The US is already in a state of economic recession. Although local political and economic authorities have not yet acknowledged this, Q1 GDP is undoubtedly down 1.6% amid unprecedented inflation. This news increased the pressure on the US stock market, and through it on the global stock markets, causing a wave of growth in dollar, a decrease in the value of commodity and raw assets, as well as a local increase in the yield of treasuries .

But before the publication of the EU's inflation data, the markets are seeing a different picture. The entry of the US economy into recession leads to a paradoxical situation, where investors have started buying up treasuries again, trying to somehow secure their assets. The only place that is clear is the forex market, where the dollar continues to put pressure on other currencies.

With regards to inflation in the eurozone, forecast say consumer inflation will rise to 8.4% year-over-year, which may lead to a local increase in euro. This is because the ECB will be forced to raise rates more aggressively at this month's meeting.

As for the PMI data in Germany, the eurozone, the UK and the United States, they should show their decline, which will ultimately lead to a new wave of sell-offs in stock and commodity markets. Demand for dollar will also rise, continuing its dominance over other currencies. Forecasts for today:

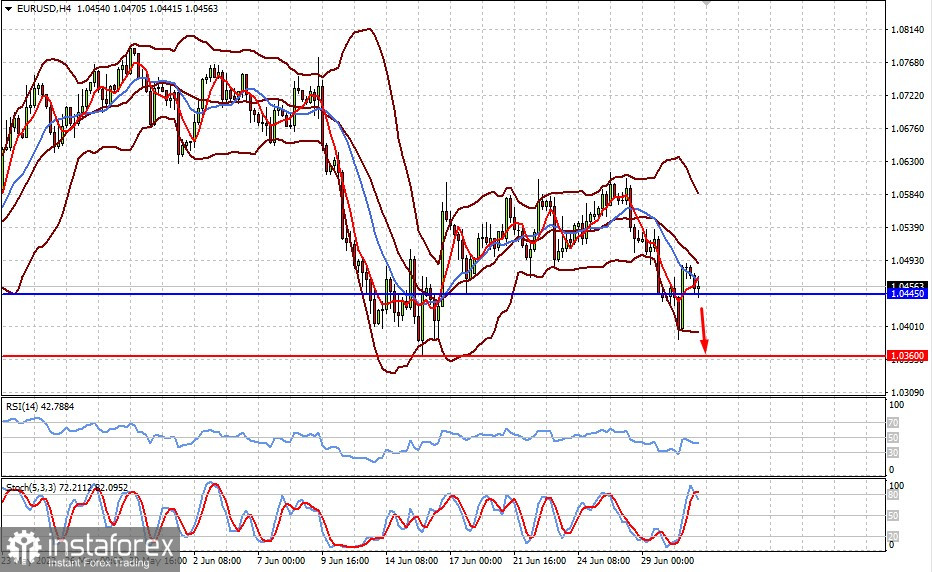

EUR/USD

Euro may rise if upcoming reports indicate that inflation continues to grow in the euro area. However, the increase will only be brief as pressure may return in the market, leading to a fall to 1.0360.

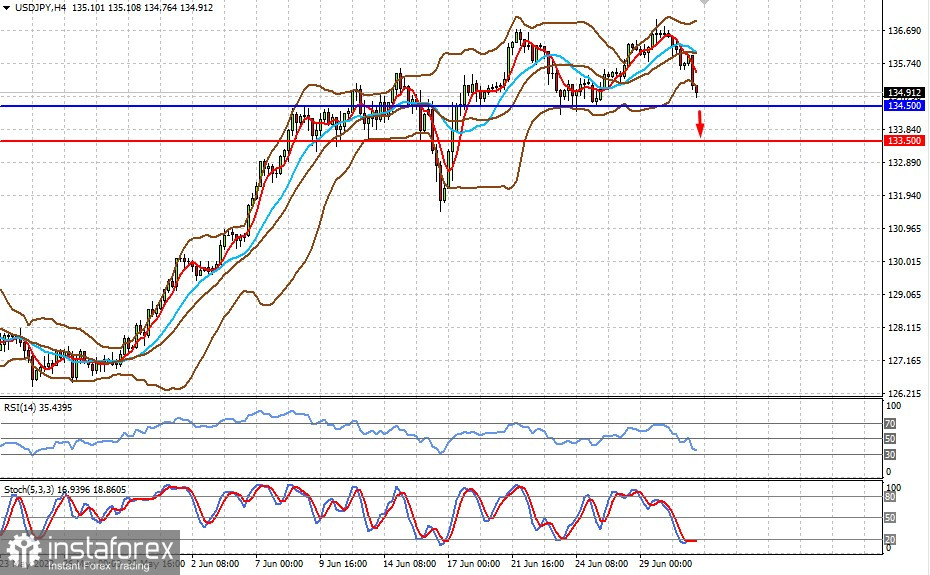

USD/JPY

The pair is currently trading slightly above 134.50. Upcoming data could put a lot of pressure on it, triggering a decline to 133.50.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română