After two weeks of continuous action and massive capitulations, Bitcoin managed to stabilize and begin a consolidation movement. The asset gradually consolidated above the round level of $20k, and subsequently rose to $21k. This partly indicates an increase in consumer activity, but also indicates the full implementation of all tasks by sellers. Despite a certain stabilization of the situation, it cannot be argued that Bitcoin has fully worked out the downward peak.

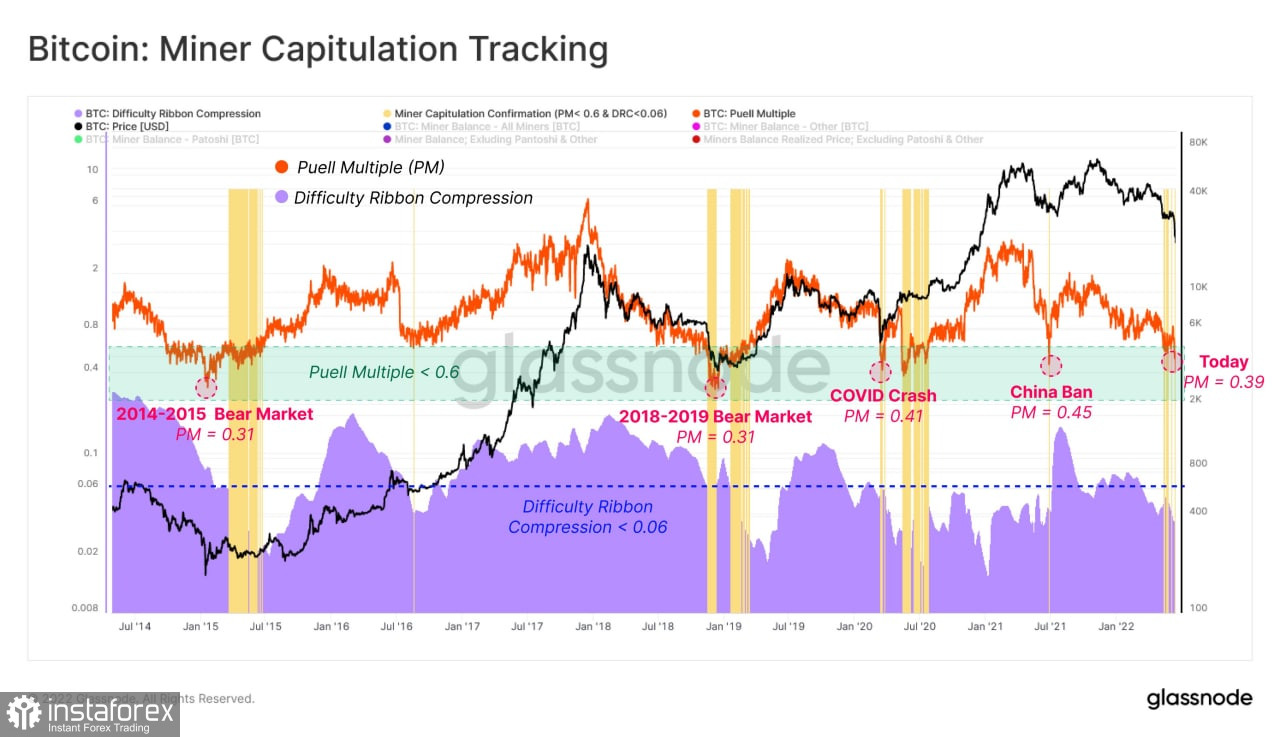

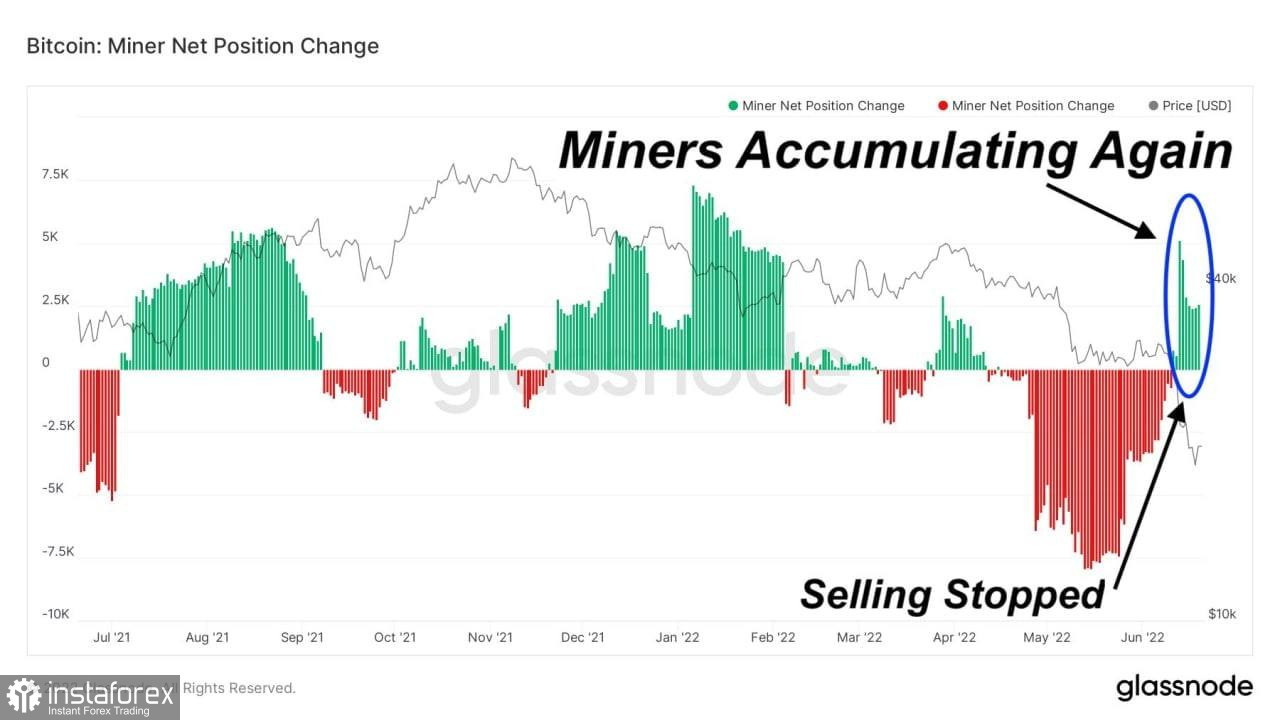

With more positive fundamental factors, BTC/USD quotes would have pierced the $17k–$20k range, and the downward trend would have ended there. However, the difficult market and macroeconomic situation affected the areas adjacent to cryptocurrencies. The most striking and key example of such an impact was the massive sale of Bitcoins by miners, who are one of the main BTC hodlers. Subsequently, the price managed to stabilize due to the resumption of the accumulation period by Bitcoin mining companies. However, the market situation and the crisis of energy resources at any moment can provoke a new surge in the sale and, as a result, a drop in the price of Bitcoin.

This was expressed by JPMorgan experts. In their opinion, it was the position of the miners that contributed to such a powerful collapse of BTC. And even despite the stabilization of the situation, mining companies continue to aggravate the Bitcoin bear market. As an argument, the bank's experts point out that in May and June 2022, BTC miners sold 20% of the total volume of cryptocurrencies on the market. This may be due to a drop in the yield from the extraction of digital assets by 61% from the initial maximum. According to JPMorgan, this is not a local surge in the sale, but a complete paradigm shift.

Previously, Bitcoin miners hodled cryptocurrencies regardless of the market situation. Now the situation has changed, and miners have no choice but to sell their BTC reserves. This is confirmed by Bitfarms, which regularly sells stocks of Bitcoin coins, as it becomes the fastest access to liquidity. With rising prices and disrupted supply chains, as well as recent events in Iran, where more than a thousand legal miners have been cut off from electricity, there is no doubt that the BTC sell-off will continue.

