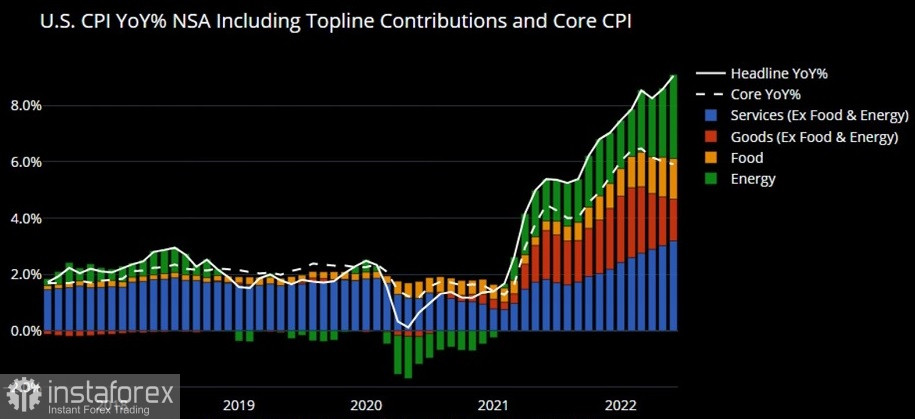

The latest CPI report shows that US inflation is still extremely high at 9.1%, a level not seen since November 1981. The US Bureau of Labor Statistics said the CPI for all urban consumers rose by 1.3%, higher than the seasonally-adjusted 1.0% increase in May.

The report mentioned that the increase was wide-ranging, and the largest contribution was made by the indices of gasoline, housing and food. Meanwhile, energy continues to be the greatest concern, with its index rising by 7.5% m/m and 41.6% y/y.

Headline inflation also increased substantially, exceeding the expectations of economists polled by the Wall Street Journal. As for the underlying CPI report, which excludes food and energy costs, there was a partial decline. The index was reportedly 0.7% higher in June, which pushed core CPI up from 6% in May to 5.9% in June. This supports the assumption that the Fed can influence core inflation but not headline inflation.

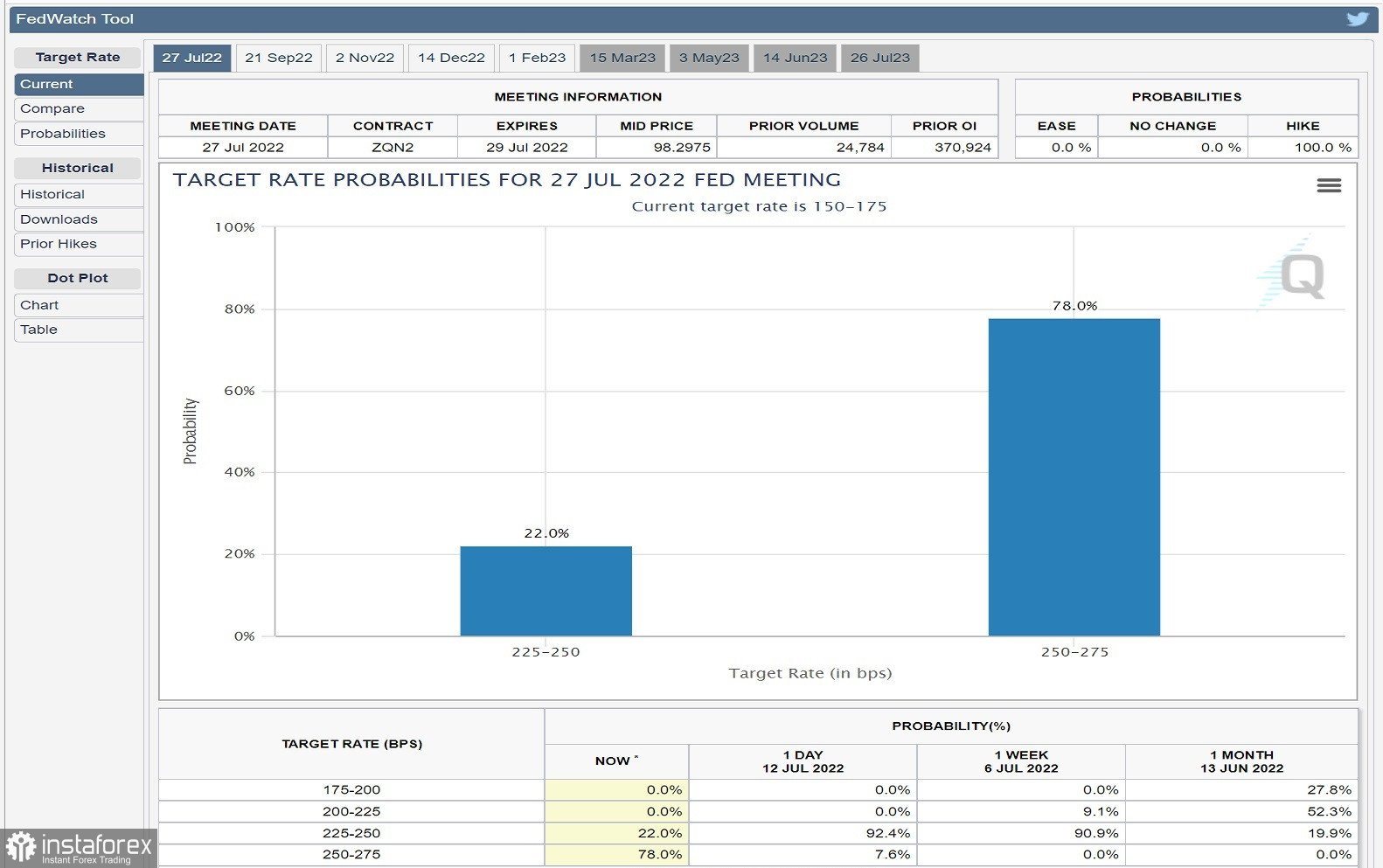

That being said, the US central bank is on track for a much bigger rate hike than expected.Yesterday, the CME FedWatch tool showed a 92.4% chance of rates increasing by 75 basis points, and a 7% chance of rates rising by 100 basis points at the next FOMC meeting on July 26-27. Today, the tool forecasts a 22% chance of a 75 basis point rate hike this month and a 78% chance of a 100 basis point increase.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română