The Fed remains in a tough position, continuing the aggressive increase of interest rates. This led to a rise in Treasury yields, particularly in 10-year bonds, which jumped to a local high of 3.498%. Accordingly, dollar shot up, but the recent decisions of the ECB, the Bank of England and the Central Bank of Switzerland, which is to tighten monetary policies as well, have led to a reversal in the market.

Another reason why dollar fell are the business activity data from Germany, the Eurozone, the UK, and the United States. Although those were quite weaker than the forecasts, they still showed continued growth, which indicates that so far, there are no signs of an economic slowdown or recession.

By and large, everyone will closely follow the latest inflation figures, where any slight decrease, primarily in the US, will provoke a rally in the stock market. This will then spread to other trading floors around the world, which will put pressure on dollar.Forecasts for today:

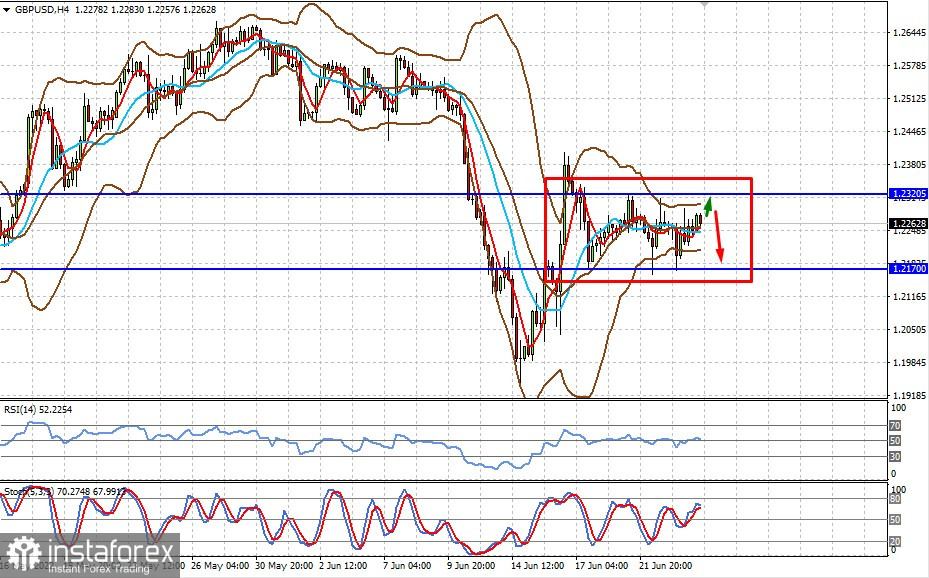

GBP/USD

The pair is trading in the range of 1.2170-1.2320. Most likely, the quote will remain within these levels despite upcoming statistics from the US.

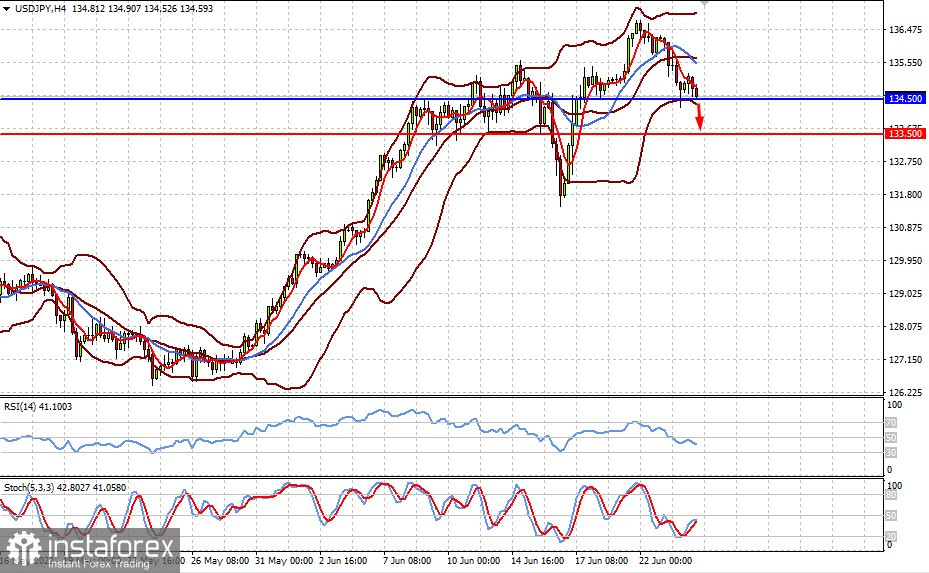

USD/JPY

The pair is trading below 134.50 amid weakening dollar. Further bearish sentiment will push it to 133.50.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română