The second quarter is historically a profitable period for the growth of altcoins. However, in 2022, during this period, the level of Bitcoin dominance reached a six-month high at around 48%. This was accompanied by the stabilization of the situation around the cryptocurrency after a serious drop below $20k. Investors preferred the main digital asset, ignoring the altcoin market. However, two months later, the situation changed dramatically.

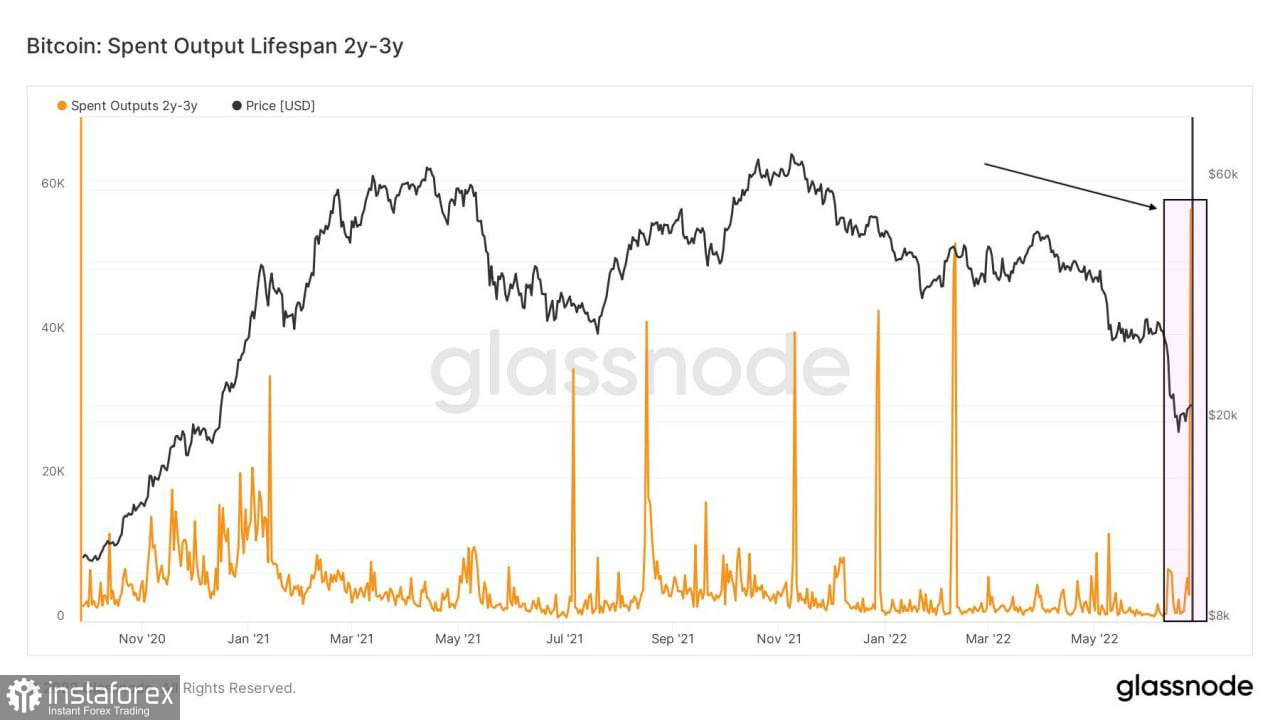

Bitcoin hit a new low at $17.7k, and the process of falling was accompanied by the largest liquidations, sell-off, and loss realization in history. As a result, investors began to massively withdraw from Bitcoin, which led to a gradual decrease in trading activity. The main negative in this situation was the position of long-term investors, who are considered the main pillar of any movement in the price of Bitcoin. In addition to the miners, who sold 20% of the total BTC on the market in May–June, the most unexpected investor audiences began to sell. According to Glassnode data, hodlers who held BTC for 2–5 years have started selling their holdings en masse.

Bitcoin-related products also saw significant declines. Shares of the famous GBTC fell by 5% after reaching a historical record. A 5% drop in the share price means that investors can purchase BTC for another 29% off the current value of the asset. However, as of June 27, there is no recovery movement in Grayscale stock quotes, which indicates a lack of interest in BTC-based products.

As a result, the level of Bitcoin dominance decreased from 48% to 43%. Investment flows are gradually declining, as is trading activity. In the altcoin market, the situation is the opposite. Over the past two days, the major altcoins have shown an increase of at least 6%, which is a positive signal indicating that the altcoin market has reached a local bottom.

The clearest picture of the altcoin market movement potential can be seen on the chart of total capitalization. As of June 27, altcoins reached a local peak, as a result of which the capitalization of the crypto market came up against the resistance level of $960 billion. It is likely that after a local consolidation period, altcoins will continue to grow.

The rapid growth of the altcoin market clearly indicates the formation of a local market bottom. Most of the coins have started a recovery process and broken the correlation with Bitcoin. This is evidenced by the fall in the level of BTC dominance. The main cryptocurrency is in a more difficult situation due to the high level of co-dependence with traditional markets.

The asset is also sensitive to Fed policy and inflation data. With this in mind, one cannot be sure that Bitcoin will reach a local bottom. Dependence on fundamental factors suggests that the asset can at least retest the bottom at $17.7k. In this case, altcoins will also suffer, but the return on BTC is getting smaller, and therefore investors are gradually reorienting themselves to the altcoin market.

In the meantime, we see that the stock indexes have also begun to recover from the shock. The upward trend in SPX and NDX gives hope that we may see a Bitcoin crusade to $23.1k soon. Technical indicators also hint at a likely local upward spurt.

The RSI index and the stochastic oscillator returned to the bullish zone, and show an increase in buying activity. A positive signal can be seen on the MACD, which has formed a bullish crossover for the first time since May. This indicates the emergence of a strong upward trend, and therefore it is likely that we can expect a recovery movement towards the $23k–$25k area.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română