US President Joe Biden asked Congress to introduce a gas tax holiday for only three months, which is far less than expected. He also requested to try to avoid cuts to the highway fund, adding that the fuel tax will continue to finance the construction and maintenance of roads. This is worrying because the budget deficit is already almost $ 1.6 trillion, and Biden's proposal will certainly push it higher. Congress has not responded, but they accepted the proposal for consideration. Unsurprisingly, dollar demand fell because, given November's congressional and Senate elections, there is little doubt that this measure will be taken.

In terms of euro, there is a high chance that it will decline during the European trading session because preliminary estimates of business activity indices are down. In particular, the manufacturing index is expected to fall from 54.6 points to 54.0 points. The service index is also projected to dip from 56.1 points to 55.8 points, and the composite PMI to decrease from 54.8 to 54.2.

Composite PMI (Europe):

Similarly, preliminary estimates to business activity in the UK also show a decrease. The manufacturing index is expected to fall from 54.6 points to 54.2 points, while the service index is projected to go down from 53.4 points to 52.8 points. The composite index is also likely to decrease from 53.1 points to 52.3 points.

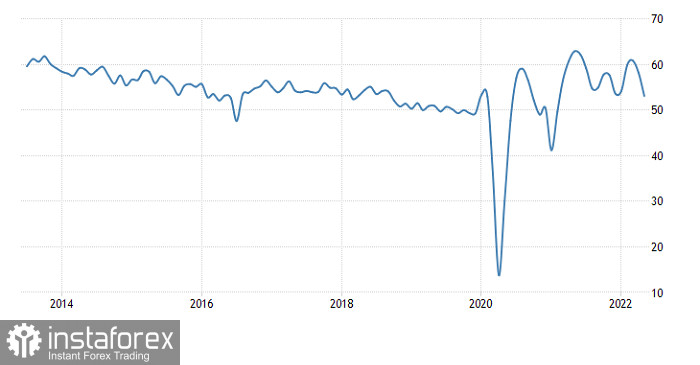

Composite PMI (UK):

But during the US trading session, the market will return to the levels hit at the opening of the trading day. After all, the US is also expected to report declines in all its indices of business activity. The manufacturing index will drop from 57.0 points to 56.0 points, while the services sector will decrease from 53.4 points to 53.0 points. The composite index will fall from 53.6 points to 52.8 points.

Composite PMI (United States):

In short, the market will fluctuate throughout the day, but close with zero result.

EUR/USD rushed up, prolonging the current corrective move. 1.0600 serves as a variable resistance on the way of buyers, relative to which a short-term stagnation-rollback has occurred. For the subsequent upward move, the quote needs to hold above 1.0600 in the four-hour TF.

Despite the strong buying pressure, GBP/USD remains within 1.2170/1.2320. In this situation, traders must first overcome one or another boundary of the established range, and only then talk about the direction. Signals will occur in the four-hour TF.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română