Parallels with the 1970s are heard at every turn. The same high inflation. The same desire of central banks to press it to the nail with the help of aggressive tightening of monetary policy. The same rise in prices in the commodity market. For Britain, this is well known. Almost half a century ago, due to poor performance, it was called the "sick man of Europe." It looks like those times are back, which does not allow the GBPUSD bulls to raise their heads.

Great Britain, which has not yet fully recovered from the pandemic and periodically feels the echoes of Brexit in its own skin, is in a deep hole. Inflation is rising faster than in the US and the eurozone, GFK consumer confidence is at its worst since the beginning of accounting about 50 years ago, business activity has collapsed to its lowest level in two years, and retail sales fell by 0.5% m/m in May . It is quite possible that the economy has already plunged into recession and is much more exposed to the risks of stagflation than its main competitors.

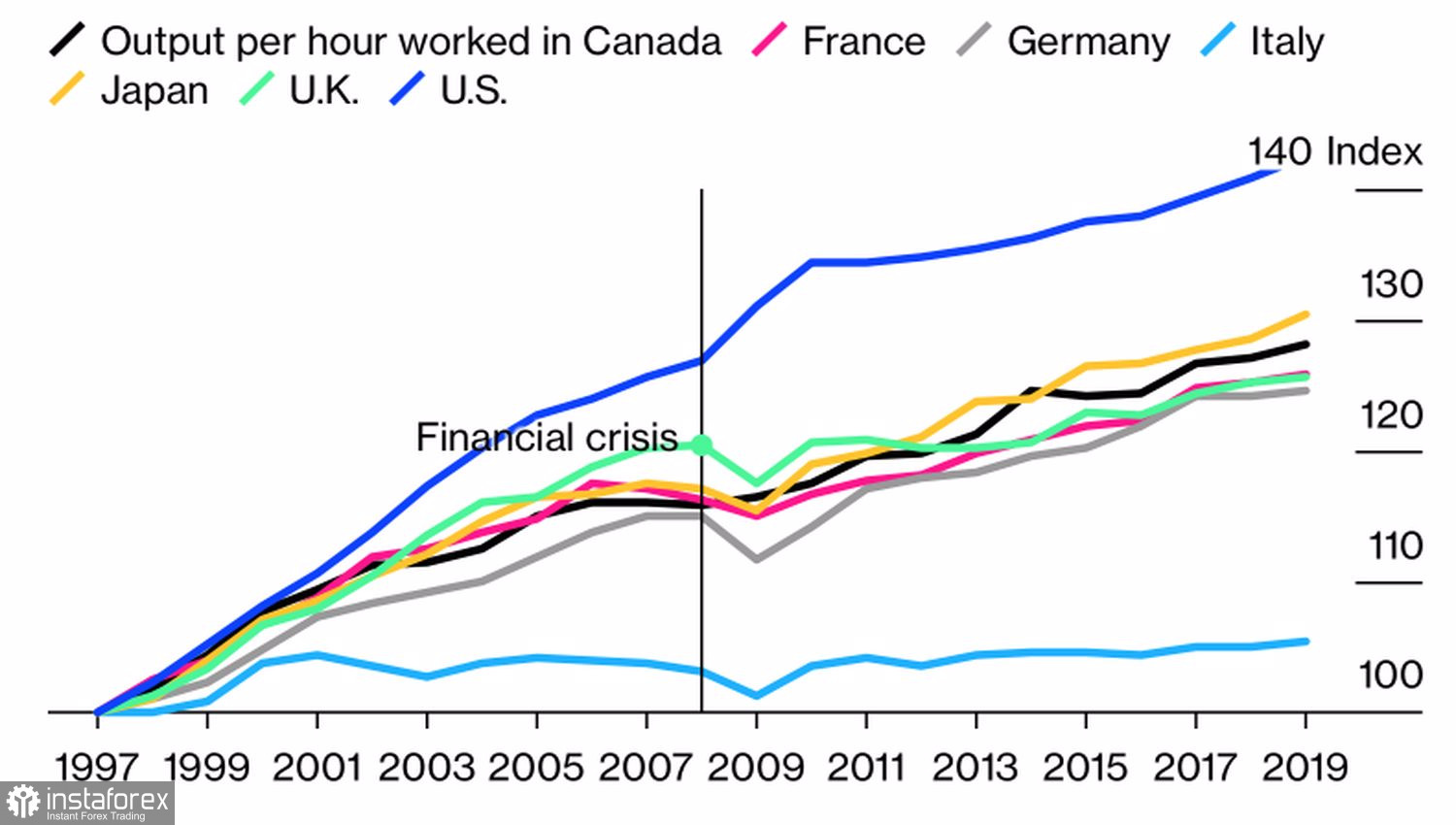

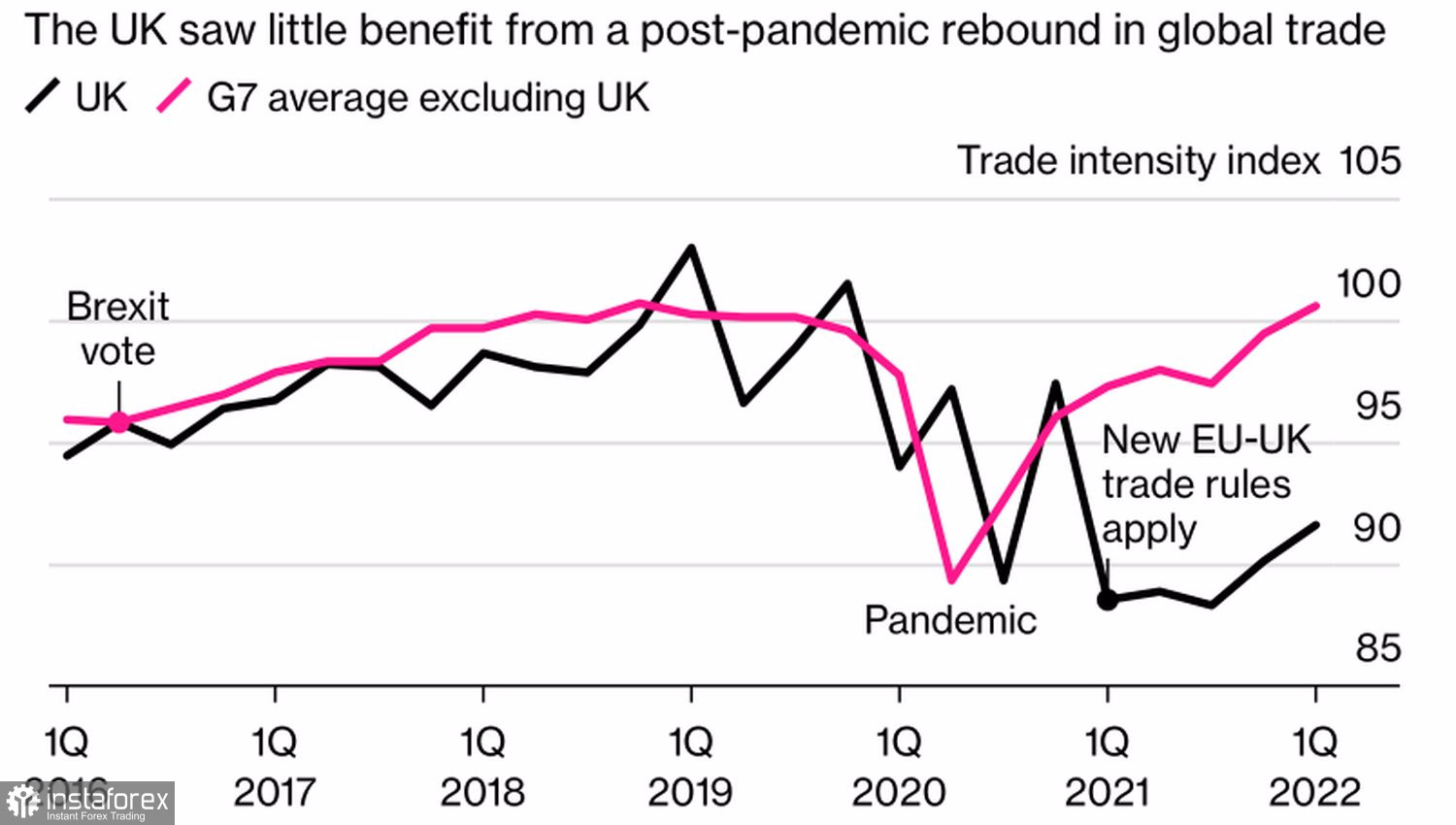

Blame it on poor productivity and Brexit, which has ruined foreign trade. As Bloomberg's analysis shows, Britain's GDP has not received much preference from the recovery of global trade amid increased economic activity after the pandemic.

Productivity dynamics in the world's major economies

British and global trade dynamics

Not surprisingly, as macroeconomic statistics of high inflation and the worst cost-of-living crisis in decades are deteriorating, the population is starting to strike. Railroad workers, lawyers... Who's next? Most likely teachers and doctors.

In the week leading up to July 1, the pound does not expect anything good either. According to Bloomberg analysts, the negative current account balance in the first quarter reached almost £40 billion, the highest since the beginning of accounting. The hole that has emerged needs to be covered with something, but with what, if the appeal of British assets is below the baseboard? Since the Brexit referendum, the FTSE 100 has lost about 10% in dollar terms, while the S&P 500 has gained nearly 50%.

