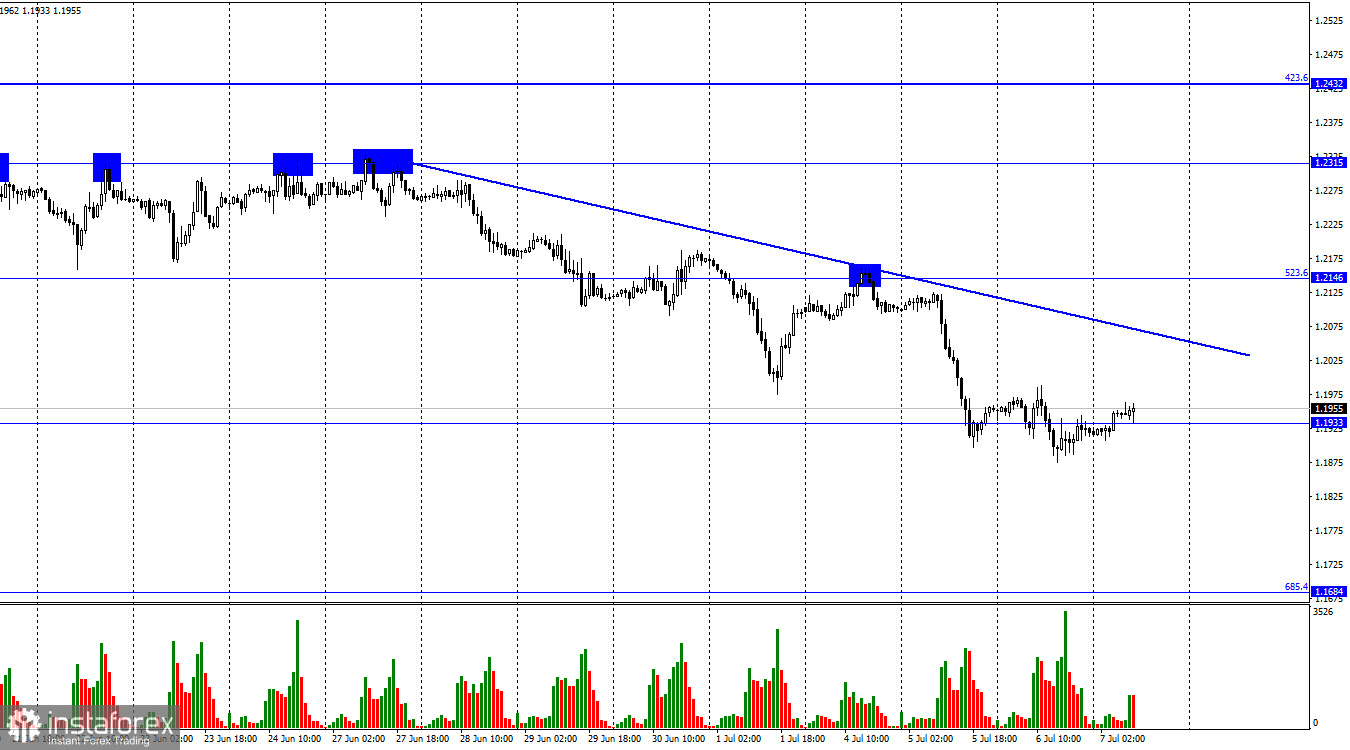

Hi, dear traders! According to the H1 chart, GBP/USD fell to 1.1933. The descending trend line indicates that trader sentiment remains bearish. The pair is likely to slide down towards the Fibo level of 685.4% (1.1684) unless GBP/USD closes above any of the two trend lines. In the UK, Boris Johnson once again became a target of controversy over the past few days. The British Prime Minister, known for ignoring established rules of conduct, survived a vote of no confidence several weeks ago, but attracted scathing criticism following the appointment of Chris Pincher as deputy chief whip of the Conservative Party.

Pincher was accused of making inappropriate advances by two Conservative MPs in 2019 - the Cabinet Office even investigated his conduct. Johnson appointed him despite being aware of allegations against Pincher. The disgraced deputy chief whip was forced to resign last week, and the prime minister was accused by the public and other MPs of covering up his conduct. Johnson refused to step down as PM, resulting in Chancellor Rishi Sunak and Health Secretary Sajid Javid handing in their resignations. 50 more MPs quit the government early on Thursday in protest of Boris Johnson's policies.

