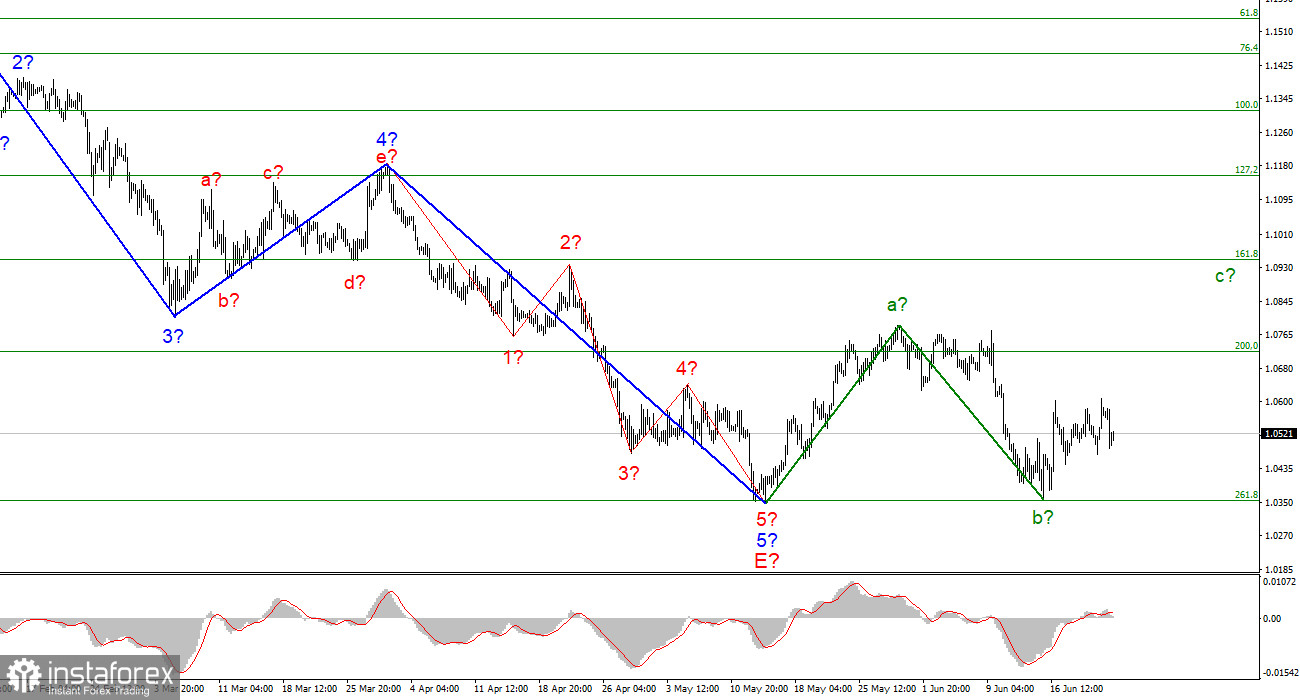

The wave layout for EUR/USD on the H4 chart looks quite convincing and does not require any adjustments. The instrument has completed the descending section of the trend. If the current wave layout is correct, then a new ascending section of the trend has begun to form. This section may turn out to have a three-wave form or maybe just an impulse movement. At the moment, two waves of the new trend can be distinguished. Wave a looks completed and the same can be said about wave b. If this is true, then the ascending wave c is being formed at the moment. As the instrument has not declined below the low of the descending section, the whole wave structure remains intact. However, the descending section of the trend may get more complex and its structure may become more extended. Unfortunately, the current promising wave layout may be broken due to the news background that puts serious pressure on the euro. Yet, there is still a chance that the ascending wave c will continue to form and the only obstacle to it can be the fundamental background.

Jerome Powell likely to confirm rate hike in July

On Thursday morning, EUR/USD depreciated by 50 basis points within one hour.

