Two weeks of calm and consolidation of Bitcoin came to a close on Monday, July 11. With the opening of the US markets, the situation around Bitcoin became more complicated. The asset broke through the $20k level and is now moving towards the $19k area. Buying activity around the first cryptocurrency is declining, as seen from the daily trading volumes. The key reason for the transformation was the onset of the reporting week, which in its consequences may surpass the events of June 2022.

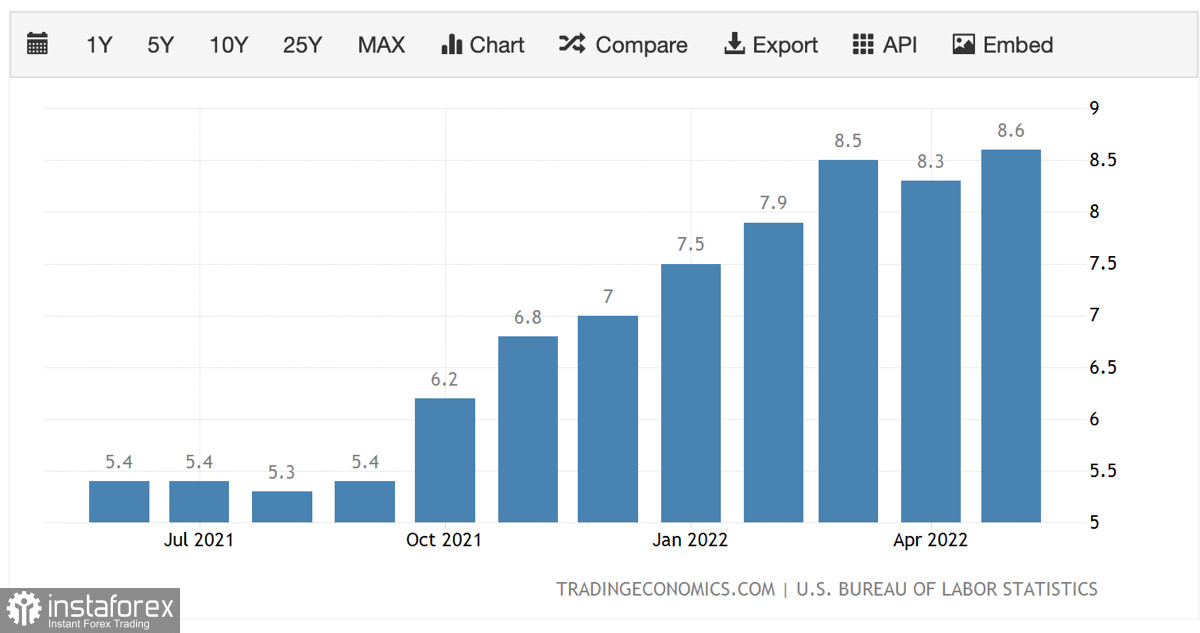

Investors are withdrawing capital from cryptocurrency funds and assets to reduce potential losses. On Wednesday, July 13, the US Department of Labor will release the consumer price growth in the US for June. Analysts believe that the US CPI will rise to 8.8% due to the war in Ukraine and the crisis in energy resources and gasoline prices. Germany, Spain, and France will provide their reports on Wednesday. Given that the euro fell to the level of the US dollar and the DXY index reached a significant high, the main inflow of capital will be in US money.

Given the inverse correlation between Bitcoin and DXY, further price declines can be expected. However, the main reason for caution was the likelihood of a second consecutive increase in the key rate by 75 basis points. At the same time, at the end of last week, we saw positive dynamics in the employment report, which, in theory, should reduce the burden on the US dollar. Nevertheless, we see that investors are massively preparing for a repeat of the events of June. The mood of major players, as well as their relative passivity during the massive accumulation over the past two weeks, suggests that the market is ready to form a new local bottom.