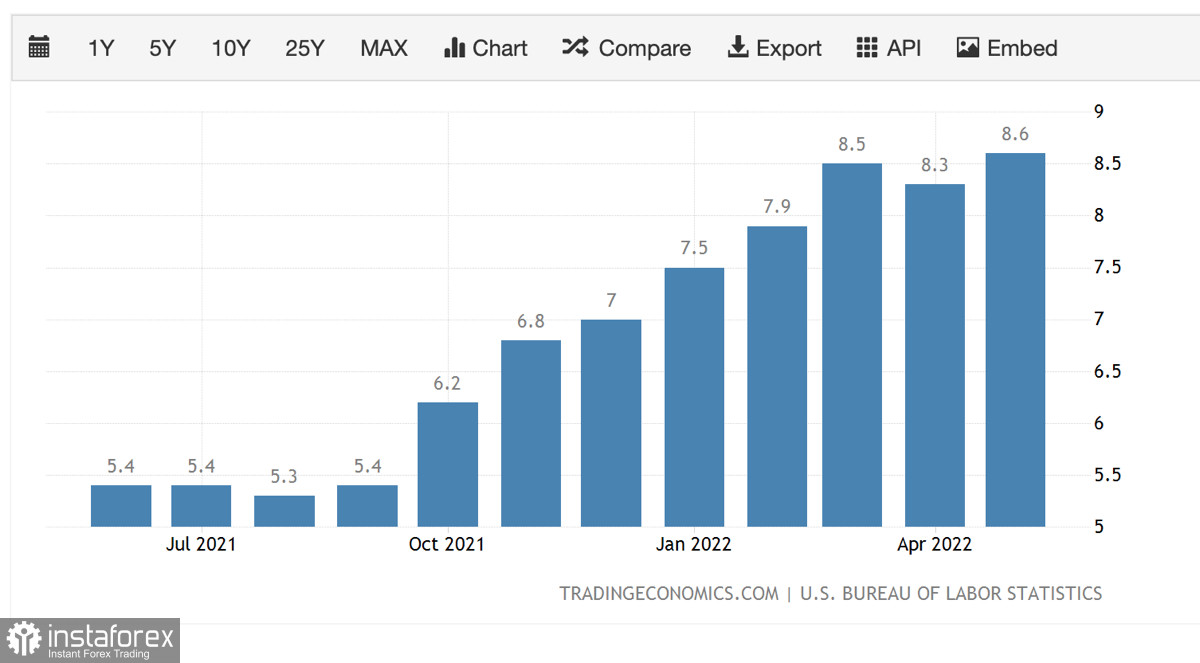

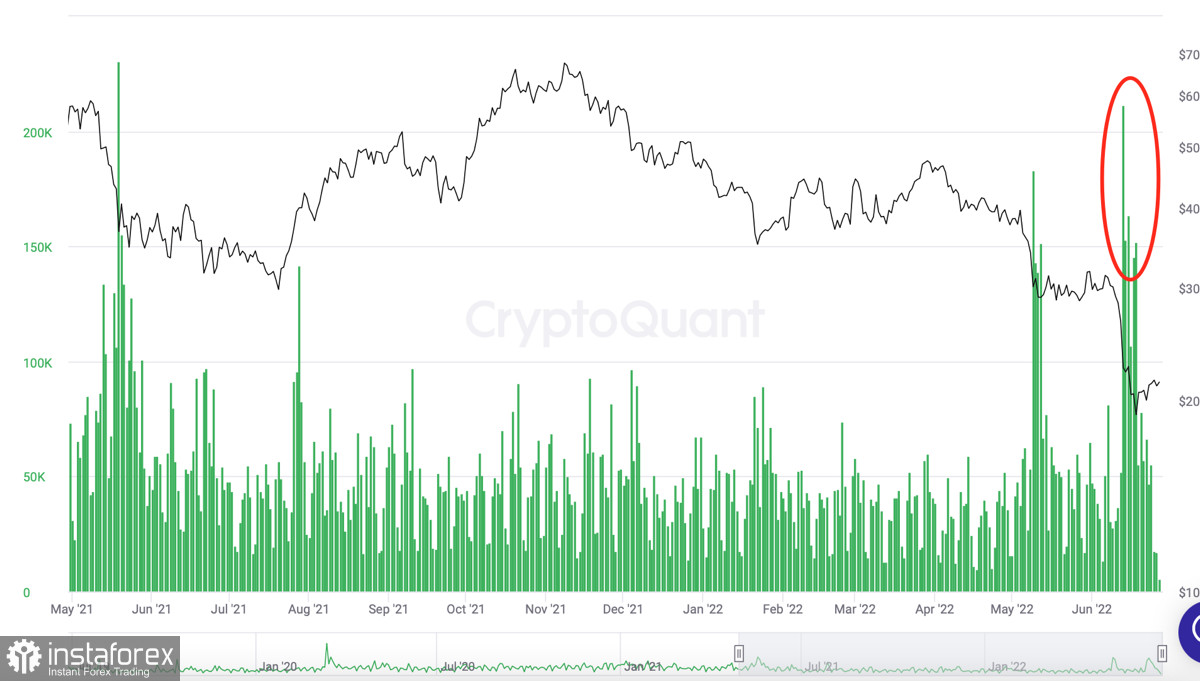

Thus, a permanent negative factor appeared on the market. The war in Ukraine also continues, and Powell, in his speech, said that this is one of the main catalysts for rising inflation. Given these facts, should we expect a further decline in the price of Bitcoin and the formation of an even deeper market bottom? Let's go back to JPMorgan, who recently said that the US dollar has reached the peak of inflation and will start to improve soon. In addition, Glassnode noticed that the net outflow of BTC from exchanges reached the levels of March 2020, which is an important positive signal for investors.

With this in mind, we can conclude that the situation on the market is gradually stabilizing, there is more liquidity, and the price of Bitcoin does not leave a narrow range. This does not mean that the price decline is over and the asset is starting a pre-bull consolidation. The factor of miners will negatively affect the overall situation and put pressure on the price of Bitcoin due to the gradual sale of their BTC reserves. Constant pressure on quotes from miners in a calm market situation will not provoke another cascade of sales, but will slow down the recovery period, and therefore it is worth preparing for a long-term consolidation within the $20k–$25k range.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română