The downbeat macroeconomic data from the eurozone was the reason behind this decline. Thus, the services PMI dropped to 52.8 in June from 56.1 in May, while the manufacturing PMI fell to 52.0 from 54.6. The composite PMI went down to 51.9 from 54.8. Therefore, all three indicators have been showing negative dynamics for 11 months in a row. In the coming month, they may easily go below the critical level of 50.0. So, a decline in the European currency was fully justified as the European economy is very close to a recession. For your reference, the inflation rate in the EU is no lower than that in the UK or US, while economic growth has slowed down, the unemployment rate is high, and business activity has been sliding for 11 months straight. Aren't these the signs of a recession?Naturally, the demand for the euro has declined which calls the formation of the ascending wave c into question, although I do hope it will be formed. I think that the market will have enough strength to push the price to the peak of the wave a, which may be then followed by a new decline and a new descending trend section. However, the longer it takes for the wave c to form, the lower the chances are. Of course, waves may be different in size, including long and extended ones. So, I think that it is too early to say that the euro has lost the game. At the same time, the weak data from the eurozone and the difference in the rate policies of the ECB and the Fed point to a new decline in the euro. This may result in a complicated structure of the descending section of the trend which is not a favorable scenario for us. The testimony by Jerome Powell also made things more complicated although it supported EUR at first.

Conclusion

Based on the analysis, we can conclude that the descending section of the trend has been completed. If so, then it is a good moment to buy the instrument with the targets located near the key level of 1.0947, which corresponds to the 161.8% Fibonacci level, following each buy signal of the MACD indicator. The wave b looks completed. An unsuccessful attempt to break through the 261.8% fibo level shows that the market is not ready to initiate new sales.

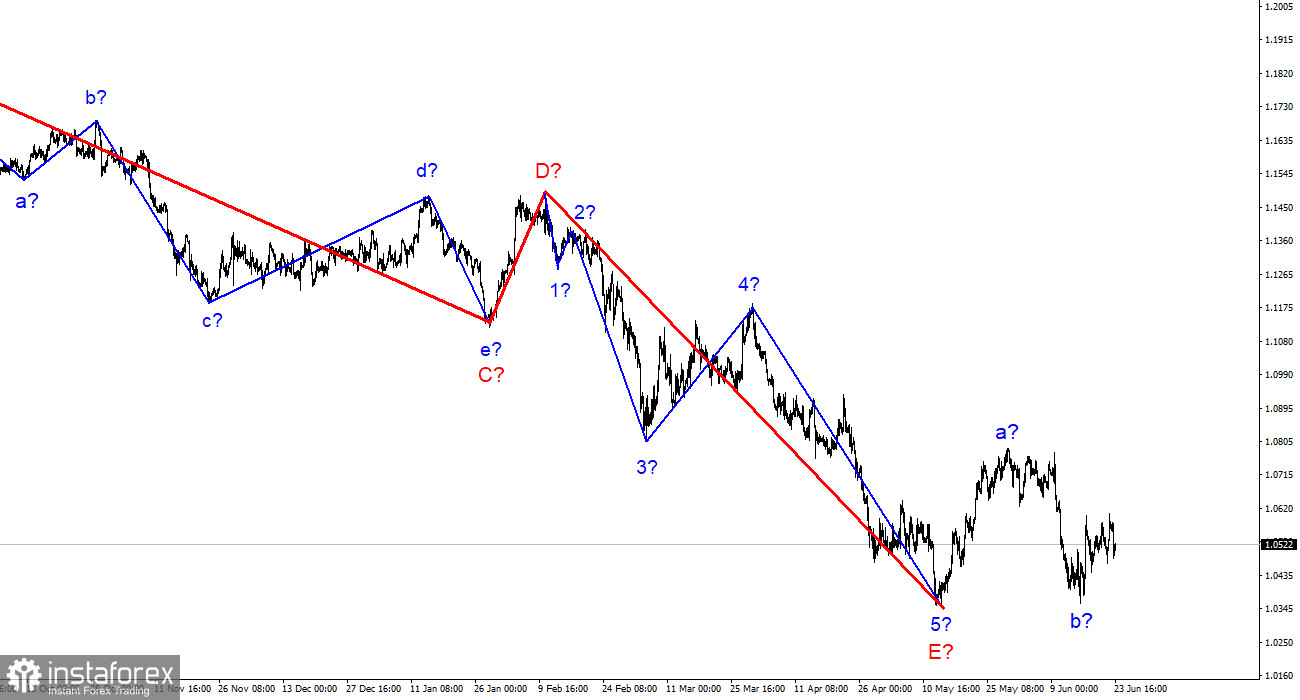

On a larger time frame, we can see that the formation of the wave E has been completed. Thus, the entire downtrend has taken on a complete form. If this is true, then the pair will be rising towards the targets located near the peak of the D wave, or the 1.15 area, in the next few months.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română