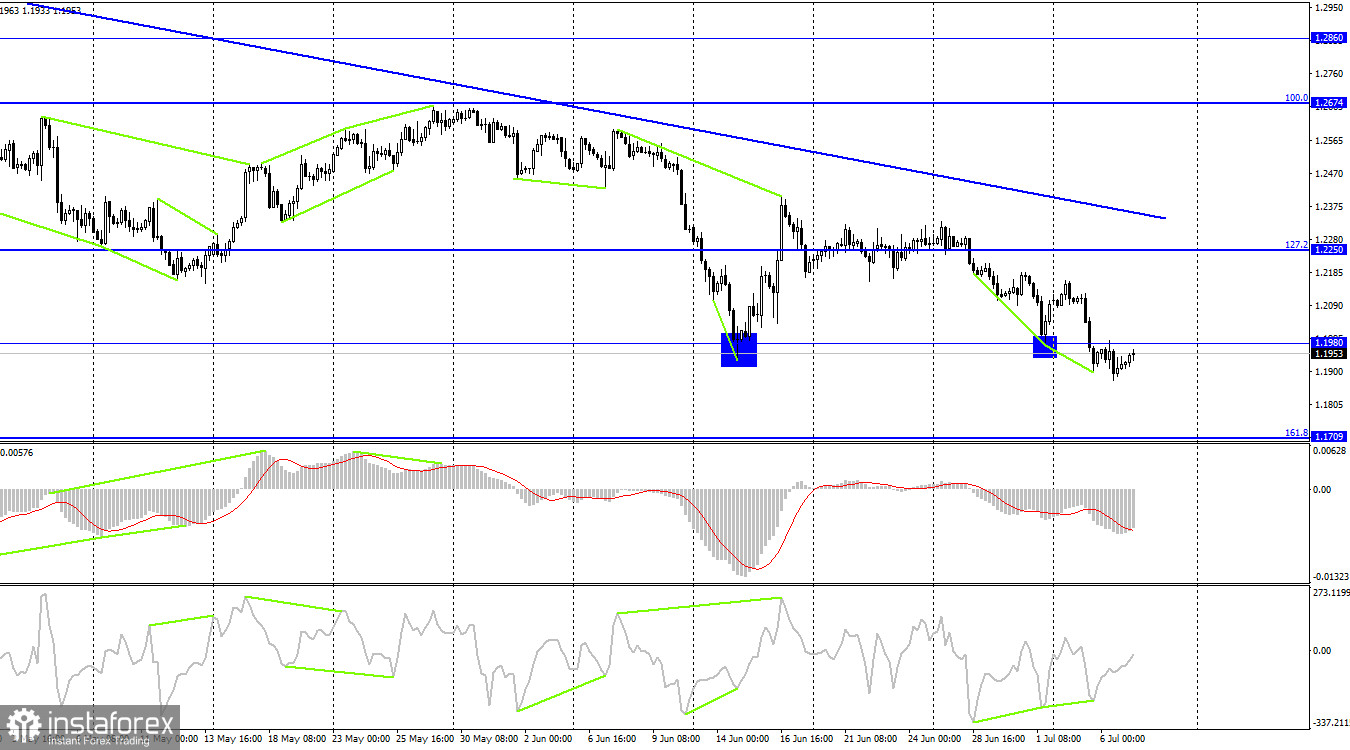

According to the H4 chart, the pair reversed downwards and settled below 1.1980. It could continue to fall towards the next Fibo level of 161.8% (1.1709). GBP/USD has formed a bullish CCI divergence which could have pushed the pair up towards the Fibo level of 127.2% (1.2250). However, bullish traders have ignored this signal. Overall, the sentiment of traders remains bearish.

