The EUR/USD currency pair continued to ride on a "swing" during Friday and showed almost the lowest volatility in the last 30 trading days. Traders had no desire to trade, so, naturally, there were no changes in the technical picture. The pair continues to be located in the side channel, although its boundaries are very inaccurate, so we still believe that the current movement should be called a "swing". Based on this, we believe that in this mode, the pair can be traded in the new week. Usually, the "swing" lasts several weeks. In general, it is almost impossible to make any loud conclusions on Friday. The European currency is in a period of consolidation, but at the same time continues to be located very close to its 20-year lows and cannot adjust. A week ago we said that last week will show the true mood of traders, as there will be a small number of macroeconomic statistics and fundamental events. The market clearly showed that it was not going to buy the euro currency even after it once again crashed down. Accordingly, the "bearish" mood persists, as does the global downward trend.

There is not much to say about the "foundation" now either. What can we say about a factor that practically does not change? We are all in a position now where the same factor can have a devastating impact on the euro for a long time. This is, of course, about the difference in monetary approaches between the ECB and the Fed. Recall that the Fed is rushing like a locomotive in the direction of the rate that will stop inflation and return it to 2%. The ECB is at the same time at the bus stop, and its driver is drinking tea in a nearby cafeteria. Thus, the market simply has no reason to buy the euro currency. Some hoped that changing Christine Lagarde's rhetoric to a more hawkish one would help the euro currency, but, as we see, this did not happen. Therefore, our forecast remains the same: perhaps the euro will be able to grow by another 100-200-300 points, but then it will inevitably collapse downwards.

Why didn't the dollar rise during Powell's speeches?

Jerome Powell spoke twice in Congress last week. If you remember, we said last weekend that these events are "loud" only according to their "poster". In reality, a week earlier, Powell had already told the market everything he wanted to hear. Now no one has any doubt that the Fed will continue to fight inflation at any cost, which Powell confirmed, speaking first before the Banking Committee, and then before the Financial Services Committee. No one doubts that the Fed's key rate will be raised again by 0.75% in July. It will be possible to avoid this only if the inflation report for June shows a serious slowdown. But we believe that this will not happen. In any case, we will not guess, we just need to wait for the report and draw the right conclusions.

It should be understood that the Fed is not its enemy. If inflation starts to decline significantly, and not by 0.1% per month, then the pace of monetary policy tightening will slow down. This may be a breath of fresh air for risky currencies and assets, but it will not change the overall fundamental picture. Again, it's no secret that the rate should rise to at least 3% for inflation to start moving towards the target value. Moreover, it will take quite a long time for the indicator to decrease from almost 9% to 2%. Who knows what else in the world might happen during this time? Already, WHO gives the status of a pandemic to "monkeypox". And no one knows how the geopolitical conflict in Ukraine will end when it will end and how it will develop further. In the near future, the Baltic States may become a new hot spot, where Lithuania has imposed a ban on the transit of sanctioned goods to the Kaliningrad region. Moscow has already made several loud statements in which they questioned the state borders of Lithuania and allowed a military solution to the problem. Recall also that the accession of Finland and Sweden to NATO has not been canceled, but only postponed for several months. Ankara and President Erdogan cannot block the decision for a long time, which is approved by all NATO countries. Erdogan is playing his game on the geopolitical chessboard, but the example of Hungary in the EU shows that "one in the field is not a warrior."

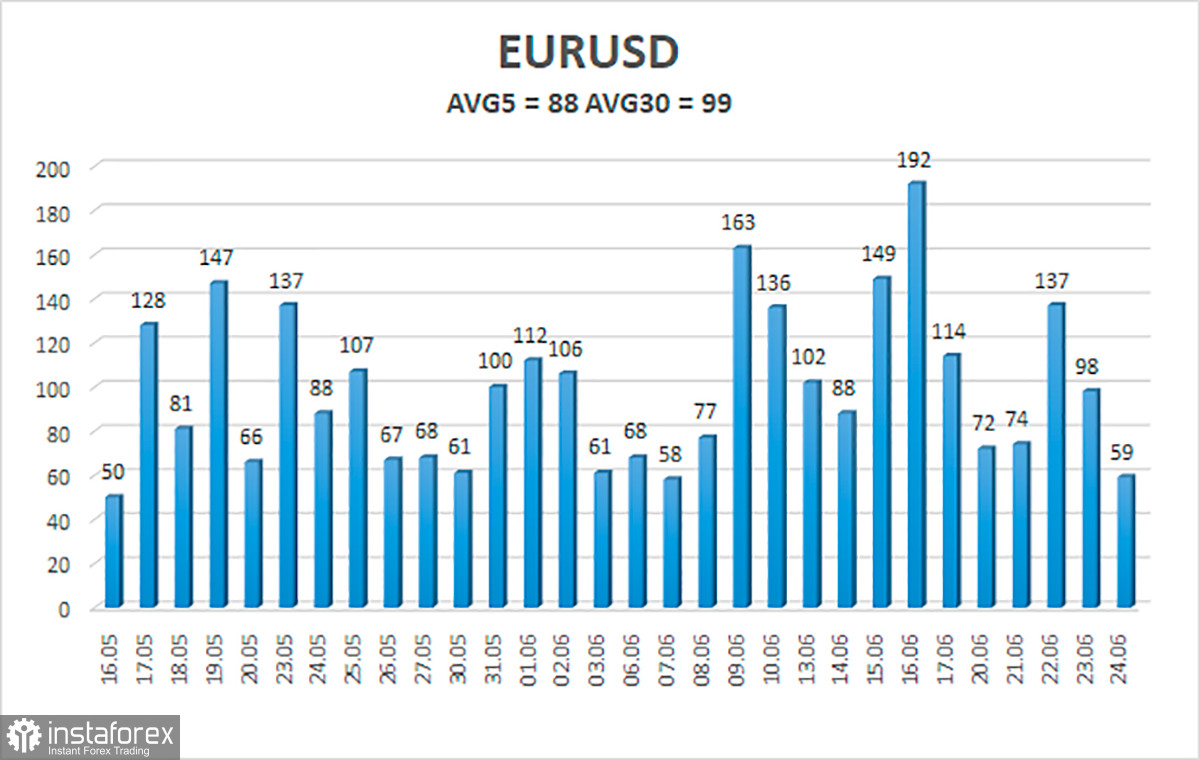

The average volatility of the euro/dollar currency pair over the last 5 trading days as of June 27 is 88 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.0468 and 1.0644. The reversal of the Heiken Ashi indicator back down will signal a new round of downward movement within the framework of the "swing".

Nearest support levels:

S1 – 1.0498

S2 – 1.0437

S3 – 1.0376

Nearest resistance levels:

R1 – 1.0559

R2 – 1.0620

R3 – 1.0681

Trading recommendations:

The EUR/USD pair continues to trade in different directions every day. Thus, now it is necessary to trade on the reversals of the Heiken Ashi indicator since there is no clear trend. There is a high probability of "swings".

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which you should trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română