period. Otherwise, we expect another rollback to the level of 1.0500.

Complex indicator analysis has a buy signal in the short-term and intraday periods due to the upward cycle. Indicators in the medium term are focused on the main downward trend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română