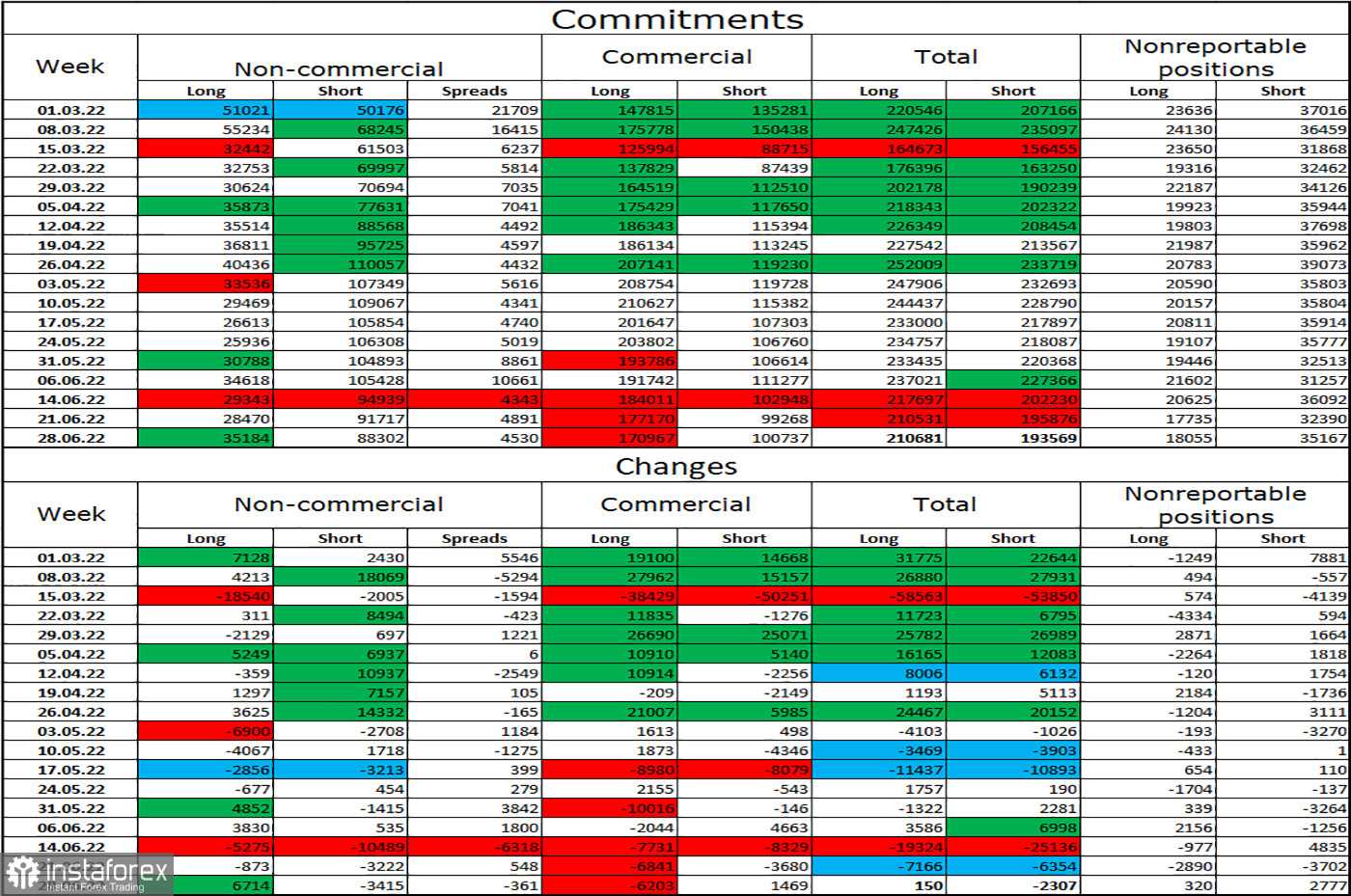

Commitments of Traders (COT) report:

Non-commercial traders became slightly more bearish over the last week. 6,714 Long positions were opened. Traders closed 3,415 Short positions. Market players remain bearish on GBP/USD, and Long positions continue to greatly outnumber Short ones. Major players continue to decrease their exposure to GBP, and their sentiment has remained unchanged recently. GBP/USD could continue to fall in the next several weeks and months, despite the gap between Long and Short positions potentially indicating a trend reversal. At this point, the news and data releases are more important for market players.

US and UK economic calendar:US - ADP non-farm payroll data (12-15 UTC).US - Initial jobless claims (12-30 UTC).

There are no events on the economic calendar in the UK, and the US data releases are unlikely to influence traders significantly.

Outlook for GBP/USD:

Earlier, traders were advised to open short positions if GBP/USD bounced off the Fibo level of 523.6% (1.2146) with 1.1933 being the target. The pair has already hit that target. New short positions can be opened if the pair closes below 1.1933 targeting 1.1709. Traders are recommended to open long positions if GBP/USD settles above the trend line on the H4 chart, with 1.2674 being the target.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română