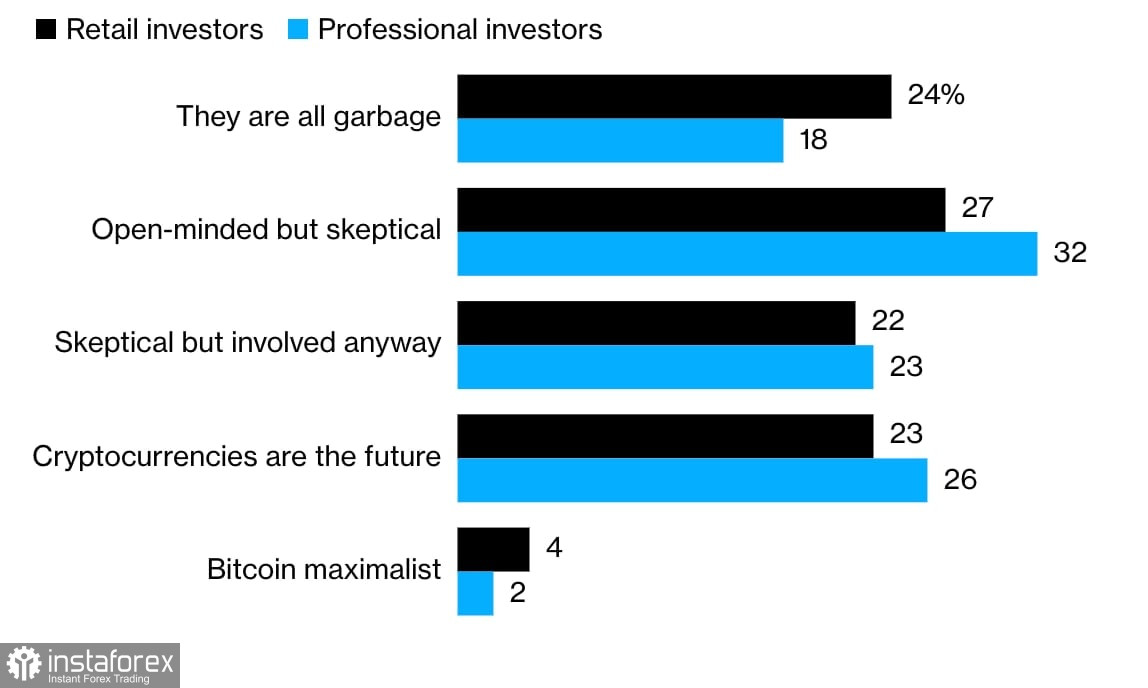

The correlation of Bitcoin with stock indices remains strong, and therefore there is no doubt that cryptocurrencies will start to decline along with the fund after the rate hike. Given this, it is likely that Bitcoin will break through the local bottom at $17.7k. Most Wall Street investors expect BTC to fall further to the $10k level, where, in their opinion, a local market bottom will be formed. In this case, the market is waiting for a series of shocks, liquidity problems, and another wave of mass liquidation.

The main catalyst for BTC to enter the exchanges will be miners who continue to experience financial problems due to the energy crisis. Today, July 12, OPEC's monthly report will be published, which directly affects the energy market. The stabilization of the Bitcoin exchange rate allowed mining companies to reduce their financial burden and resume the process of accumulating Bitcoin coins. However, with a decrease in the price of the cryptocurrency, we should expect another wave of capitulation of miners, which will turn out to be the main striking force of the bears.

The fundamental background remains negative, and the probability of falling below $17.7k increases as we approach the day of the release of CPI data. Despite this, Bitcoin holds the key milestone of $19k, the lower end of the range of fluctuations over the last two weeks. If the cryptocurrency manages to keep this level, then an upward impulse can be formed. Judging by the current investor sentiment, the price of BTC/USD remains above the $19k level.

The main metrics indicate the local consolidation period. At the same time, there are no prerequisites for an upward movement in Bitcoin. Trading activity is declining, and investors are transferring capital to protect against future shocks. Most likely, we are waiting for a breakdown of the $19k and $17.7k levels, as well as a new inflation record in the US. With this in mind, most of the capital should be sought in the dollar index, which in the coming months will replace gold and Bitcoin as a savings asset.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română