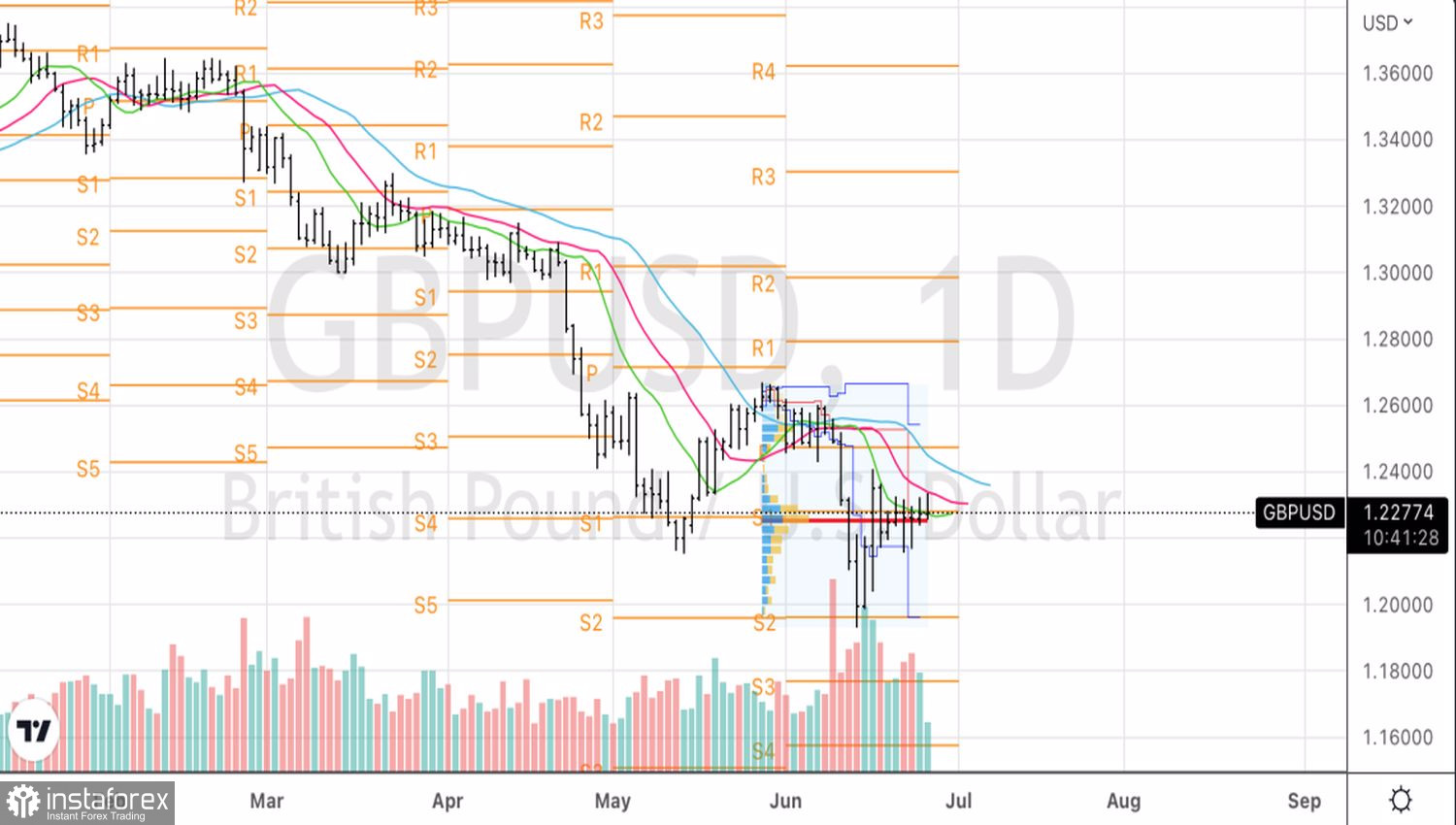

GBPUSD, daily chart

The positions of the pound really look extremely vulnerable, however, there are always two currencies in any pair. The fact that the latest US macro statistics are signaling an approaching recession is leading to a drop in US Treasury yields and weakening the US dollar. As a result, the GBPUSD fell into a consolidation, the way out of which will be determined by the conjuncture of the US securities market. If the S&P 500 continues to rise and debt market rates fall, the pound may strengthen against the US dollar, even though Britain is again beginning to be considered the sick man of Europe.

Technically, on the GBPUSD daily chart, consolidation continues in the range of 1.217-1.234 within the Splash and Shelf pattern. A breakthrough of resistance at 1.234 is a reason to open long positions. On the contrary, quotes falling below 1.217 should be used for shorts.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română