Gold prices fell after the US reported better-than-expected pending home sales data in May. The National Association of Realtors (NAR) said the index rose 0.7% last month, after showing a 4% decrease in April. But if compared to the figure last year, sales are down 13.6%.

To be more specific, pending home sales stood at 99.9 points in May, slightly higher than the 99.2 points in the previous month.

But despite the surge, NAR chief economist Lawrence Yun said the US housing market is in transition due to higher mortgage rates hurting consumers. Contract signings have dropped significantly compared to last year as the monthly mortgage payment for the median price of a single-family home with a 10% down payment has increased by $800 since the start of 2022.

In fact, the biggest monthly gain in the index was in the northeast, where pending sales rose 15.4%. Meanwhile, the greatest decline was observed in the Western region, where the most expensive houses are located.

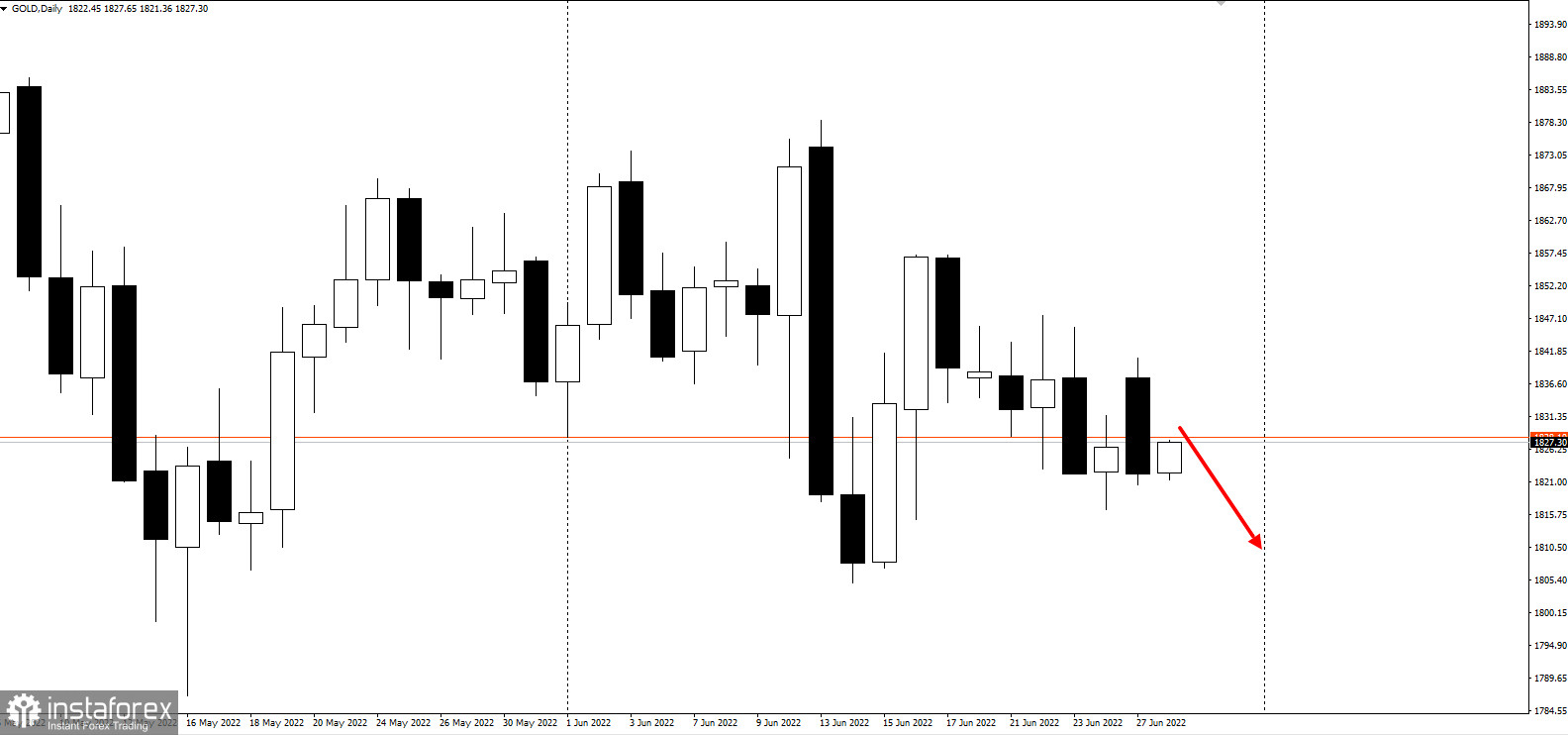

Economists are paying close attention to this data as it is seen as a forward-looking barometer of the housing market. As such, it was not surprising that after the release of the report, gold lost all of its morning gains and traded at new daily lows.

In this situation, sellers can look for signals to make prices even lower.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română